A Global Eurodollar Shortage

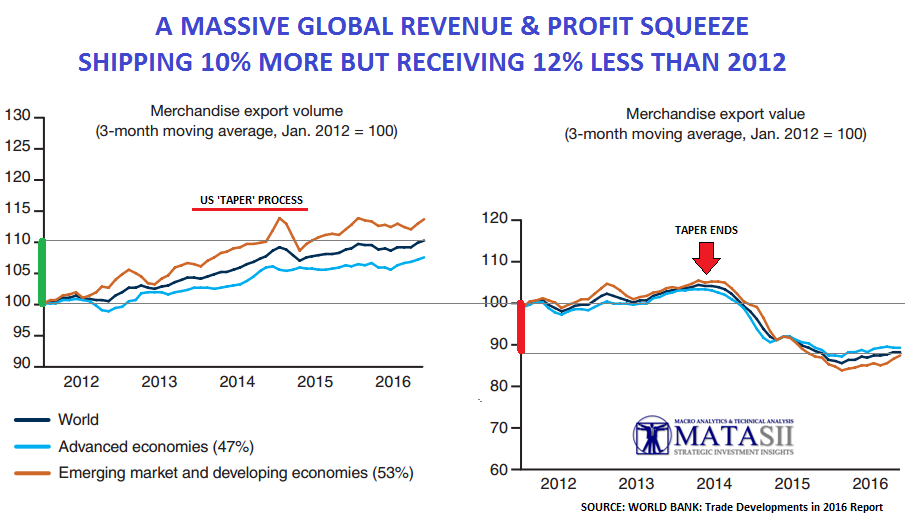

The World Bank just released a telling report entitled "Trade Developments in 2016: Policy Uncertainty Weighs on World Trade". Though they deflect the problems in global trade to areas such as excessive regulatory initiatives and policy uncertainty (which is true), what is to be found buried in the appendix are the two un-annotated charts below. I suspect the World Bank didn't compare them directly (they are shown separately) because it would cast a spotlight on an even larger political 'football'.

How does global trade ship ~10% more trade volume but receive ~12% less revenue over a 5 year period? The answer has traditionally been significant improvements in productivity. However, the productivity numbers by country don't even come close to supporting such a premise.

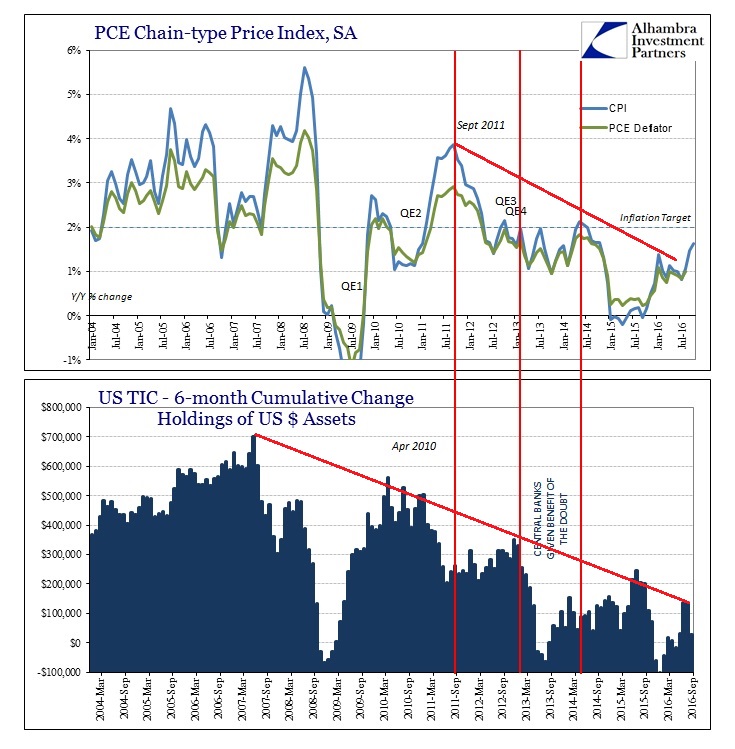

We believe the actual answer is that a strong US dollar is choking global profits and wealth creation because of a dollar shortage and a lack of real global economic growth! It went "critical" when 'TAPER' ended. You can see this inflection point in an endless array of economic charts.

US DOLLAR SHORTAGE HAS CREATED US DOLLAR DEMAND AND EXCHANGE INCREASES

The Bank of International Settlement (BIS) believes the concerns with the US Dollar are now such that it has replaced the VIX as a "Fear Gauge" for global banks. This development has occurred since QE3 and "TAPER" came to an end in December 2014. At that time the dollar exploded higher, commodities fell, global trade stalled and emerging markets with ~ 9 Trillion in US dollar denominated debt became saddled with higher debt financing charts on falling revenues.

SINCE “TAPER” ENDED WE HAVE AN ALREADY AGGRAVATED GLOBAL DOLLAR SHORTAGE

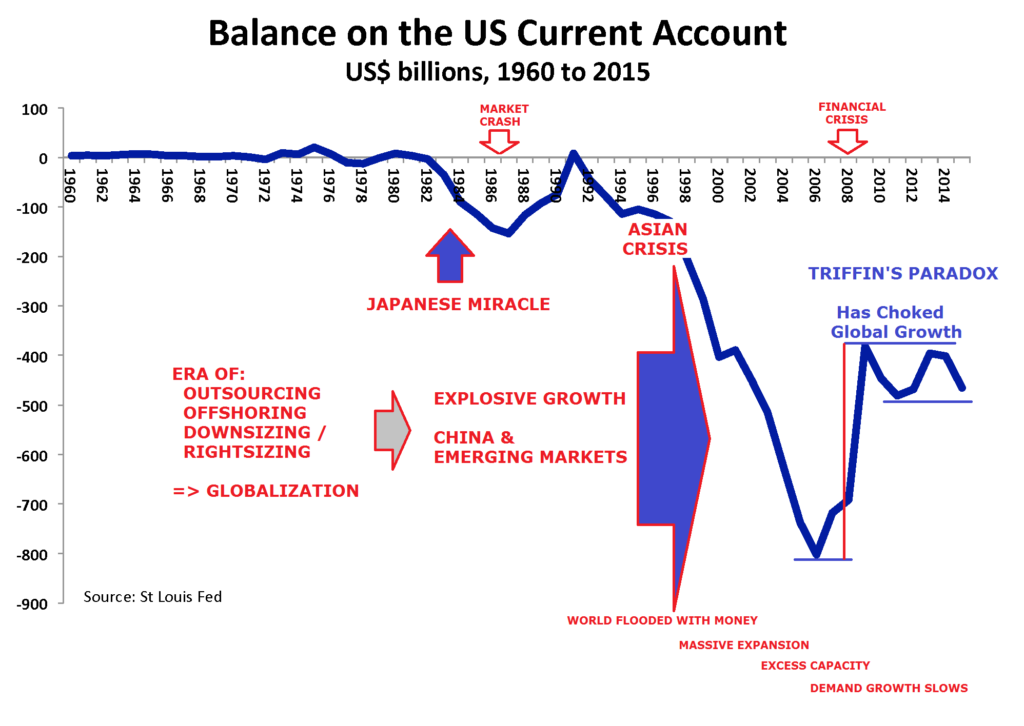

The US dollar as the Global Reserve Currency absolutely still dominates world trade payments & settlements. Additionally, the fact that because of the Petrodollar agreement with Saudi Arabia, oil can only be transacted in US dollars, this has assured the required for US dollars around the world in what is termed "Eurodollars".

- Trade, Shipping Finance, Settlement etc is conducted in US$

- World Requires Dollar Credits (Usually Sourced from US Debt Obligations)

THE REDUCED US TRADE DEFICIT HAS ADDITIONALLY COMPOUNDED A WORSENING PROBLEM!

What many don't fully appreciate is that US debt liabilities become foreign bank assets and as such as part of their capital ratios become a basis for increased foreign fractional reserve lending. Reduced US trade deficits and improving current account deficits place a 'choke hold" on available foreign US denominated lending. This is a well-documented phenomenon referred to as the "Triffin Paradox".

THE PROBLEM IS TEMPORARILY BEING “HELD TOGETHER” BY THE USE OF US DOLLAR LIQUIDITY SWAPS

Few realize that in a stealth manner Liquidity Swap Agreements are replacing foreign currency funding in the marketplace with foreign currency credit provided by the central banks.

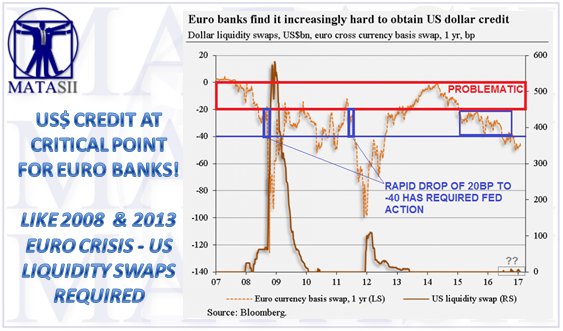

My friend Thorstein Polleit via The Mises Institute, recently published the graph below (annotations are mine) and outlined:

The graph shows the Fed’s supply of newly created US dollar liquidity sent to other central banks around the world. It also shows the so-called “euro cross currency basis swap,” which can be interpreted as a “stress indicator”: If it drops into negative territory, it means that euro banks find it increasingly difficult to obtain US dollar credit in the free market place. The Fed’s injection of new US dollar balances into the financial system has helped to reduce the euro currency basis swap. Since late 2016, however, it has started to venture again into negative territory — potentially signaling that euro banks are again heading for trouble.

The financial and economic crisis 2008/2009 has increased further the dependency of the world’s financial system on the US dollar. As early as December 2008, the Fed provided so called “liquidity swap agreements.” Under the latter the Fed is prepared to lend newly created US dollars to other central banks around the globe. For instance, the European Central Bank (ECB) can obtain US dollars from the Fed and lend the funds on to shaky domestic banks in need for US dollar funding. In other words:

Liquidity swap agreements can easily replace foreign currency funding in the market place by foreign currency credit provided by central banks.

Meanwhile, all major central banks around the world — the European Central Bank, the Bank of Japan, the Chinese central bank, the Bank of England, and the Swiss National Bank — have joined the liquidity swap agreement club. They also have agreed to provide their own currencies to all other central banks — in actually unlimited amounts if needed.

It is no wonder, therefore, that credit default concerns in financial markets have declined substantially. Investors feel assured that big banks won’t default on their foreign currency liabilities — as such a credit event is considered politically undesirable, and central banks can simply avoid it by printing up new money.

Watch for the Federal Reserve to soon issue another round of massive US dollar liquidity SWAPS to the ECB.

All of the above are signs that global imbalances have created such distortions and complexity that the global economy is increasingly exposed to the inevitability of a "Black Swan" event!

Disclosure: Information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, ...

more