3 Stocks That Will Go From Worst To First In 2016

Find out which stocks that were complete losers in 2015 are about to become the biggest winners in 2016. These are four stocks that you will want to watch as we move into the fourth quarter.

I came across one of the most interesting data points I have seen in some time this weekend. Bespoke Investment Group did some research into the components of the S&P 500 Index. The research firm took a look at the 50 worst and 50 best performers in the S&P 500 from the benchmark’s peak on May 21st to the end of September. In the first ten days of October, the 50 biggest losers over the previous time frame have gained an average of 15% while the “winners” have lost nearly four percent. This marks a huge rotation in the market.

Obviously, a lot of this has to do with a bounce in energy and commodity prices during October so far. These have been dismal sectors for investors throughout 2015 and were overdue for some good news at some point. The energy sector gained some eight percent in the week ending October 9th and the sector was a market leader in last week’s rally as well. I still think the energy and commodity complex is too opaque to make big bets in until we see some acceleration of global growth. I also worry about the debt levels of a good portion of the companies in these sectors as well which is why I continue to underweight them in my own portfolio.

However, low PE value stocks seem to be grabbing market leadership from growth plays to start the final quarter of the year. Maybe some beaten up value stocks are worth a look here as they feel oversold compared to the rest of the market. As my late father liked to say “Life is like a pendulum. It swings too far to the right. It swings too far to the left. It is rarely in the middle where it belongs.” With that in mind, let’s take a look at some dismal performers in 2015 that look like good values and could close out the year on a stronger note. If the 2014 train wreck known as the Atlanta Falcons can start 2015 with five straight victories, why can’t these stocks also go from “worse to first” too?

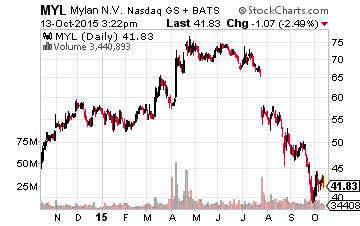

Let’s start with generic drug heavyweight Mylan (NYSE: MYL) whose stock is down some 25% so far in 2015. Incredibly the shares are trading for approximately half what industry leader Teva Pharmaceuticals (NASDAQ: TEVA) offered to buy the firm during this summer which shows you how negative investor sentiment has gotten for the pharma and biotech sectors, the latter of which is in official bear market territory.

The company is currently in a battle to take over Perrigo Group (NASDAQ: PRGO) that would give it economies of scale as well as territorial tax advantages. More importantly, the shares are extremely cheap at 10 times this year’s likely profits. This is a deep discount to the overall market multiple and the company is seeing annual earnings gains in the low teens which is a far sight better than the average component of the S&P 500.

In addition, most of the populist and election-driven rhetoric around drug price “gouging” is centered around the huge price increases on older but very targeted drugs to a small subset of the population or the huge costs of so-called “Orphan Drugs” which can easily run past $100,000 annually to treat one patient. Mylan is in neither of those targeted parts of the sector and is unlikely to become a piñata for politicians.

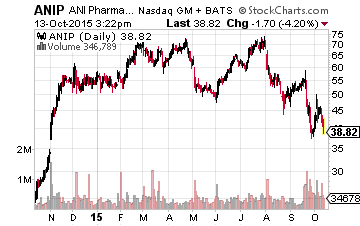

In the same category is ANI Pharmaceuticals (NASDAQ: ANIP) which is like a mini-version of Allergan (NYSE: AGN). I have profiled this stock before and the company was called “one of the three best open-ended healthcare plays I have seen in my investing lifetime” by longtime Barron’s roundtable stalwart Oscar Schafer last week on CNBC. It is a little more expensive than Mylan, but it is also growing much faster. It too has been unfairly punished by the recent decline throughout this sector.

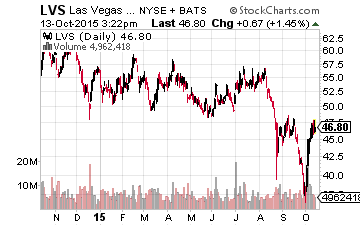

Few sectors of the market have been punished more than casino operators with significant operations on the gambling enclave of Macau. The Chinese crackdown on “corruption” has resulted in an approximate 35% decrease in traffic to this destination in 2015. However, last week the head of the region signaled authorities might have overplayed their hand and that this is hurting the economy of Macau.

This could mark the bottom of the gauntlet these operators have had to endure this year. The major players in Macau have seen their stocks rally over the past week but are still way below where they started the year. Melco Crown (NASDAQ: MPEL) got upgraded by Credit Suisse Monday. The analyst there went negative on Melco just before the big downdraft from Macau cratered its stock and now is positive on the equity again.

Wynn Resorts (NASDAQ: WYNN) had a nice rally last week, but the equity is down two-thirds from its 52-week highs. It is a reasonable value now and cheap on a trailing earnings basis. The stock also pays a three percent dividend yield. However, my favorite play in the space continues to be Las Vegas Sands (NYSE: LVS). The company is less exposed to the “VIP” market than the other two. It is this segment that the authorities have been cracking down on and the stock also pays a six percent dividend, which is a nice incentive to stick around until fortunes in Macau turn around. Finally, it has a 3,000 room resort coming online in Macau in early 2016. This will boost revenues, improve cash flow, and also substantially reduce capital expenditure needs in the next few years.

All of the stocks profiled above have had rough years. However, given how low expectations are on these stocks they could well surprise in the fourth quarter and into 2016.

Disclosure: more