About That Inflation Problem

For those of you keeping score at home, it was the inflation data that dominated the stock market game last week. While the numbers were eye-popping, the market reaction was not. And the narrative around the subject appears to be evenly split between the two teams on the field.

In one dugout, the argument is made that inflation is currently much higher than anyone had suspected and is most definitely here to stay. Those dressed in the bear uniforms suggest that inflation - and the associated consequences, is going to be the next big problem investors must deal with. And with plenty of historical evidence pointing to the fact that stocks tend to struggle (oftentimes mightily) when inflation runs hot, our furry friends contend that it is only a matter of time before things start to get ugly in both the stock and bond markets.

The Wall Street Journal ran an article appearing to support the bear club's point of view. On Thursday they wrote, "The inflation pressure we’re seeing is significant," General Mills Inc. Chief Executive Jeff Harmening said at a recent investor conference. "It’s probably higher than we’ve seen in the last decade.

He and his peers point to transportation, commodity and labor costs all increasing at the same time. They expect the trend to continue for at least the rest of this year. As a result, General Mills, Campbell Soup Co., Unilever PLC, J.M. Smucker Co. and other big food companies are raising prices. Some increases are already visible on supermarket shelves, and more are coming this summer. Restaurants including Chipotle Mexican Grill and Cracker Barrel Old Country Store have raised menu prices. Executives say they expect more price increases this summer as costs remain elevated for labor, commodities and transport.

In addition, there are areas that could reflect more lasting changes in the consumers behavior going forward. In this case, it is a simple matter of increased demand. For example, the demand for furniture, appliances, computer hardware, printers, and other home "stuff" are a result of a changing work environment for many Americans. And with many companies suggesting that a healthy chunk of their workforce will continue to work from home, prices for home office items could certainly remain high.

All of the above would seem to support the idea that inflation could certainly be/become a problem, am I right?

But, as you might suspect, there is a different message coming from the dugout on the other side of the infield. Although even the most ardent bull team members will admit that the 5.0% "print" on CPI is the highest level seen in 13 years, the argument from our heroes in horns is that the current spike in prices isn't likely to last.

The good news for stock market investors is that the bullish view on inflation is supported by a group of central bankers headed by Mr. Jerome Powell. Cutting to the chase, Powell's Fed has taken the stance that the current inflationary pressures are "transitory" and will fade over time.

The argument here is pretty straightforward. For example, it is fairly easy to argue that the increases seen in airfares, at restaurants, and in business apparel are a result of the country returning to normal. And much of the surge can be attributed to year-over-year comparisons. Lest we forget, prices of many things had collapsed at this time a year ago due to the lockdown. In addition, other areas where prices are surging such as car and truck prices, are due to shortages of parts (think chips) or materials. As such, these price increase won't continue at the current pace and thus, are likely to be temporary.

Bloomberg summarized the situation nicely last week, writing: "In the end, a print like this (the CPI data, that is) is not enough to get the Fed to flinch, which is — big picture — what matters," said Baird's Ross Mayfield. "If the economy is strong, and people are out buying, and retail sales are high, and prices are jumping because there's demand, that's good for stocks."

In addition, when one removes the COVID-sensitive items (including auto manufacturing disruptions) and this thing economists are calling "the base effect," it can be argued that core inflation remains relatively stable.

The bond market seemed to agree. Although the CPI numbers did spike more than expected, the reaction in the bond market was quite muted as yields actually moved lower instead of higher. From my seat, it appears that all of the "bad news" we just got on the inflation front had already been priced in. And since the CPI report wasn't worse, a "sigh of relief" rally seemed to occur in both the stock and bond markets.

As I've mentioned a time or two hundred, markets look forward, not back - they are a discounting mechanism of future expectations. As such, the real issue here is whether or not inflation will become a problem over time. And with Fed officials saying recently that they are willing to let inflation run hot for more than a year, it doesn't look like the markets are worried about the Fed switching gears any time soon.

Here's hoping you have a great week. Now let's turn to our weekly model update...

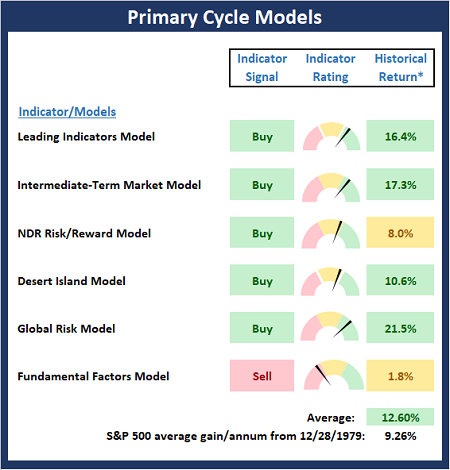

The Big-Picture Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the "state" of the overall market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

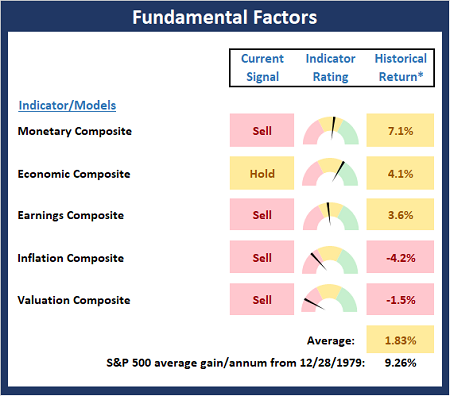

The Fundamental Backdrop

Next, we review the market's fundamental factors including interest rates, the economy, earnings, inflation, and valuations.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

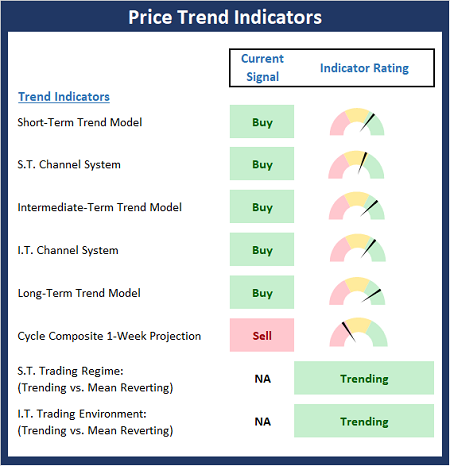

The State of the Trend

After reviewing the big-picture models and the fundamental backdrop, I like to look at the state of the current trend. This board of indicators is designed to tell us about the overall technical health of the market's trend.

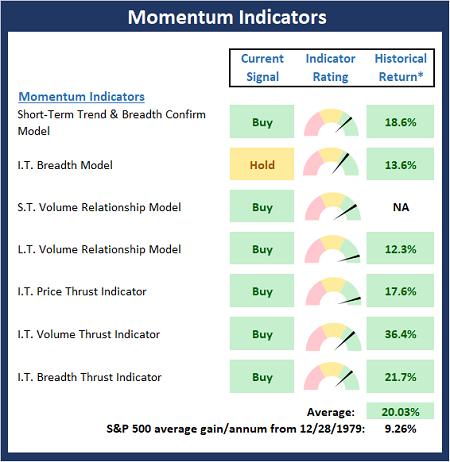

The State of Internal Momentum

Next, we analyze the momentum indicators/models to determine if there is any "oomph" behind the current move.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

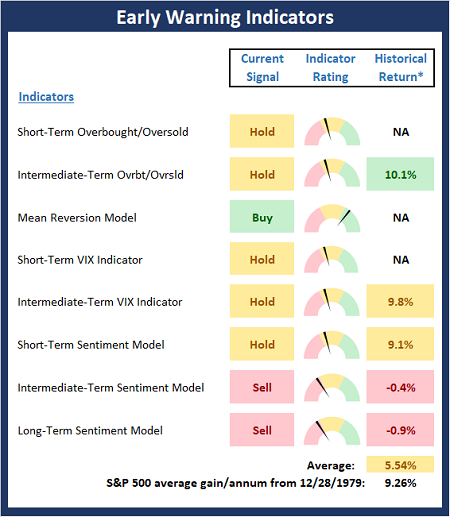

Early Warning Signals

Finally, we look at our early warning indicators to gauge the potential for counter-trend moves. This batch of indicators is designed to suggest when the table is set for the trend to "go the other way."

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Thought for the Day:

People remember acts of kindness for a lifetime. -Terry Wise

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should ...

more