5 Stocks Unlocking Value On Breakup Pressure

Spinoffs have historically been great investments, and right now a number of companies are feeling the pressure to break apart to unlock more value. These are the stories you should be buying and selling.

With the S&P 500 now down nearly 5% over the last year, companies are looking to unlock value any way they can.

This includes spinning off parts of their business or doing full-blown breakups. Now, spinoffs have historically been great investments.

Joel Greenblatt has one of the best investing track records ever, thanks to investing in spinoffs and other special situations. Greenblatt started his hedge fund, Gotham Capital, in 1985. For the next 10 years, he generated an annualized return of 50%.

He did this by looking for spinoffs that were unloved for a variety of reasons, including the fact that the parent company was just getting out of a “bad” or unrelated business. In that case, institutions generally don’t want to own the spinoff and dump it, putting unnecessary pressure on the stock.

However, what about investing in companies before the spinoff process and getting in before the breakup?

Well, that’s not always quite as profitable. You really have to do your due diligence when assessing a potential breakup.

Just look Xerox (NYSE: XRX), which announced just last month it would split into a hardware and software business. Shares are now down 9% over the last month.

Then there’s Manitowoc (NYSE: MTW), which announced in January of last year that it would split into two businesses: a food equipment company and a crane company. However, shares have fallen 20% over the last twelve months.

The key is that sometimes splitting up a struggling business just means you’ll be left with two struggling businesses that are not necessarily any better off. It’s about doing your due diligence.

With that in mind, here are five stocks getting breakup pressure that might be worth buying, or selling:

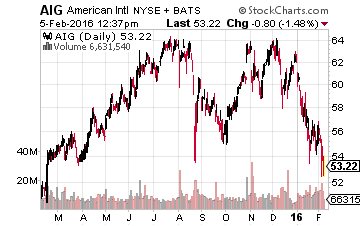

Break Up Bet No. 1: American International General (NYSE: AIG)

Carl Icahn is working hard to get AIG to split into three companies, which is an effort to reduce the regulatory overhang. AIG has pushed back, however, opting to divest only certain assets and spin off part of its mortgage insurance business.

This isn’t enough, at least not for Icahn. He’ll likely wage a proxy battle to get board seats with the ultimate goal of replacing current CEO Peter Hancock.

Shares of AIG are trading at 75% of book value, while major peers like Travelers (NYSE: TRV) and Allstate (NYSE: ALL) are trading at premiums to book value. The quickest way to close that gap is to reduce its regulatory overhang which includes getting AIG to rid itself of the “SIFI” (systemically important financial institution) designation.

This is an interesting breakup play, as Icahn not only has the support of fellow hedge funder John Paulson but also has the support of the majority of AIG shareholders. During a January survey, Sanford Bernstein found that nearly 75% of respondents want AIG to shake the SIFI designation. AIG will have to do more if it wants to keep shareholders happy.

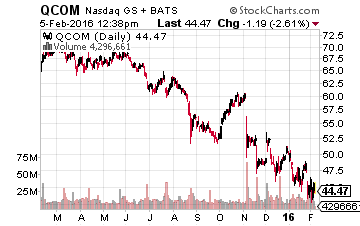

Break Up Bet No. 2: Qualcomm (NASDAQ: QCOM)

This tech giant has been getting pressure from activist hedge fund JANA Partners to split into a hardware and a licensing business. The idea is that this would allow the respective companies to pursue their “best” growth opportunities. But, the stock is down 30% over the last year as it faces headwinds, namely slowing smartphone demand and issues with royalty collections. Shares are now trading at less than 10 times next year’s earnings estimates.

Qualcomm makes its money from royalty income for 3G/4G handsets sold, owning patents for wireless chips used in these phone. The key is that Qualcomm has its own headwinds, which means that even if it splits into two companies, generating revenues will be tough.

It’s facing issues with a licensing dispute with LG and slowing demand from Apple (NASDAQ: AAPL). It’s also losing market share in China to Huawei. Don’t hold your breath for a breakup, and if there is one, it will likely be a negative.

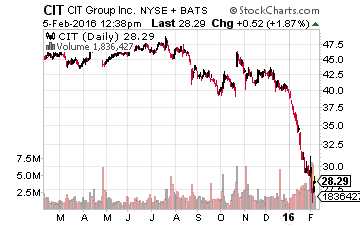

Break Up Bet No. 3: CIT Group (NYSE: CIT)

This financing company is getting pressure from a new activist hedge fund that owns a small stake. The group, Hudson Executive Capital, owns a 0.5% stake and wants CIT Group to look into selling or splitting off certain assets.

This likely includes getting CIT Group to sell its rail business and lending operations. This comes as its rail operating performance has been weakening, leading to the steep selloff in the stock of late.

CIT Group, after going on an acquisitions spree when John Thain joined in 2010, now has over $50 billion in assets. This has increased its regulatory burden, and it is now designated as a SIFI. John Thain announced his retirement last year, which could help spur a change in strategy.

Again, the CIT Group break up story is a lot like AIG; CIT Group could reduce its regulatory and tax costs if it breaks up. However, this is not as much of a slam dunk, but still worth digging deeper into. A number of CIT Group shareholders have mentioned the breakup idea in the past, so there’s some support for the idea. And, with the stock now down 30% so far in 2016, they’ll likely be hearing from more shareholders. The company has a conference set for March 23 to update shareholders about its strategy going forward.

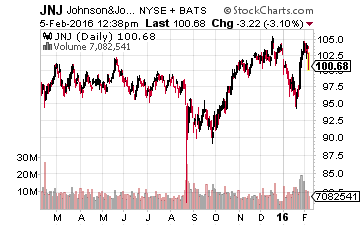

Break Up Bet No. 4: Johnson & Johnson (NYSE: JNJ)

Break up talk among the major consumer products and pharma companies is nothing new. Activist Bill Ackman tried to break up Procter & Gamble (NYSE: PG) in 2012, to no avail. However, shares of P&G have gone on to underperform the S&P 500 by 20 percentage points over the last three years.

With a market caps of over $200 billion, have the likes of P&G and Johnson & Johnson gotten too big to grow? That’s what Artisan thinks. The hedge fund is putting pressure on Johnson & Johnson, looking to get the mega cap pharma company to break into three companies: a pharma, medical device, and consumer products company.

Chances of a break up are nil, in my opinion. Johnson & Johnson still has its appeal to shareholders as a near $300 billion market cap healthcare conglomerate, which helps support its 3% dividend yield and affords the stock a lack of volatility (beta of 0.6). One thing that this call to break up might do is force Johnson & Johnson into returning more capital to shareholders. Which is not a farsighted since it has a solid balance sheet and $38 billion in cash.

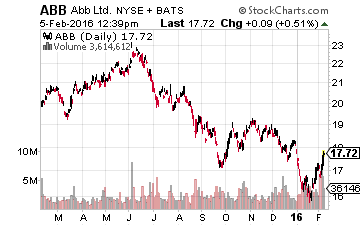

Break Up Bet No. 5: ABB Ltd. (NYSE: ABB)

This is the most underrated company on our breakup list. The company is U.K. based and is getting pressure from a U.K. based activist, Cevian. It’s not a full-blown breakup story, yet, as Cevian hasn’t put forth a breakup plan. However, it’s still a story worth digging into.

ABB operates globally in the power and automation technology industry. It’ll be one of the biggest benefactors of the push to renewable energy; new power networks and grids coming online is a positive for ABB.

The key for the split up talk is that ABB’s automation tech business is expected to grow quite nicely over the next decade, but its power business appears to be in decline. The power business is likely overshadowing ABB’s true growth hence the reason it trades at a hefty discount to peers. With shares down 13% over the last year, calls for a break up could get louder going forward.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more