5 Stocks To Watch This Week - March 21, 2016

(Photo Credit: daniel julià lundgren)

We’re officially at the crossover point for earnings season, with some stragglers still reporting for Q4, such as Krispy Kreme and GameStop, while a handful of names, including Nike, Finish Line and Red Hat are beginning to report for the first quarter.

Tuesday, March 22

Thursday, March 24

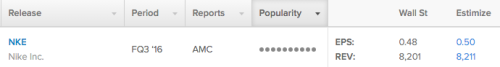

Nike (NKE)

Consumer Discretionary - Textiles, Apparel & Luxury Goods | Reports March 22, after the close.

The Estimize community is looking for EPS of $0.50 and revenue of $8.2 billion, 2 cents higher than Wall Street on the bottom-line, in-line on the top-line. Nike is seeing adverse revisions activity lately with earnings estimates falling 7% in the past three months. Still, the footwear company is predicted to see favorable year-over-year earnings growth of 11% and sales growth of 10%.

What to Watch: Just ahead of its FQ3 2016 report, Nike introduced the first-ever power lacing sneaker, an ode to Marty Mcfly in Back to the Future. Nike’s creative and innovative prowess has been leaps and bounds ahead of the competition in recent years, solidifying its staunch market position in the footwear industry. In the past 12 months the footwear giant has rode 4 consecutive earnings beats to a 29.6% increase in share price.

Like most retailers, Nike’s growth strategy has focused on developing its digital and ecommerce channels. In the first half of this fiscal year, digital sales grew 48% YoY on a constant currency basis. Online sales have also driven growth in Nike’s key Direct to Consumer segment. At its current pace, Nike is expecting digital revenue to reach $7 billion on $50 billion of total revenue by 2020. The company is also investing in 3D printing, with the goal of allowing customers to one day print sneakers from home.

The biggest obstacles the footwear giant is facing include stiffening competition, stagnant spending trends in the US and a slowdown in China (the company’s fastest growing region, responsible for nearly 15% of total sales). From a competitive standpoint, the rapidly growing Under Armour brand has been Nike’s biggest threat. With Tom Brady and Stephen Curry representing the brand, the two hottest athletes in their respective sports, experts believe other top athletes will begin to change allegiances to Under Armour from Nike. For the time being, Nike still remains the preeminent player at the moment, with a portfolio of star athletes in all major sports, a rapidly growing digital channel and a list of new innovative products on the way.

Krispy Kreme Doughnuts (KKD)

Consumer Discretionary - Hotels, Restaurants & Leisure | Reports March 22, after the close.

The Estimize consensus calls for EPS of $0.19, a penny higher than Wall Street, with revenue expectations of $134.35 million, roughly $1.5 million below the Street. Krispy Kreme is expected to maintain respectable year over year growth with earnings predicted to grow 12% on a 7% increase in sales. The Estimize community has been optimistic regarding profitability, revising EPS estimates up 6% since the company last reported. On average, Krispy Kreme consistently beats expectations, trumping Estimize 44% and Wall Street 54% of recorded quarters

What To Watch: This past year has been full of ups and (mostly) downs for Krispy Kreme. The iconic donut chain is coming off a mixed third quarter in which it missed on the top line but beat its earnings expectations. Domestic same store sales rose 3.4% while international franchise same store sales declined 3.7% as the negative effects of a stronger U.S. dollar continue to take their toll. The company’s biggest problem lately hasn’t been profitability, but revenues, which have missed expectations in each of the last 3 quarters. Consequently, shares have dropped 20.8% in the past 12 months. It’s well known that Krispy Kreme has suffered in recent years as the U.S. undergoes a systemic shift in consumer preferences. Americans are increasingly opting for healthy snacks over sugary treats like doughnuts and other baked goods. Even so, Krispy Kreme is taking an aggressive stance in its short term expansion. The company expects to open 20 new domestic franchise stores and over 100 to 110 new international stores by the end of fiscal 2016. Moreover, Krispy Kreme has maintained a clean balance sheet, ending the most recent quarter with $37 million in cash and less than $12 million in debt. If the company can deliver on its growth strategy and maintain sound financials, investors may recoup their losses.

Red Hat (RHT)

Consumer Discretionary - Specialty Retail | Reports March 24, after the close.

The Estimize consensus calls for EPS of $0.48, one cent above Wall Street and guidance, while revenue expectations of $337 million are $1.35 million above the Street and roughly in-line with guidance. However, our Select Consensus is even higher than the mean, with EPS expectations of $0.49 and revenues of $538.8 million. The Estimize community has been slightly bearish on Red Hat’s earnings in the past three months, revising EPS estimates down 2%. Still, these estimates predict as a YoY increase of 14% on the bottom line, while sales are expected to grow 16%. Red Hat has consistently outperformed expectations, beating both the Estimize EPS and revenues consensus 71% of the time.

Red Hat is one of the leaders in open source technology and has been hard at work making improvements to many of its services. Most of the focus has been on the cloud, as RHT looks to provide a solid support base and a cost friendly platform which includes applications, middleware, desktop domains, and an operating system. Late last year, the company made its Red Hat Enterprise Linux (RHEL) available on Microsoft’s Azure cloud and has made support available for Microsoft Azure on its CloudForms hybrid cloud management system. Cloud subscription services alone bring in close to $100 million in revenue, the integration with Azure will certainly add to this figure. Furthermore, Red Hat has been working with Alcatel-Lucent, a French global telecommunications equipment company. The two came to an agreement in December, in which their pre-existing partnership on CloudBand, Alcatel-Lucent’s platform for network functions virtualization (NFV), and RHEL, would be expanded upon. Essentially, Red Hat will assist Alcatel-Lucent with the task of improving NFV based features in the telecommunications realm within open source.

Finish Line (FINL)

Consumer Discretionary - Specialty Retail | Reports March 24, before the open.

The Estimize consensus calls for EPS of $0.81, in-line with Wall Street and guidance, with revenue expectations of $570.7 million, about $1 million less than the Street. The Select Consensus on the other hand, is right in line with Wall Street on the bottom line, but is expecting sales of $572.7 million. The Estimize community has maintained a pessimistic stance on profitability, revising EPS estimates down 16% in the past 3 months and 5% in the past month. It comes as no surprise that current estimates forecast a 8% YoY decline on the bottom line while sales are looking to rise a meager 3%.

What to Watch: Finish Line is coming off a rough third quarter in which it missed on both the top and bottom line by a mile. Both Estimize and Wall Street had expected marginal losses in the the single digits for the quarter, but ultimately Finish Line posted EPS of -$0.49 and missed on the top line by $20 million. As a result, shares have taken a beating, falling 26.8% in the past 6 months. The company’s third quarter performance was severely impacted by a disruption in its supply chain following the implementation of a new enterprise management system. Finish Line ended the quarter with net sales decreasing 3.5% on a YoY basis and comp sales down 5.8%. One way FINL intends to improve profitability is by shutting the doors on 150 of its worst performing stores, or 25% of its store base, in the next 4 years. On the competitive front, Sports Authority’s recent bankruptcy creates some customer acquisition opportunities for Finish Line, but Foot Locker still remains the biggest threat. Finish Line maintains a sound balance sheet, ending the most recent quarter with no interest bearing debt and $55.3 million in cash and cash equivalents.

GameStop (GME)

Consumer Discretionary - Specialty Retail | Reports March 24, after the close.

The Estimize consensus is calling for EPS of $2.26 and revenue of $3.58 billion, 1 cent higher on the bottom line and $10 million great in sales. However, the Select Consensus is expecting a miss of $11 million on the top line. The crowdsourced community has been been bearish on Gamestop, revising both EPS and revenue estimates down 6% in the past 3 months. Compared with the previous year, this predicts earnings growth of 5%, while sales are looking to grow by 2%. Historically, the video game retailer has consistently beat expectations, trumping Estimize in 69% and Wall Street in 76% of recorded quarters.

What to Watch: Despite a weak holiday shopping season, Gamestop is hoping year-end sales can give fourth quarter results a much needed lift. Shares received a nice boost last week after management indicated that the company is on pace to beat its fiscal 2015 guidance. However, this hasn’t been enough to reconcile the 28% decline in the stock price over the past 6 months. Gamestop is coming off of a disappointing third quarter with total sales decreasing 3.6%, reflecting a decline in every key segment; next generation hardware fell 20.4%, new software sales declined 9.3% and global comp sales shrank 1.1%. A majority of the contraction was attributed to currency headwinds which cost Gamestop $100 million in sales and 2 cents in earnings per share. Unfortunately, early indications look bleak for the video game industry and Gamestop this quarter. In the past 3 months, overall U.S. software sales reported consecutive declines highlighted by a 10.3% decline in February. Moreover, industry sales of prior generation and portable units declined 74% and 54%, with the only bright spot being next gen hardware. Even so, Gamestop really doesn’t have much direct competition and controls over 50% of the market.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.