5 Mid Caps For Momentum Investors

Today I used Barchart to sort the S&P 400 Mid Cap Index stocks to find the 5 best Momentum picks. First I sorted for the most frequent new highs in the last month, then again for technical buy signals of 80% or better. Next I used the Flipchart feature to review the charts for consistency.

Today's watch list includes: CDK Global (NASDAQ:CDK), Manhattan Associates (NASDAQ:MANH), Clear Harbors (NYSE:CLH), Communication Sales & Leasing (NASDAQ:CSAL) and Bio-Techne (TECH).

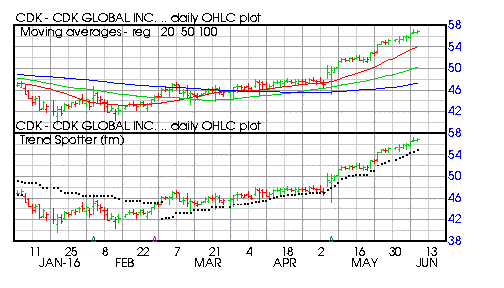

CDK Global

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 18 new highs and up 13.47% in the last month

- Relative Strength Index 85.34%

- Technical support level at 56.23

- Recently traded at 56.88 with a 50 day moving average of 50.22

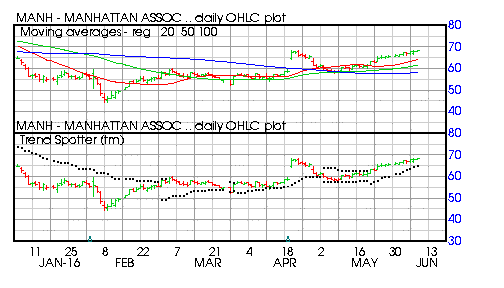

Manhattan Associates

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 18 new highs and up 16.05% in the last month

- Relative Strength Index 75.24%

- Technical support level at 66.20

- Recently traded at 68.17 with a 50 day moving average of 61.44

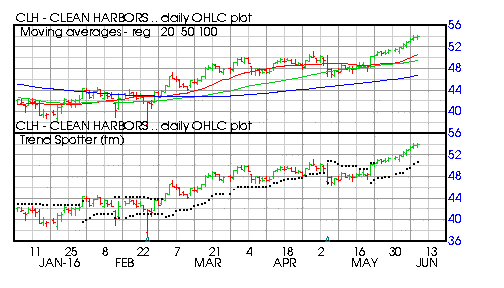

Clear Harbors

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 17 new highs and up 13.30% in the last month

- Relative Strength Index 76.65%

- Technical support level at 52.83

- Recently traded at 53.95 with a 50 day moving average of 49.45

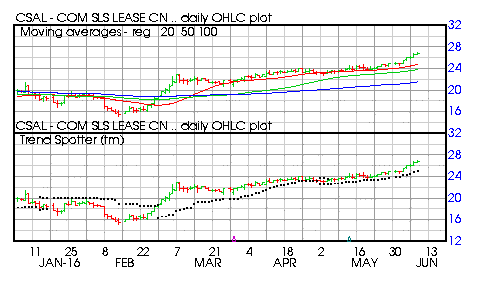

Communications Sales & Leasing

Barchart technical indicators:

- 100% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 13.82% in the last month

- Relative Strength Index 80.76%

- Technical support level at 25.79

- Recently traded at 26.68 with a 50 day moving average of 23.80

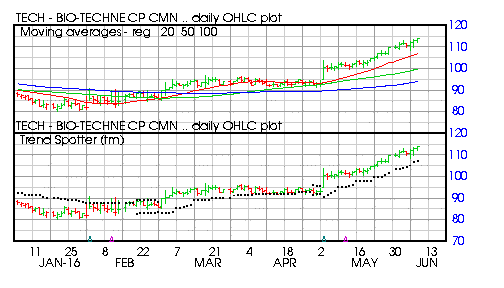

Bio-Techne

Barchart technical indicators:

- 96% technical buy signals

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 12.30% in the last month

- Relative Strength Index 82.14%

- Technical support at 108.33

- Recently traded at 113.77 with a 50 day moving average of 99.73

Disclosure: None.