5 High Probability Options Trades For May

When I first started trading, I ignored the Dow Jones Industrial Average and its ETFs (DIA) because – after all – why would I limit myself to the 30 most popular stocks? But now, as an options trader, I find myself almost limited to those stocks that are most liquid. Because of this, I’ve looked into many aspects of this index, including the seasonality of its components.

DIA is not without problems. Not only is it unevenly weighted in favor of high-priced stocks, but its overriding idea – that it measures the health of the US economy – is likely flawed. For this reason, investors eyeing the DIA as a portfolio component would be well advised to pick apart the ETF’s holdings and look at each stock individually.

I am a huge fan of seasonality. Many readers scold me for “attempting to time the market.” But statistical patterns are real, and “this time is different” are the four most expensive words in the English language.

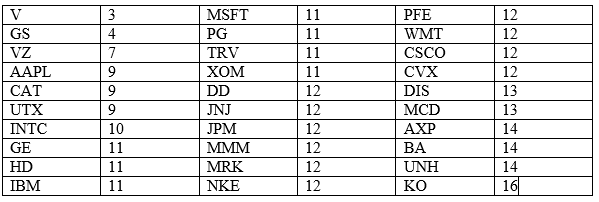

Consider the following:

What you’re looking is the table of “rankings.” I derived the rankings by running over each stock for the past twenty years and tracking the number of positive months for May. Larger numbers are better for the stock’s prospects.

The fundamental basis for a certain company performing well or performing poorly in May differs. Interestingly, this is not a sector seasonality phenomenon, as evidenced by – for example – one credit card company American Express (NYSE: AXP) performing reliably well in May and another Visa (NYSE: V) performing poorly. We see this again with banks – JP Morgan (NYSE: JPM) a “hold” in May; Goldman Sachs (NYSE: GS) a “sell.”

The driver of each stock’s seasonality is best left to in-depth fundamental analyses on each individual stock. For now, we want to focus on a general portfolio-building. Based on these rankings, you could easily build a portfolio of more intelligently weighted DIA components. I leave that up to you; for this article, I merely want to look at the most extreme results of this ranking and provide an options trade on the stock.

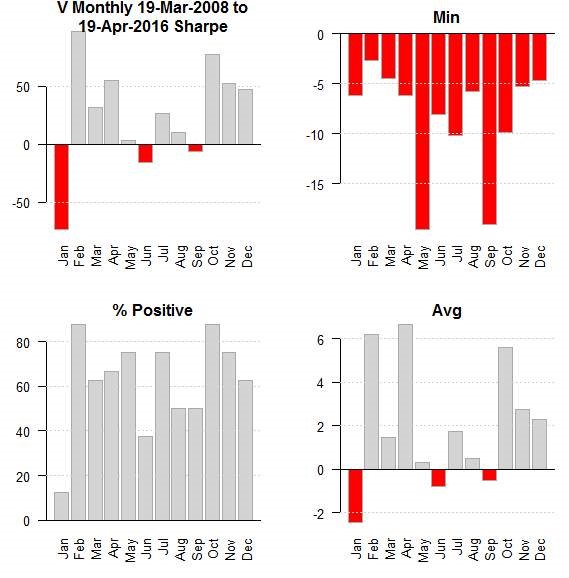

Visa

Visa is the most extreme in this set of results:

May certainly is the most dangerous month for Visa, with a max drawdown of 20%. The average May is negative for this stock. Still, the bullish Mays overtake the bearish Mays in the long run, giving a slightly positive average for the month.

Regardless, investors would be well advised to stay away from Visa during May – or at least hold off on adding more to your position. For credit cards, we prefer American Express for May. Let Visa build up some new projects in May, and consider diving back in during the fall.

Visa recently released its earnings report, and it’s not pretty. May should see a downturn. Here’s the play:

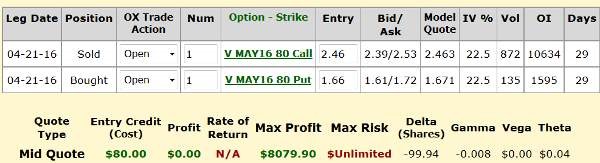

Synthetic short position, opened at a credit:

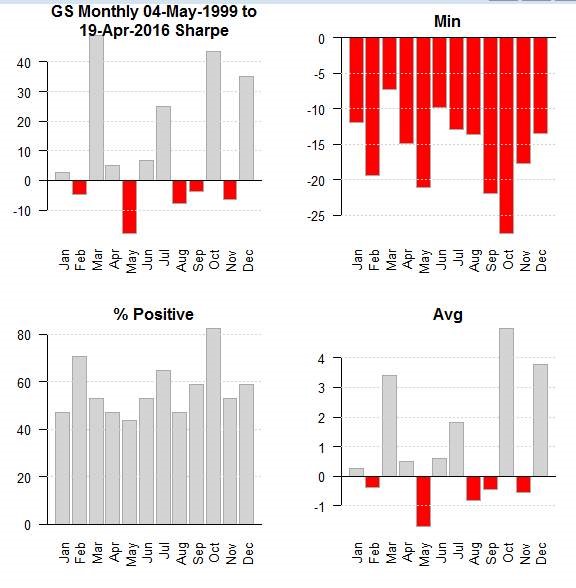

Goldman Sachs

GS is the second most extreme May DIA stock:

For May, GS’s Sharpe ratio is actually negative. The max drawdown is not the worst, however. Still, the average May for GS is negative.

With fewer than 50% of Mays being positive for GS, you should stay away from GS. We prefer JPMorgan in May. This goes double in light of its earnings report, which – although beating on earnings – does not look good for the company in terms of overall revenue.

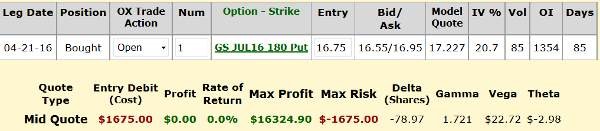

Here’s the play for GS:

Long put:

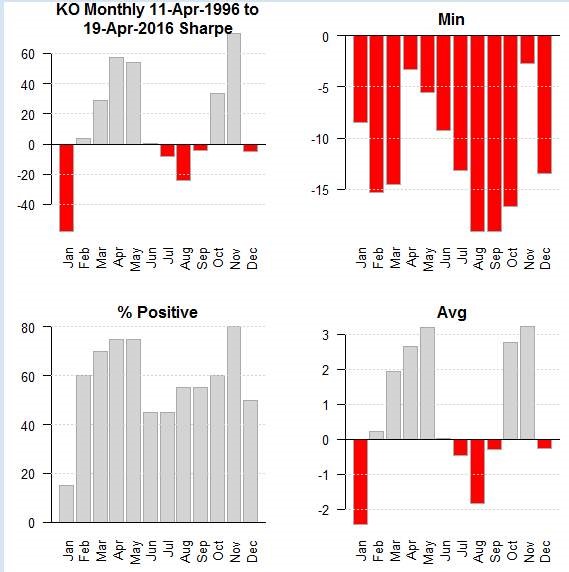

Coca-Cola (NYSE:KO)

KO shows the best results for May:

Nearly 80% of Mays are positive for KO, and May ties for first place for the stock’s average yield. Expect a 3% gain for the average May.

May also has the third-lowest drawdown. Perhaps it’s the post-earnings boost that drives May gains for KO. KO again beat estimates for earnings this quarter, yet the stock is down and set to recover – now is a good time to buy.

Here’s the play:

Credit spread:

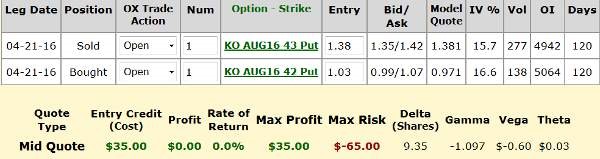

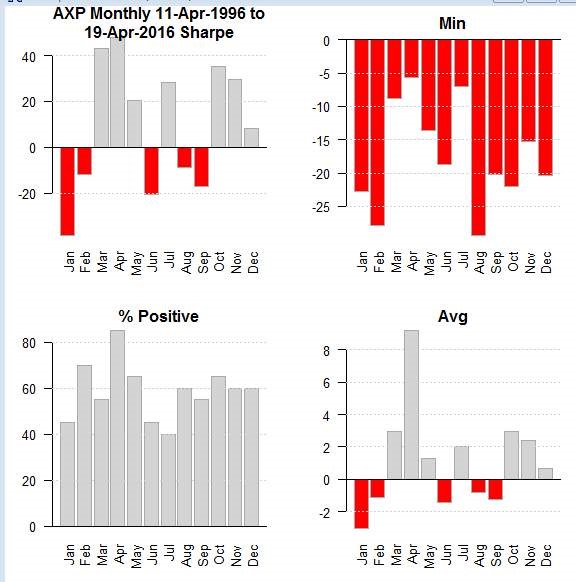

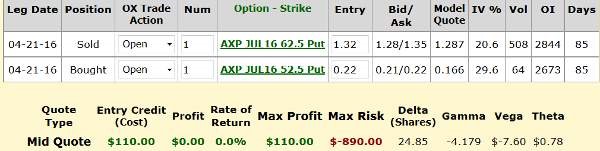

American Express (AXP)

In contrast to Visa, this company does quite well in May. Although the positive-negative ratio is essentially zero, its good years beat its bad years, leading to an average 2% gain for May. We will know how May looks after the earnings report tonight.

As for a pattern, AXP seems similar to Visa, only trickling off later than Visa. Like Visa, AXP’s best performance is in the Autumn. Wait for earnings before deciding whether to jump into this one.

But here’s the play in advance:

Credit spread:

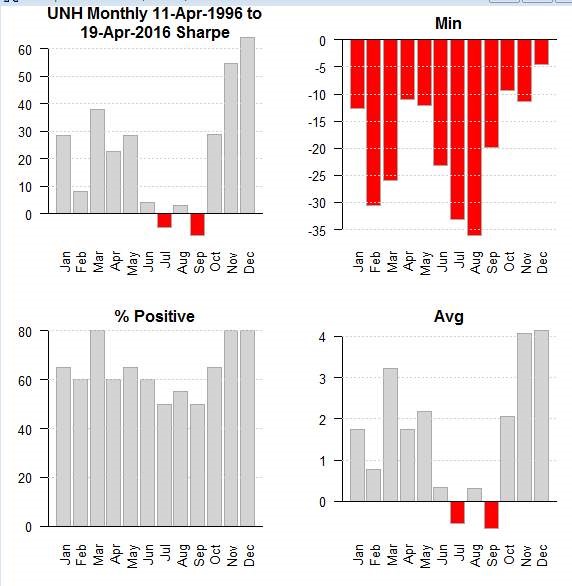

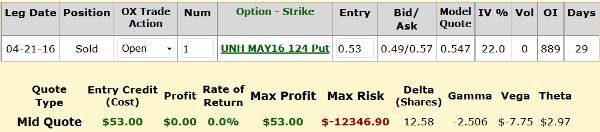

UnitedHealthcare (UNH)

UNH is positive most months, but May is especially safe. Though KO tends to offer a better yield in May, UNH is perhaps better for a conservative portfolio. With UNH posting especially encouraging results for this quarter, the company should outperform in May.

Here’s the play for May:

Short puts:

Conclusion

The above stocks in the DIA show the most extreme results. A hedged portfolio would short V and GS, going long AXP, UNH, and KO. Overall, the “sell in May” phenomenon does not apply to every stock in the DIA. While using high probability options trades like the five above are a great way of earning some extra income from your portfolio, they do not replace owning high-quality income stocks that you can buy and hold forever. In the market right now there are a limited amount of options for investors looking to earn a growing income stream from safe investments. And, with the Federal Reserve punishing savers like they are right now, buying a safe CD that pays good interest is no longer an option.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more