4 REITs Raising Dividends In April

The potential of regular dividend increases is one factor that sets REITs apart from many other higher yield types of investments. With the REIT sector acting pretty ugly over the last month or so, an announced dividend increase can be the catalyst to move a share price higher, even in the face of a volatile or down market. If that is what you’re looking for as an investor, then look no further as these 4 REITs look to be prime candidates for dividend increases.

Most REITs that have histories of dividend growth pay quarterly dividends and announce an increase once a year. Some REIT companies increase their payout every quarter and a few more that will increase the dividend at random intervals. As a result, announced dividend increases from the REIT sector happen every month of the year. If you buy shares before a dividend increase is announced, you have a good chance of getting a nice share price increase when the market figures out that a REIT’s dividend has grown and the share price should go up to keep the yield in line. Each month I review my database of about 120 REITs to ferret out those that are scheduled by historical precedent to increase their dividends in the next month. Here are the four REITs that should (or at least have a high probability to) announce dividend increases in April.

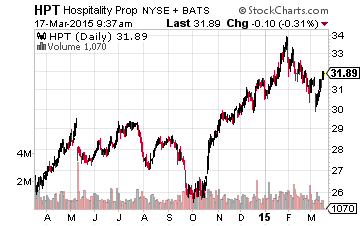

Hospitality Properties Trust (NYSE:HPT) typically announces a dividend increase in the first week of April. In the company’s 2014 year end results, normalized funds from operations, FFO, per share increased by 10% compared to 2013. The dividends paid in 2014 were just 59% of the FFO generated for the year. HPT yields 6.15% and a 10% dividend boost would not be out of line.

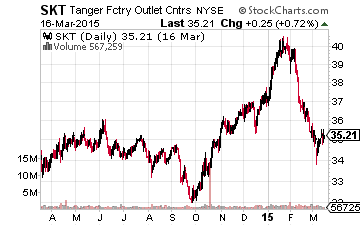

Tanger Factory Outlet Centers Inc. (NYSE:SKT) should also announce a dividend increase in the first week of April. For 2014, Tanger’s adjusted FFO per share increased by 4.9% compared to 2013 cash flow. The 2014 dividend was 49% of FFO per share, a very low REIT payout ratio. SKT is one of the most highly regard mall REITs and has increased its dividend for 21 consecutive years, every year since its IPO. The SKT dividend was increased by 6.7% last year. Expect a similar increase this year and the stock yields 2.7%.

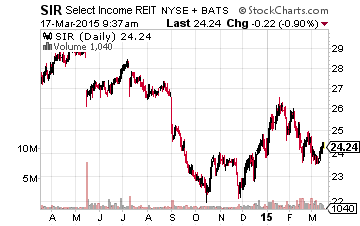

Select Income REIT (NYSE:SIR) also uses the first week of April to announce any increase in its quarterly dividend rate. Last year the SIR dividend was increased by 4.3%. For 2014, FFO per share declined by 2.8% due to a larger number of shares outstanding. The current dividend rate represents 70% of FFO, so there is cash flow available for an increase. Whether Select Income actually does announce a higher dividend depends on management’s outlook for 2015. This REIT currently yields 7.9%.

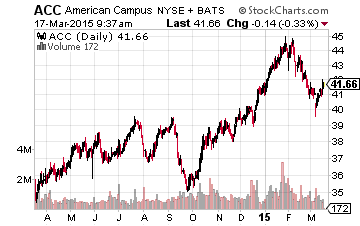

Near the end of April, American Campus Communities, Inc. (NYSE:ACC) will make a dividend announcement. Last year the quarterly rate was increased by 5.5%. For 2014, ACC’s FFO per share increased by 7.2%. The current dividend rate is 64% of last year’s FFO. Expect a dividend increase to at least match last year’s bump, but it could be higher in the 7% to 8% growth range. ACC currently yields 3.6%.

Remember that after a dividend announcement, the actual payment may occur up to a month or longer later. REITs with lower yields are viewed as of higher quality than those listed above with higher current yields. Usually, a higher than expected dividend increase will result in a very nice share price gain.

REITs that raise their dividends, like the ones above, have been an integral part of the income strategy with my newsletter, more