A Far Simpler, Much More Effective Model

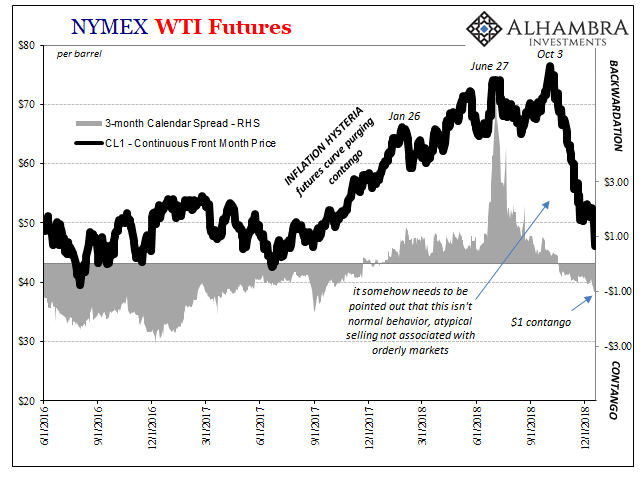

The week is only two days so far, but the oil crash in it has now been taken into elite company. The WTI benchmark is now down about 40% from its high set just a month and a half ago. As noted yesterday, this isn’t normal, healthy behavior. Crude isn’t exactly fickle, so a crash like this should be appreciated for what it says about this important market’s expectations.

If history is a guide, nothing good.

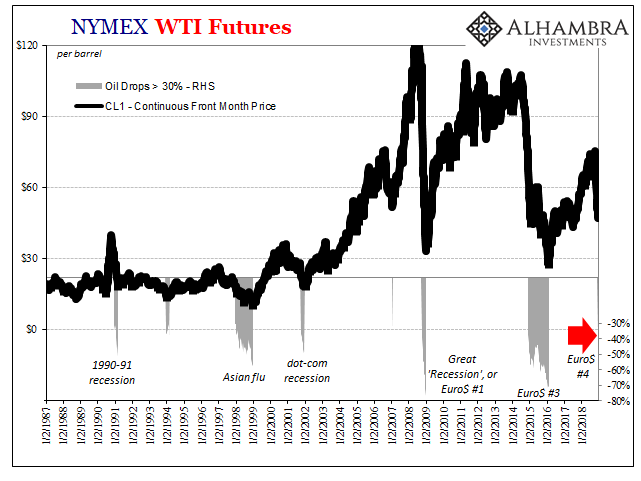

There is one false alarm around 30% (1994), but none over 40%. If oil declines by that much, then in the past it has meant some variety of downturn ahead. Supply simply doesn’t matter, when demand shifts nothing good comes out of a 40% crash. Even the first crude collapse in the panic cycle showing up in early 2007 was something policymakers should’ve taken seriously (liquidity).

But they don’t ever. The reason is simple; Economists don’t trust markets, they steadfastly follow models that assume no matter how much evidence stacks up against them monetary policy always leads to success (growth). And for plainly dubious reasons.

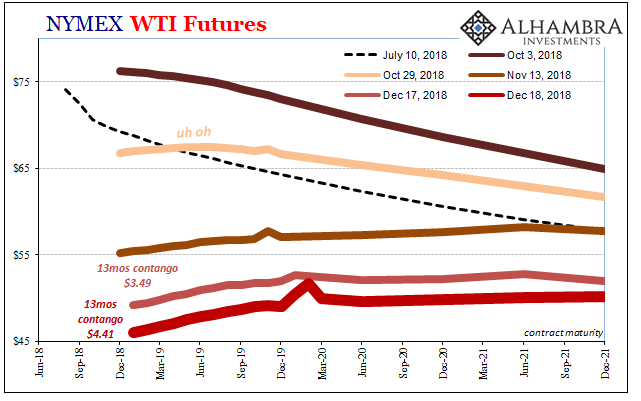

Equally momentous this week, the WTI futures curve has sprouted very deep contango. For most of the decline since October 3, the deepest point of contango had been maintained around $1 to $1.50. That’s serious stuff all its own, but now it has shifted to something much greater; more than $4 today.

The message in the crude curve is therefore incredibly simple and consistent with the past – big problems ahead, serious deterioration. Whatever physical imbalance the market perceives right now for the near term and intermediate future, investors are positioning (and being positioned) for it growing worse, not better. Even with about 40% already.

A big piece of that imbalance is financing, meaning liquidity therefore eurodollars.

We can add this to other prominent market signals, such as the small inversion in a limited space on the UST curve, the wider but still relatively minor inversion on the eurodollar futures curve, plus the related collapse of inflation expectations. Swap spread compression.

Long before trade wars and the mainstream excuse about T-bills, I warned in September 2017 about the warning the curious hump in bills and what we could have expected from it:

It started with repo, and that part is confirmed. The real question is what this all means, up to and including whether it marks like fails in June 2014 the start of whatever the next phase of eurodollar decay might be. We obviously won’t know anything like that for some time (and we have to be very careful about bias, meaning that since I suspect it, it’s easy to believe and see what I think is already there), but the biggest clue will be in escalating warnings like this.

In December 2017, there were more warnings; in December 2018, more and bigger still. It was like June 2014 after all. Eurodollar #4 is here.

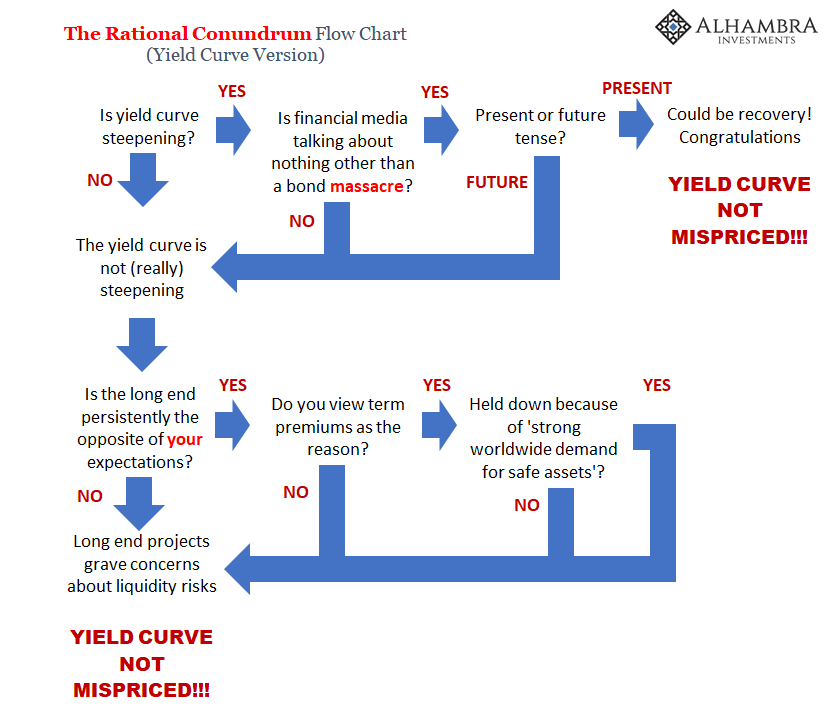

For their part, Economists and central bankers (redundant) refuse to admit them. They’ve tried all year to suggest that markets are mispricing the heavenly future they’ve set for the world, “safe assets” in particular. It doesn’t matter the track record of markets versus models has uniformly fallen the markets’ way time and again, Powell, Draghi, and the whole rotten bunch have been steadfast in optimism as these warnings escalate and multiply – and they do nothing about them (not that they could).

As late as August, with the release of the July minutes, the FOMC statement went out of its way to suggest the long end of the bond curve(s) was mispricing risks. Such serious flattening was another conundrum. It took overlooking obvious contortion to arrive at that conclusion, as I noted at the time:

The yield curve is flat and therefore the long end is mispriced because it is correctly pricing these things. You would never associate “strong worldwide demand for safe assets” with a true economic boom – unless you have to.

With oil markets loudly merging into the proliferating chaos, who is mispriced now? It was a contest Jay Powell like Janet Yellen had no chance of winning. A much simpler model should have been employed all along.

Disclaimer: All data and information provided on this site is strictly the author’s opinion and does not constitute any financial, legal or other type of advice. GradMoney, nor Jennifer N. ...

more