A Negative “Turnaround Tuesday”

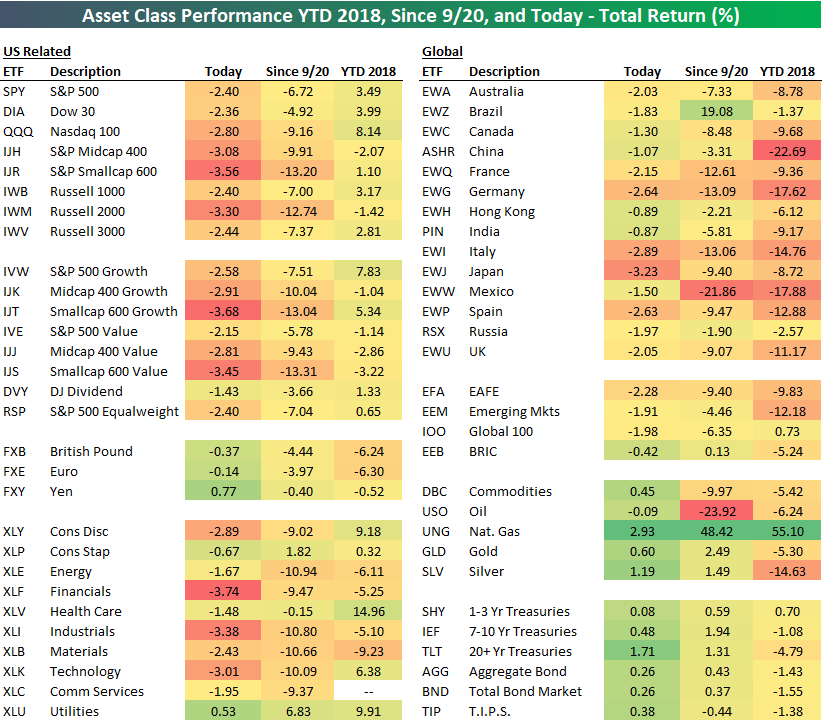

Monday’s 1.09% gain for the S&P 500 was the 19th time that December has started off with a 1%+ up day since 1928 when the index began. Unfortunately, all of yesterday’s gains and then some have been lost as of early afternoon today. Below is a quick look at the performance of various asset classes today using our key ETF matrix. We also include each ETF’s total return since the 9/20 peak for the S&P 500 as well as year-to-date.

As shown, major US index ETFs are down 2%+ across the board, with even more pain coming in the mid-cap and small-cap space. The S&P Smallcap 600 (IJR) is getting crushed by 3.56% as we type.

Looking at US sectors, the most pain is being felt in Financials (XLF), Industrials (XLI), and Technology (XLK), with all three down more than 3% on the day. The one sector that’s higher is Utilities (XLU), which benefits on days like today when risk-free interest rates are falling. The high-dividend yields of Utilities become more attractive as risk-free yields fall.

Outside of the US, Japan (EWJ) is getting hit the hardest with a drop of 3.23%. Germany (EWG), Italy (EWI), and Spain (EWP) are all down 2.6% or more as well. Hong Kong (EWH) and India (PIN) are down the least on the day with drops of roughly 90 bps.

The equity asset space is getting crushed today, but commodities and fixed income are performing well. The 20+ Year Treasury ETF (TLT) is up 1.71%, which is its best day since May 29th when it rose more than 2.19%.

(Click on image to enlarge)

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more