5 Stocks For Finding Stable & High Yields In The Energy Sector

Even after oil prices were cut in just six months, recent negative press, a string of dividend cuts and fear-mongering have investors continuing to sell everything oil-related. In spite of this, there are still some underrated plays on the beaten down oil industry that can provide investors with stability and income in this time of uncertainty.

The oil industry just can’t catch a break.

Let’s start with the negative news — Last week, a CSX (NYSE: CSX) train carrying crude oil derailed in West Virginia, with 14 railcars going up in flames. Interestingly enough, this came just a few days after a Canadian National Railway (NYSE: CNI) train transporting 100 tanks of crude derailed in Ontario, Canada.

Although neither of these derailments have anything to do with supply or demand, or even the price of oil, it’s still a big negative for an industry that can’t seem to stay out of the news.

This comes after a string of high-profile dividend cuts, exaggerated by the fear of more dividend cuts.

The big dividend cuts that investors are focusing on came from Linn Energy (NASDAQ: LINE), LinnCo (NASDAQ: LNCO) and Breitburn Energy Partners (NASDAQ: BBEP). These guys were big time dividend payers, offering 20% plus dividend yields heading into 2015.

But the main reason for the steep dividend yields was the fact that their stock prices had taken a beating, following the price of oil sharply lower. And with oil prices falling, the three companies were seeing their cash flow dwindle.

You see, they generate a large part of their income from upstream oil and gas activities, where they profit from the exploration and production of oil. But with oil prices being cut in half, the amount of exploration and production activity is grinding to a halt.

But have no fear.

There are still opportunities to collect a steady dividend check, while still keeping your exposure to the energy industry intact. Without a doubt, any conversation of dividends and oil can’t be had without talking about the midstream part of the market; specifically, the MLPs that operate pipelines.

Granted the debate over the massive Keystone XL pipeline project continues, with the bill being passed by both the House and Senate earlier this year. And the proposal will hit President Obama’s desk later this month.

But in the meantime, there are other ways to collect dividends — ways that allow investors to enjoy a bit more stability than companies that rely heavily on the amount of oil extracted from the ground.

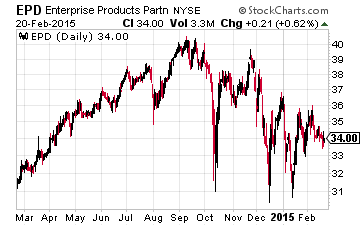

This includes, Enterprise Products Partners LP (NYSE: EPD), which is one of the largest MLPs around — having a $65 billion market cap. Its 4.4% distribution yield isn’t that bad either. This MLP has assets from the Gulf of Mexico to the Rockies.

The interesting thing about Enterprise Products Partners is that it’s shown interest in taking advantage of companies that are being beaten down due to the selloff of energy-related investments. And its balance sheet is strong enough to do so, with over $4 billion available on its credit lines.

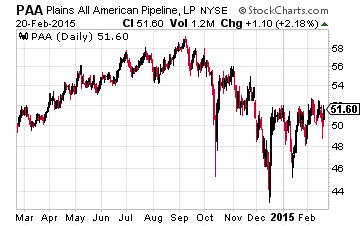

Then there’s Plains All American Pipeline LP (NYSE: PAA), which is another fairly large MLP and one that my colleague Tim Plaehn fromThe Dividend Hunter has covered extensively, having a near $20 billion market cap. And its distribution yield is over 5%. This MLP has pipelines that funnel from all over into the Midwest.

With various acquisitions over the years, Plains All American now has pipelines, terminals and storage facilities to support moving crude from Canada, the mid-continent and Gulf of Mexico to the Midwest. All its segments have a large number fixed fee contracts that continue to help support cash flow while oil prices remain low.

But at the end of the day, the conversation surrounding the midstream MLPs that transport oil and gas is well told; yet, one part of the market that’s being left out is refining.

Refiners are much like midstream pipeline and transportation assets. They make money on the volume of oil that is refined, but also capitalize on the spread between oil prices in the U.S., versus internationally. And as gas prices remain low, consumers will travel more, meaning they fill up their cars more. More gasoline demand is great news for the refiners and transporters.

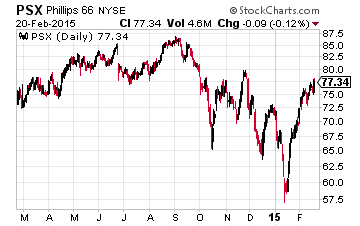

One of the biggest players in the refining space is Phillips 66 (NYSE: PSX), paying a 2.6% dividend yield. But the other part of the Phillips 66 story is that it’s becoming a midstream-downstream hybrid company. By 2017, just 30% of its earnings will be from refining as it continues to boost its transportation and storage capabilities.

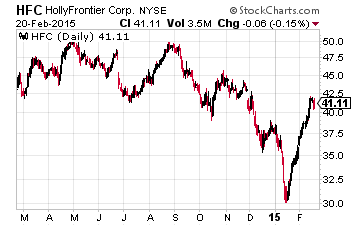

Then there’s the much smaller HollyFrontier Corp (NYSE: HFC), which pays a 3.1% dividend yield. That 3.1% yield is just for its regular 32 cent a share quarterly dividend payment. However, the company has been consistently paying a 50 cent a share special dividend each quarter. Add that in, and its yield is upwards of 8%.

Despite being one of the smaller refiners, HollyFrontier shouldn’t be overlooked, because it has a strategic geographical setup. It’s the only independent refiner that has operations in the three major refining markets — operating in the Southwest, the Rockies and the mid-continent areas.

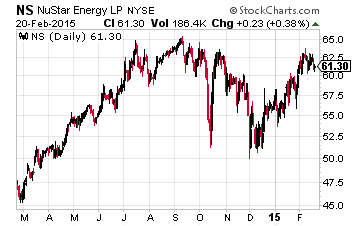

Refiners have also been capitalizing on the growing demand for high yielding MLPs by spinning off their assets. One of the most diverse downstream MLPs is NuStar Energy LP (NYSE: NS), which runs various terminals and pipelines related to refining. In addition to a focus on the U.S. it has assets in Europe, Mexico and Canada.

Its distribution yield is also an enticing 7.2%. And again, its appeal is that its cash flows are largely fee-based. In the last two years it has vastly reduced its exposure to commodity prices, where less than 20% of its cash flows are dependent on the price of oil and gas.

In closing: Trying to time the bottom in oil prices will prove to be a fool’s game. For investors interested in gaining exposure to the oil market without the volatility (think: stable cash flows and robust dividends), your best bet is well insulated MLPs and stable dividend payers.

Disclosure: None