Additional Improvement In Primary Cycle Models

Good morning. As a reminder, we have made a change to the presentation of our market models and my oftentimes meandering morning market missives. The goal is to create a series of more concise, bite-sized reports, which will be published on a daily basis. Below is the weekly publishing schedule:

- Market Model Monday - A review of my key market models designed to indicate the state of the primary market cycle

- Technical Tuesday - An analysis of the current state of the market's trend and momentum

- Early Warning Wednesday - An examination the potential for countertrend moves

- Thesis Thursday - My take on the key market drivers (or whatever else may be running through my mind)

- Fundamental Friday - A look of the state of the market's fundamental factors

It is my sincere hope that you find the new schedule easier to consume and more beneficial to your investing endeavors.

Although the market's primary cycles do not change often, I still like to start each week with a clear understanding of what type of market we are dealing with. For me, a quick glance at the color of the cycle board and the weekly/monthly S&P graphs below tells me an awful lot about the "state" of the key market cycles.

My Current Take...

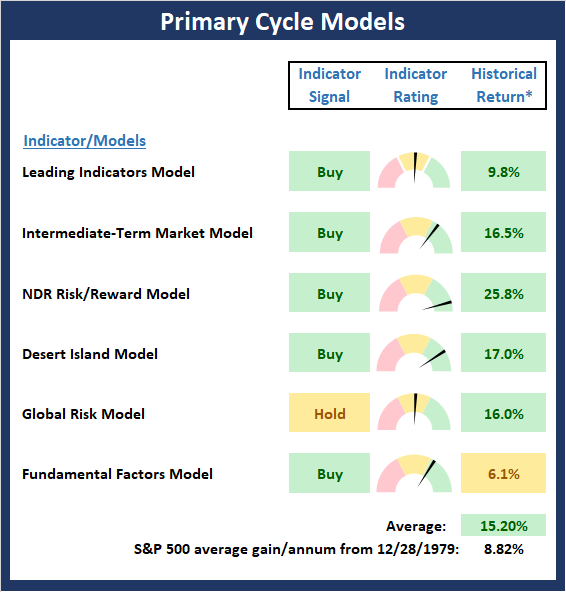

There is one important change to report on the Primary Cycle board this week as the Fundamental Factors Model upticked from neutral to positive. Digging into the Fundamental Model's components, I found that the Economic Composite was responsible for the model's improvement. This actually makes sense based on the rebound seen in so many economic indicators over the past month.

The new Buy signal on the Primary Cycle board pushes the historical average return based on the current readings of the component models to 15.2% annualized, which is well above the mean seen since 1980.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

View the Primary Cycle Model Board Online

From my seat, this is just another indication that the market is looking ahead to better days and that the bulls should be given the benefit of the doubt when things get sloppy and/or scary.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

View the Primary Cycles Board Online

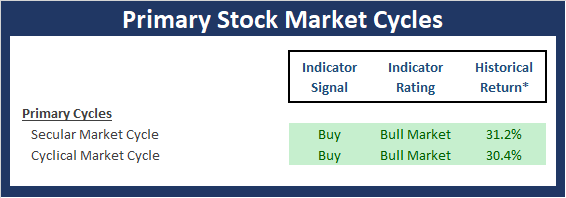

The Secular Market Cycle

A secular bull market is defined as a period in which stock prices rise at an above-average rate for an extended period (think 5 years or longer) and suffer only relatively short intervening declines. A secular bear market is an extended period of flat or declining stock prices. Secular bull or bear markets typically consist of multiple cyclical bull and bear markets. Below is a monthly chart of the S&P 500 Index illustrating the current cycle, which we estimate began on March 9, 2009.

S&P 500 - Monthly

The Cyclical Market Cycle

A cyclical bull market requires a 30% rise in the DJIA after 50 calendar days or a 13% rise after 155 calendar days. Reversals of 30% in the Value Line Geometric Index since 1965 also qualify. A cyclical bear market requires a 30% drop in the DJIA after 50 calendar days or a 13% decline after 145 calendar days. Reversals of 30% in the Value Line Geometric Index also qualify. Below is a weekly chart of the S&P 500 illustrating the current cycle, which we estimate began on March 24, 2020.

S&P 500 - Weekly

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more