5 Best Energy Stocks For Growth And Stability

It looks like oil prices have finally plateaued, and with that in mind now is the best time to go on the offensive, picking up some great companies trading at bargain valuations. These five stocks are poised to grow double digits when oil rebounds and have above 3% yields so you can be sure they are safe investments.

Calling a bottom in anything is never easy, and often times impossible.

But here we go; by all accounts, oil appears to have put in a bottom. Now, I’m not saying oil will be at $100 a barrel in six months.

Rather, it could lull around the $60 a barrel for several months.

It’s for that reason, along with the fact that it could be a slow move upward, that investors should seek refuge in oil stocks that will provide income, in addition to stock price growth.

Oil prices experienced a powerful downward spiral from $100 a barrel to $50 in just six months. That story is well-told and well-known. A glut of oversupplied oil appeared to be driving the drop.

The shale boom in the U.S. was the main culprit, leading to a boom in oil supply across the globe. But after the collapse in oil, shale players started reining in oil production by cutting capital expenditures and idling drilling rigs. After several months, all this is finally translating into deceased production.

Last week, the government released numbers that showed U.S. oil production is finally starting to fall. Oil production fell by 36,000 barrels a day, which doesn’t sound like much, but it is an important market to what was a seemingly endless climb to record oil production levels in the U.S.

Through all this, demand has remained en vogue. So, the supply and demand imbalance is getting reined in rather quickly.

Global unrest is still afoot, which is also working against low oil prices, or for them, depending on which side of the trade you’re on. Recall the spike in oil we saw after Saudi Arabia launch air strikes against Yemen.

Now, will it rocket back to $100 a barrel in six months? That’s tough to say, but as long as prices remain low, the likelihood of a supply shortage only compounds.

Nonetheless, it does appear to be a buying opportunity here; a chance to lock in certain oil stocks trading at ridiculously low valuations and multi-year lows, but especially those that will perform well as oil prices rise over time.

I think it’s infinitely harder to estimate exactly how fast oil prices will rebound, that’s why I like oil stocks paying hefty dividends. I’m talking about 3% to 5% dividend yields that are protected by strong balance sheets and backlogs of work.

So, for investors looking to play offense here to capitalize on the oil bottom, it also pays to be a bit defensive. Without further ado, here are the five ways to play the oil bottom:

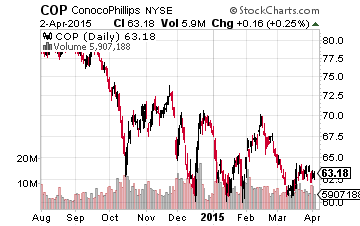

No. 1 Way To Play The Oil Bottom: ConocoPhillips (NYSE: COP)

Sometimes biggest is best, and when it comes to the oil Supermajors, ConocoPhillips is the best way to capitalize on the oil bottom.

With a $78 billion market cap, it’s one of the largest oil and gas companies around. But the real reason to like it is, since the 2012 spinoff of its refining business, now trading at Phillips 66 (NYSE: PSX), it’s the largest independent pure play oil explorer and producer in the world.

Meaning, unlike the typical Supermajors, which are large integrated oil and gas companies, ConocoPhillips makes all its money from finding and extracting oil. Thus, it’s much more levered to oil than the likes of Chevron (NYSE: CVX) and Exxon Mobil (NYSE: XOM).

Its dividend yield of 4.7% is also well above what you’ll get from other large oil companies, including fan favorite Exxon Mobil, which is paying just 3.2%. ConocoPhillips has also upped its dividend for two years straight now.

Operations wise, the reason we like ConocoPhillips as a stable way to play the oil bottom is that it only operates in stable OPEC countries. Most notably, it also has large positions in the fast growing Bakken and Eagle Ford shales in the U.S., which will be big benefactors from an oil price rebound.

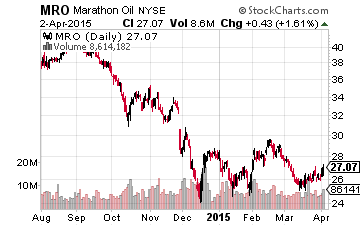

No. 2 Way To Play The Oil Bottom: Marathon Oil (NYSE: MRO)

Marathon Oil is an underrated exploration business. It too spun off its refining business a few years ago, but with just a $18 billion market cap, it’s sometimes overlooked. It’s paying a 3.1% dividend yield and has upped its dividend for three consecutive years.

The reason to like Marathon is that it has exposure to a number of liquids-rich shale plays. These plays include the Bakken and Eagle Ford shales.

Marathon also has a strong balance sheet, where it had nearly $5 billion in available liquidity going into 2014. What this means is, instead of having to continue producing oil at a cheaper price just to cover debt payments and meet obligations, it has been able to cut production in rapid fashion, in an effort to save its valuable acreage for when oil prices are higher.

Now let’s get into a few more volatile (read: speculative) plays.

Oil stocks with a strong balance sheet have proven to be some of the best ways to play thevolatile industry of late.

Just over a month ago we profiled the stocks to own in today’s oil market, where we called out two stocks with top notch balance sheets, Newfield Exploration (NYSE: NFX) and WPX Energy (NYSE: WPX). Both those stocks are up around 10% since then.

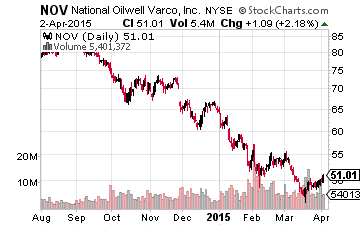

No. 3 Way To Play The Oil Bottom: National-Oilwell Varco (NYSE: NOV)

National-Oilwell is the $20 billion market cap oil service equipment maker, but it’s already been rocked this year, having its stock fall 20% over the last three months.

But it still has a healthy dividend yield of 3.6% and has upped its annual dividend payment for six straight years. Balance sheet wise? Well it has enough cash to cover its entire debt load, so there’s that.

It counts many of the major drilling companies as customers. And it’s the market share leader in nearly every product it makes. Yet, its core customer is offshore drillers, which has been a volatile bunch.

Nonetheless, it also has $14 billion worth of backlogged work, compared to its $20 billion in annual revenues. So this alone will help cushion the company should oil prices remainstubbornly low.

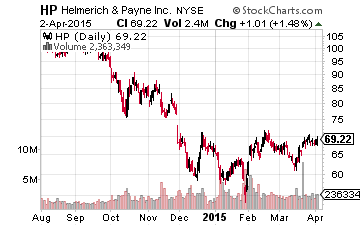

No. 4 Way To Play The Oil Bottom: Helmerich & Payne (NYSE: HP)

HP is an onshore driller of oil and gas wells in the U.S. And with a $7.5 billion market cap and just $80 million in debt, it undoubtedly has the best balance sheet of our five stocks. It goes without saying, but it has more than enough cash to cover its debt.

The story gets better too. Shares are trading at an enterprise value-to-earnings before interest taxes depreciation and amortization (EV/EBITDA) multiple of just 4.3x. The last time we saw HP this cheap was back in 2008-2009.

Let’s not forget the near 4% dividend yield; that’s the highest we’ve seen since the late 80s. It also has a 42 year streak of dividend increases. It just upped its dividend, showing resiliency at a time when other oil-related companies are cutting theirs. Plus, its backlog is above $4.5 billion, compared to its $3.9 billion in revenues from the last twelve months.

The beauty of HP is that it has vast exposure to the horizontal drilling market, which has quickly become the go-to method for drilling in the U.S. — 70% of the wells in the U.S. are being drilled horizontally.

It has managed to grow its market share from less than 5% to nearly 20% over the last decade, having taken share from the likes of Nabors (NYSE: NBR) and Patterson-UTI Energy (NASDAQ: PTEN) during the financial crisis of 2008.

No. 5 Way To Play The Oil Bottom: Tidewater (NYSE: TDW)

With a 5% dividend yield, it’s our highest yielding play. It’s also our most indebted play, where its market cap is right at $1 billion, but it carries some $1.5 billion in debt. Then there’s the fact that it services the offshore drilling industry. Which makes it our most volatile play.

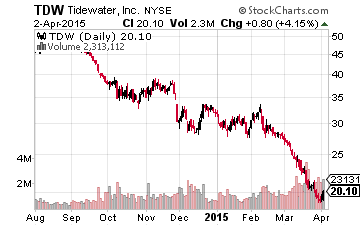

The oil & equipment services industry is one of the worst performing over the last six months, having fallen 24%. This comes as offshore drillers like Transocean (NYSE: RIG) and Pacific Drilling (NYSE: PACD) have taken a beating, down more than 50% over the last six months. Tidewater is right there with them, off 48% over the same period. Trading at $20 a share, Tidewater has now sunk to 15-year lows.

But back to the dividend for a minute, its the highest yield we’ve seen from Tidewater since the early 90s. We’re also encouraged by the fact that its dividend remained intact throughout the last oil collapse in 2008, where the company actually upped its quarterly dividend from 15 cents to 25 cents during that time.

There are positives for Tidewater in the current environment, however. This includes the fact that it has one of the newest fleets of vessels among offshore services, which means its vessels are in higher demand and they command a higher price.

In closing, I’ve said before that “trying to time a bottom in prices will be a fool’s game.” This remains true, hence the reason the overarching theme from above is oil stocks paying enticing dividend yields. We no longer liken investing in oil to trying to catch a falling knife. It has hit its bottom and now it’s a game of wait-and-see until oil prices start to rise, thanks to the law of supply-and-demand. That’s why we like stocks that also pay hefty dividends.

Disclosure: None