A Slow Grind Higher For Refined Product

Close-up of industrial pipelines of an oil-refinery

More refinery rationalization to come?

Unsurprisingly refinery margins have slumped this year, with COVID-19 hitting demand for refined products.

The weakness in margins has seen refineries around the globe cut run rates significantly this year, something that the market has needed to limit a further build-up in refined product inventories. Refineries are yet to get back to pre-COVID-19 utilization rates, and this is something that we are unlikely to see until late 2021 at the earliest. In fact, given the extremely weak margins we have seen this year, a number of refineries have announced plans to permanently shut or repurpose themselves.

Since the beginning of 2020, it is estimated that around 1.4MMbbls/d of global refining capacity closures have been announced or openly discussed by companies, according to IHS Markit. While the impact of COVID-19 is key to these closures, the other important driver behind this is that we continue to see new and more efficient capacity coming online in parts of Asia and the Middle East, which makes it increasingly difficult for older refiners to compete. This suggests that even as we see demand returning to more normal levels, we will likely continue to see refinery rationalization through 2021.

Fuel oil and naphtha the stand outs, but likely to weaken over 2021

Despite the pressure we have seen in refinery margins there are a couple of products, which have performed well over 2020, including high sulphur fuel oil (HSFO) and naphtha.

While naphtha came under significant pressure during the peak of the lockdown period in 2Q20, as a result of the weaker gasoline complex, it has rallied strongly since, as gasoline demand has improved. In addition, naphtha remains the favourable feedstock for the petrochemical industry, with naphtha trading at a discount to the alternative feedstock, propane. Naphtha is likely to remain the preferred feedstock over the winter months, with propane prices likely to remain relatively more expensive over these months due to heating demand. However, as we move further into 2021, we would expect to see some renewed pressure on naphtha cracks.

Meanwhile, the surprise has been HSFO. Coming into the year, it was expected that this was going to be the one product which would be under a significant amount of pressure due to IMO 2020 sulphur limits. However HSFO cracks have only strengthened, and in fact, is the best performing product across the complex. There are several reasons for this.

Firstly, bunker fuel demand has not been as hard hit as road fuel and jet fuel demand during the pandemic. Secondly, supply has been an issue, with refiners reducing run rates this year, which would have tightened fuel oil output. Then, finally, the significant OPEC+ cuts we have seen have also tightened HSFO supply further, given that the group have cut heavier grades of crude oil, which meant that refiners have turned to a lighter crude slate, and as result yield less HSFO.

Looking ahead into 2021, HSFO supply should improve, as we see refinery utilization rates continue to increase, along with the expectation that over the course of the year we should see some further easing from OPEC+ when it comes to production cuts (UGA, USO).

Jet fuel to strengthen, but vaccine dependent

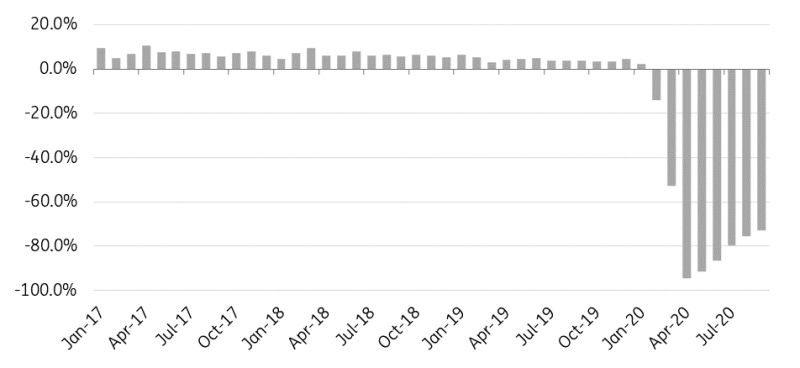

Jet fuel has been under significant pressure this year, as a result of lockdowns and travel restrictions. Since April jet fuel crack has traded several times into negative territory in NW Europe, and so far this year the crack averages a little over US$3/bbl, compared to an average of almost US$16/bbl over full year 2019.

Air travel has clearly taken a significant hit as a result of COVID-19, with passenger traffic over the first nine months of 2020 down by 64.7% YoY. While traffic has improved from the 94.3% YoY decline in April, the recovery has slowed in recent months, with traffic in September still down 72.8% YoY. In fact, the recovery in international air travel has stalled, with border restrictions and quarantine holding back a full recovery. While we expect air travel to improve over 2021, it's unlikely we will get back to pre-COVID-19 levels next year. In addition, it is difficult to see a more meaningful recovery in international air travel until a vaccine is widely available, which would see countries reopening their borders and lifting quarantine restrictions.

This reduced amount of air travel has meant that jet fuel demand has declined significantly. At its peak in April, jet fuel demand was estimated to be down almost 5MMbbls/d YoY or 75% YoY according to Rystad Energy, and at the moment it is about 3.5MMbbls/d lower YoY. For FY20, jet fuel demand is expected to be down in the region of 3.4MMbbls/d YoY. While for 2021, jet fuel demand will still lag 2019 levels, with it expected to be around 1.8MMbbls/d below pre-COVID-19 levels.

We would expect jet fuel cracks to continue to gradually strengthen over the course of next year, as air travel continues its recovery.

Global air passenger traffic- RPK YoY % change

Source: IATA

Gasoil weighed down by weak jet market

Gasoil was unable to escape the pressure that we have seen across much of the products basket this year, with the crack in Europe edging dangerously close to negative territory. This is despite the expectation that middle distillates would benefit from IMO 2020 regulations, which sees shippers having to turn to lower sulphur fuel. Given the slack in the market, along with it appearing that shippers are favouring very low sulphur fuel oil over marine gasoil, the middle distillate market has been largely unaffected by IMO 2020.

Road fuel demand had been recovering fairly well post the 2Q20 lockdowns, however, the more recent wave of COVID-19 and the further restrictions that we have seen imposed around various parts of Europe have started to weigh on middle distillates demand once again, although clearly not to the extent we saw earlier in the year.

In addition to the demand hit, the gasoil market is also having to deal with refiners adjusting their yields due to the collapse in jet fuel demand. Over the course of this year, the regrade (the spread between jet fuel and gasoil) has traded into negative territory, sending a clear signal to refiners to do all they can to minimise jet fuel yields, however, in doing so this has meant that yields for diesel/gasoil have increased this year. As a result, this has only added further downward pressure on gasoil cracks. According to IEA data, prior to COVID-19, jet fuel yields in the OECD averaged around 10%, however it does appear as though yields this year will average in the region of 6-7%. Assuming that we continue to see jet fuel demand recovering next year, we could see these yields increase to somewhere in the region of 8% over 2021. The fall in these yields has meant that we have seen diesel/gasoil yields increase as a result, and given that jet fuel demand will still likely struggle next year, diesel/gasoil yields will likely remain above pre-COVID-19 levels.

While there is the potential for some near term pressure on the gasoil market, with current restrictions across parts of Europe, we see gasoil cracks trending higher over 2021 with the broader global recovery proving supportive. Road transportation fuels demand (which includes both diesel and gasoline) is expected to basically be back at pre-COVID-19 levels before the end of 2021. Meanwhile, the pressure from the jet fuel market should also be somewhat less over the course of next year.

Source: ING Research

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more