3 Stocks A Young Warren Buffet Would Buy For 50% Returns

Back in August, we talked about the three Buffett style stocks, one of which is up 20% since then, but we’ve dug even deeper this time. Here are three more stocks Warren Buffet wants to buy.

Warren Buffett’s top holdings are in some serious trouble. Three of his top five holdings are down more than 10% year to date, while the S&P 500 is roughly flat.

His top holding, Wells Fargo (NYSE: WFC), is facing pressure from low-interest rates and the potential slowdown in mortgage loan originations once rates do rise. People just aren’t drinking soft drinks, hurting his number two holding, Coca-Cola (NYSE: KO).

On down the line, International Business Machines (NYSE: IBM) has been hammered due to the continued decline in demand for personal computers. American Express (NYSE: AXP) is losing its prestige as retailers dump the brand for MasterCard (NYSE: MA) and Visa (NYSE: V).

And finally Wal-Mart (NYSE: WMT), another Buffett holding, is losing market share to smaller retail startups and Amazon.com (NASDAQ: AMZN).

All five are facing serious headwinds. But at this point, does it really make sense for Buffett to sell?

He’s up magnitudes on his investments in these top five stocks and they’re still sending him a healthy dividend check each quarter — roughly $500 million.

If he does dump these stocks he’ll take a large tax hit — After all, he invested in Coke when it was trading at less than $3 a share and bought into Wells Fargo when it was a $2 billion company — now a $275 billion mega bank.

But he’d also be forced to find something else to buy and with $70 billion invested in these five stocks, there’s only a handful of mega caps that he could invest in without materially moving the market.

It’s not worth the hassle at this point. That doesn’t mean that Buffett is happy with the paltry stock returns these holdings are offering. If he just had less money …

Buffett has noted before that the thinks he could return 50% a year if he had significantly less capital, allowing him to invest in small- and mid-cap stocks.

That’s right, if Buffett could start over, he’d be fishing in the small- and mid-cap stock ponds. So let’s say you’re a young Warren Buffett with permanent capital that affords the benefit of having a long-term horizon, where do you find value?

Back in August, we talked about the three Buffett style stocks, one of which is up 20% since then, but we’ve dug even deeper this time.

To start, as a young Buffett, you look for stocks in the small-cap and mid-cap space. But don’t fall into the trap of investing in commodities, retail or turnaround situations. One of Buffett’s big keys is to find stocks that have a wide moat and track record of generating returns on equity.

I started working from a very large list of small- and mid-caps, weeding out those with spotty historical returns and complicated business models. The key is to find companies that are simple and can survive any economic environment.

As I worked the list down, I came across a number of stocks that met Buffett’s criteria, but still just weren’t perfect.

HCI Group (NYSE: HCI) is an example, operating as an unsexy homeowners’ insurance company that had a strong history of generating returns on equity. But, it’s never going to grow into a large cap company given its small addressable market.

And recall that Buffett has had an affinity for newspaper companies. Well the modern newspaper is broadcasting and TV. Fitting the mold for consistent earnings and strong cash flows is Scripps Networks (NYSE: SNI), which owns various TV networks. But technology is a disruptive force that Buffett has underestimated before.

So, with all that in mind, here’s the top 3 stocks that a young Warren Buffett would buy today:

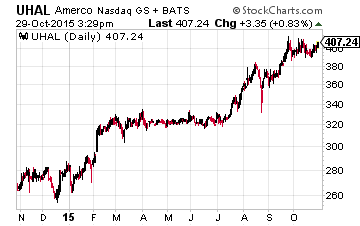

No. 1 Young Buffett Stock: AMERCO (NASDAQ: UHAL)

MERCO operates via U-Haul, which is the moving and storage company that operates in the U.S. and Canada. AMERCO is trading near all-time highs, but one thing that value investors make the mistake of doing is assuming you have to buy at 52-week lows. Some of the best companies are trading at all-time highs for a reason, AMERCO is one of them.

AMERCO has a median ten-year return on equity of nearly 19% and has been an earnings generating machine over the last few years. It’s managed to grow operating income at an annualized 11% for the last ten years. Even with all this, it’s still trading at just 12.5 times next year’s earnings.

It’s not a sexy business, but it is simple — something Buffett likes, after all, he owns undergarment and ice cream companies. AMERCO has managed to employ pricing power through the years, which has kept margins and returns high. As it shifts capital expenditures from the trucking segment to the faster-growing storage business, there’s more upside to come.

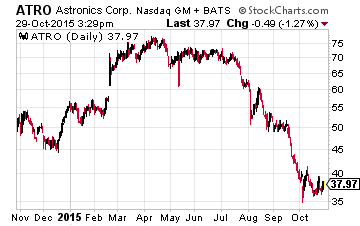

No. 2 Young Buffett Stock: Astronics Corporation (NASDAQ: ATRO)

tronics is a manufacturer of parts for the aerospace and defense industries. Buffett’s recent outright purchase of Precision Castparts (NYSE: PCP) suggests he knows the benefits of being a major supplier to various companies.

The company has done everything right, helping it generate a ten-year median 20% return on equity and grow operating income by an annualized 70% for the last ten years.

But shares of Astronics have pulled back of late, now trading at a 40% discount to all-time highs earlier this year. At 11 times forward earnings, it’s trading at the cheapest valuation we’ve seen in well over a year. It is transitioning to a focus on its more high-margin and high-growth aerospace businesses.

The company supplies lighting and electronic systems to all the original equipment manufacturers in the aircraft industry — it is the only supplier to cater to all the different manufacturers. Management has done a great job of making strategic acquisitions to spur growth and the clean balance sheet means there are plenty of opportunities for future buys.

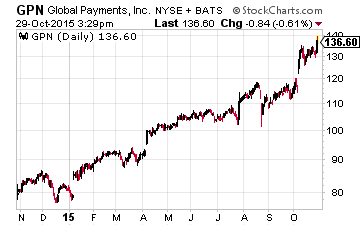

No. 3 Young Buffett Stock: Global Payments (NYSE: GPN)

lobal Payments is a provider of electronic transaction processing services. Global Payments is another stock trading at all-time highs, but again, for good reason. Its ten-year median return on equity is 18% and it has grown operating income at an annualized 11% over the last decade.

Global Payments has seen high-margin growth from the rise of card payments in the U.S. The company gets most of its revenue via a percentage of a card transaction amount or a set fee per transaction. And the biggest tailwind for the company going forward is a transition toward electronic payments worldwide.

There are still plenty of growth opportunities for Global Payments in geographic expansion, namely in the underdeveloped areas of Brazil and Asia. It still generates about 70% of revenues from North America.

In the end, Buffett sticks to companies that are easily understood, but it’s never that simple. The big key is to search for Buffett-like stocks that have managed to build a moat around their business for sustainable returns over the long-term. Something all three of the companies above have managed to do.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more