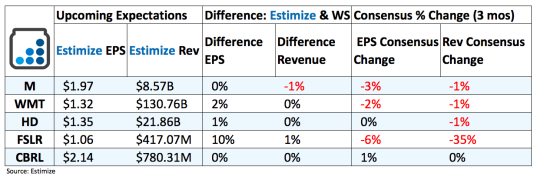

5 Stocks To Watch That Report Earnings Tomorrow

Macy’s (M): Macy’s efforts to lift financial performance include focusing on price optimization, inventory management, merchandise planning and private label offerings. But the primary drivers lately have been its ecommerce and off price business, Macy’s backstage, that continue to keep the Macy’s brand afloat. Furthermore the company plans on shutting the door on over 100 unprofitable stores to maintain modest margins. Meanwhile, there is ongoing pressure for Macy’s to spin off its real estate into a REIT, a move believed to be worth billions and provide an injection of capital

With that in mind, the competitive retail landscape following Amazon’s onslaught on the industry continues to pressure traffic and top line performance. Macy’s already indicated that the holiday season fell short of initial expectations. Comparable sales on an owned plus licensed basis fell 2.1% while owned basis decreased 2.7% during the final two months of 2016.

Walmart (WMT): In the past 6 months shares of Walmart tumbled about 5.5% owing to Trump’s rhetoric surrounding immigrant workers and a border tax, both of which would severely hamper financial performance. Walmart currently employs 2.3 million associates worldwide, many of which hold an immigrant status, while also offering everyday low prices, largely due to overseas production and manufacturing. Any comments or insights on the new administration’s impact on future quarterly results will break investors historically indifference to an earnings report.

Otherwise, Walmart continues to work tirelessly to modernize its brick and mortar stores and expand the online platform. The acquistion of Jet.com in the past 6 months should theoretically close the gap on Amazon’s dominance in online retail. But most analysts don’t believe the combination of Walmart and now Jet will make any meaningful progress at catching Amazon.

On a constant currency basis, ecommerce sales grew 20.6% with gross merchandise value up 16.8% in the third quarter, both reflecting a continued acceleration from previous quarters. This contributed to a 2.5% increase in domestic Walmart sales while international volume decreased by nearly 5%. The combination of macroeconomic volatility, weaker brand recognition overseas and currency headwinds play a considerable role in lackluster overseas sales, As for Sam’s Club, Walmart’s wholesale arm, net sales grew 1.1% to $14.27 billion from $14.08 billion with comp sales up 100 basis points.

Walmart’s biggest advantage over Amazon and other online retailer is its expansive grocery and fresh food offerings. Walmart’s are often considered one stop shops for families to do their weekly grocery shopping and to pick up anything else they might need. The adoption of these services amongst online retailers have yet to gain traction. Amazon of course opened up its first grocery store in Seattle that will eventually pose a problem for Walmart down the road. In the meantime stores like, Walmart, Target and Costco hold the upper hand in this segment.

Home Depot (HD): Home Depot continues to benefit from the persistent housing market recovery along with a greater focus on improving customer experience and expanding its omni channel capabilities. Many of these moves have supported financial performance in the past few years, despite ongoing difficulties in the retail space created by Amazon. Home improvements have remained resilient from Amazon’s wrath where clothing or electronics retailers continue to struggle. The biggest concerns moving forward include currency headwinds, soft consumer spending, and the ongoing rhetoric coming out of the Trump administration.

First Solar (FSLR): From a financial perspective, First Solar is one of the only solar companies that hasn’t consistently posted a loss. Its primary focus has been on large commercial markets where its competitors have been tied to less profitable residential and small commercial markets. In the previous earnings call the company lowered its revenue guidance for 2016 to $2.8- $2.9 billion from earlier projections reaching as high as $4 billion. Some of this should be offset by the sale of large scale utility projects such as the one signed with MCE last quarter.. First Solar robust pipeline and unique technology gives them the upperhand against its peers but an industry wide pullback doesn’t mean it won’t suffer. Meanwhile, Trump’s appointment of Scott Pruitt to the EPA sets the stage for a rollback in renewable energy policies that supported financial performance.

Cracker Barrel (CBRL): The restaurant continues to outperform the broader restaurant industry owing to a differentiated brand experience, strong marketing efforts and sound operations execution. In each quarter of the past 2 years Cracker Barrel posted positive comparisons on both the top and bottom line. Its most recent report recorded a 1.3% increase in comparable store sales, marking a 10th consecutive quarter of positive growth for this metric. Retail sales, on the other hand, remain a point of concern after comp sales decreased 4.0% from a year earlier. Meanwhile traffic continues to decline across both restaurant and retail stores likely from a 2.2% increase in average menu prices.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.