5 Solid Large Caps

Today I used Barchart to sort the S&P 500 Large Cap Index stocks to find the stocks with the best technical indicators and charts.

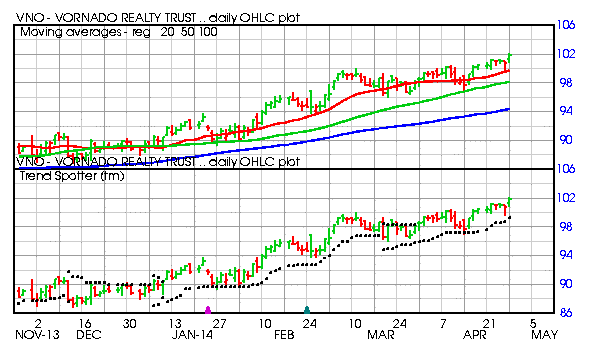

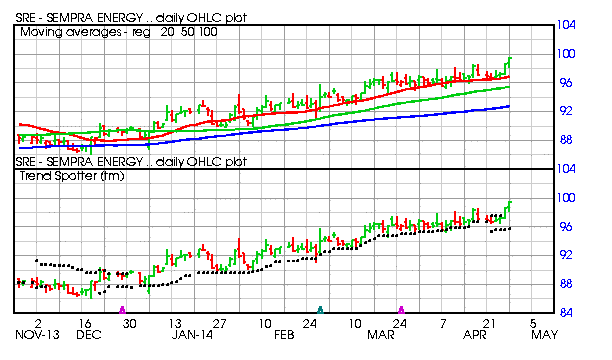

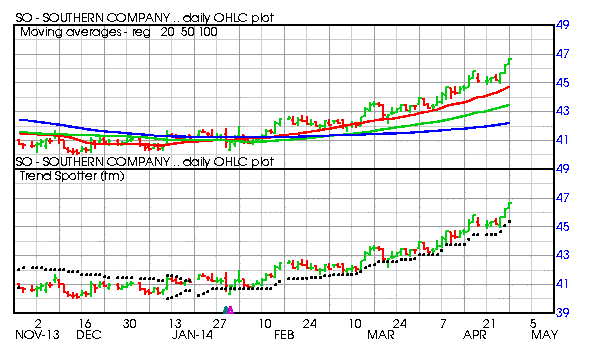

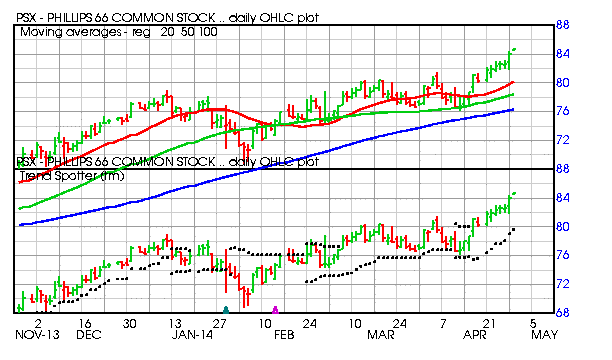

My list includes Voranado Realty Trust (VNO), Sempra Energy (SRE),Southern Company (SO), Phillips 66 (PSX) and Public Storage (PSA):

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter technical buy signal

- Above its 20, 50 and 100 day moving averages

- 11 new highs and up 3.90% in the last month

- Relative Strength Index 67.26%

- Barchart computes a technical support level at 100.37

- Recently traded at 102.38 with a 50 day moving average of 98.16

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter technical buy signal

- Above its 20, 50 and 100 day moving averages

- 7 new highs and up 3.86% in the last month

- Relative Strength Index 69.21%

- Barchart computes a technical support level at 97.60

- Recently traded at 99.49 with a 50 day moving average of 95.51

Barcart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter technical buy signal

- Above its 20, 50 and 100 day moving averages

- 10 new highs and up 7.63% in the last month

- Relative Strength Index 74.85%

- Barchart computes a technical support level at 46.08

- Recently traded at 46.61 with a 50 day moving average of 43.48

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter technical buy signal

- Above its 20, 50 and 100 day moving averages

- 10 new highs and up 9.65% in the last month

- Relative Strength Index 69.147%

- Barchart computes a technical support level at 80.91

- Recently traded at 84.54 with a 50 day moving average of 78.26

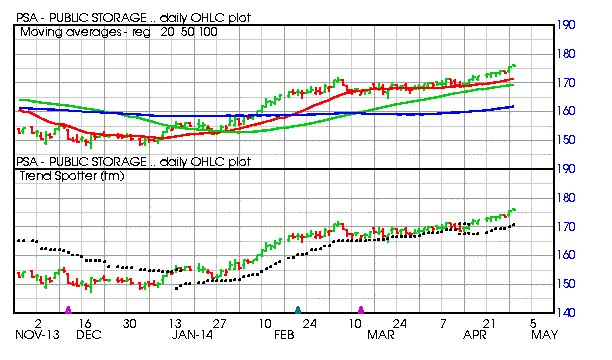

Barchart technical indicators:

- 100% Barchart technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 12 new highs and up 4.51% in the last month

- Relative Strength Index 72.50%

- Barchart computes a technical support level at 172.85

- Recently traded at 176.19 with a 50 day moving average of 169.16

Disclosure: None.

PSX hit a high of 87.51 on Sept 4, but then began a steep decline down to 65.09 on Dec 15. A few days later, Deutsche Bank upgraded the stock from Hold to Buy, but lowered its target price down from $101 to $92, and selected the company a "Top Pick".

Do you feel it will pull back to $90 given enough time?