3 Safe Trades Leveraging The Market’s Biggest Trends

While the market tests new highs, some stocks and ETFs seem destined to fall. These three contrarian plays make great trades right now, and could be some of your most profitable moves for all of 2016.

Changes are coming in three major areas of the market, and being on the right side of these trends will make you large profits in the months to come. All of these changes are still uncertain. In the form of questions, they are:

- Will the Fed raise rates?

- Are speculative, non-fundamental metrics still driving stock growth?

- Is the energy sector at the end of its bear market?

For each one of these questions is a logical answer and a corresponding trade. These trades will be some of the most profitable trades for 2016. Let’s tackle them one-by-one:

Will the Fed Raise Rates?

The beginning of 2016 showed less focus on interest rate speculation, considering that the Fed just raised rates in December. But now, nearly halfway through 2016 and no rate raises, investors are asking when the previously planned “two to four” rate raises will come. In the recent weeks, many Fed presidents have turned hawkish, implying that the Fed will be raising rates soon.

However, last week we witnessed the release of negative reports for the US economy. As the Fed now claims it will raise rates per decisions based on hard data, these reports contradict the hawkishness of the Fed presidents. Job numbers have coerced many investors to drop or reverse their speculations that a rake hike is imminent.

Are they right? This is the question many investors are asking, yet it is not the only important question. Perhaps a more important question is, “Assuming the rate hike comes, are these holdings the right positions to leverage interest rates?”

My answers to these two questions are “yes” and “no,” respectively. First, yes, the reverse on interest rate speculations is the correct direction. Looking to direct bets on the interest rate hike decision gives us the best indication, as money is at stake (instead of just analysts’ reputations).

CME Group is now showing a mere 4% probability for a rate hike in June. Moving further into the year, we see the probability of a rate hike before November at only 49%. Money speaks: The likelihood of a rate hike before September is low, implying that we should bet against a rate hike.

The second question – one few are asking – is whether investors are using the right vehicles to play the rate hike trade. Many investors piled into financial stocks, hoping for a surge after the rate hike. Theoretically, financial stocks, such as banks, benefit from the rate hike by allowing them to charge higher rates to their customers, thereby creating higher margins.

The

Financial Select Sector SPDR Fund ETF (NYSE:XLF)

includes all the major banks and financial stocks. Theoretically, XLF should rally after a rate hike. But this is not what happened in December, after the rate increase:

The rate hike caused a selloff, hurting all sectors, financials included. Although this sector, in theory, should have rallied, it was dragged down by the overall panic selling. Thus, regardless of the Fed’s decision to hike rates, XLF is a clear short.

If the Fed does not raise rates, speculative money in XLF flows outward, placing downward pressure on the ETF. If the Fed does raise rates, another selloff will likely occur, again forcing XLF downward. Hence a short position on XLF is safe from either angle.

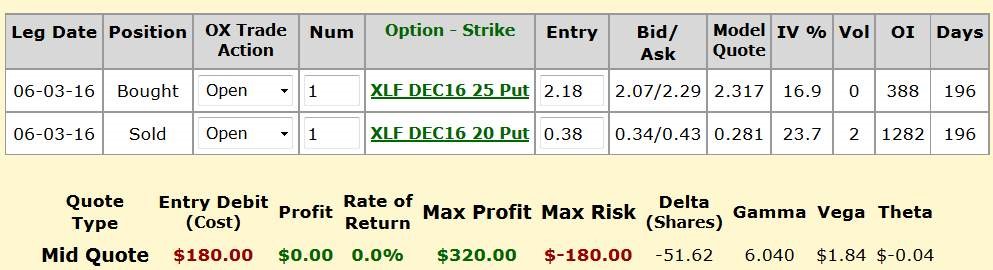

We benefit by the hawkish statements and speculations driving XLF to shortable highs. These highs are entry points for a low-risk short trade, “low-risk” implying the use of options, not an outright short position. Here is my recommendation:

(Click on image to enlarge)

This is a put debit spread. We buy one in the money (ITM) put and sell one out of the money (OTM) put. The OTM put marks our price target, which is $20. If XLF hits $20, we will gain $320 from a $180 investment – nearly a 100% ROI trade.

Because we sold one put in addition to the bought put, we arrive at a theta of nearly 0, meaning that we need not worry about the natural time decay of the long put option. Thus, time is on our side, and we can safely hold this position until the end of the year.

Are speculative, non-fundamental metrics still driving stock growth?

In this bull market, investors have become used to reacting to non-financial ratios. We saw this in the dot-com bubble when unprofitable companies were trading at nosebleed prices. We now see this with stocks such as Netflix (NASDAQ:NFLX), which is our target for this trade.

Prior to the most recent earnings report, NFLX was driven by subscriber growth. Even when revenue and margins weakened, NFLX stock rallied as long as subscriber growth was strong. This changed last month, when NFLX beat on subscriber growth estimates, but the stock dropped by over 10%.

Have investors changed their metric for valuing NFLX, possibly switching to more traditional metrics? Possibly, as NFLX missed on revenue, reporting $10M under estimates. The debt issue also remains to be solved, and some investors are reasonably questioning whether NFLX will have the cash flow to pay down debt.

Then again, perhaps investors still don’t care about the traditional metrics for NFLX. After all, as $10M is chump change for NFLX and should not cause a 10% tumble. Perhaps the real concern is the prediction for a year-to-year decline in subscriber growth.

Regardless, if the bulls are still disregarding the fundamental valuation of NFLX, shorting NFLX is the right decision. If NFLX is now being valued as per fundamental valuations, it is overpriced. If NFLX is being valued based on subscriber growth, that ratio has reached its peak and will begin falling from here on out.

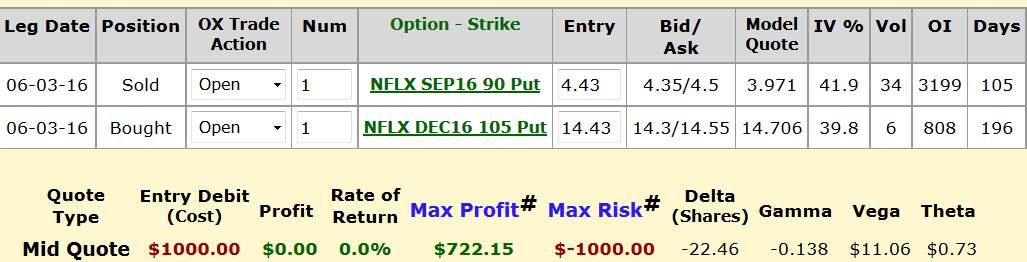

We want to play a safe short here. Essentially, the catalysts for speculative growth on NFLX are gone, implying that NFLX is likely on its way down. With probability on our side, we should open a diagonal spread:

(Click on image to enlarge)

In this play, we buy a long-dated ITM put. Noticing this put is expensive and has a theta (time decay) cost, we sell an OTM put to counteract these issues. As a result, we get a short-delta, long-theta play.

We profit from a slow but steady downward move to our price target of $90. At that point, we sell for nearly 100% ROI. If NFLX is still above $90 by September, we are left with a long put, which we can sell for profit or continue to ride.

Is the energy sector at the end of its bear market?

This question has been asked several times in 2016, with the correct answer always being “no.” With “this time is different” being the most expensive four words in the English language, we should default to “no” as our answer. Of course, having more research on our side makes for a more accurate play.

The higher oil prices that we have seen recently were previously predicted to imply a strengthening economy. They have not. Manufacturing indexes have shown the economy to be weakening in spite of rising oil prices.

While the price of oil has strengthened the dollar, holders of debt are feeling the pressure, which explains the fall in energy stocks, as tracked by the Energy Select Sector SPDR ETF (NYSE:XLE). That is, rising oil prices have hurt energy companies, oil included, by influencing the weight of the sector’s heavy debt liabilities. A rise in the dollar is correlated to a fall in the energy sector, partly due to the weakening of commodities such as copper.

The dual catalysts of a weakening economy and a rising dollar give merit to a short position on the energy sector, on XLE specifically. And with energy bulls’ speculative plays on energy having driven the ETF to recent highs, we are at a nice entry point.

Here’s my trade for XLE:

(Click on image to enlarge)

This is a ratio backspread. It is a bearish position that is – more importantly – long on volatility. Notice the vega of $23.80. This is the amount we can expect to gain for every 1% movement in XLE’s implied volatility.

As volatility tends to increase when XLE falls, being long volatility works in tandem with being short delta. Our goal for this play is to witness a sudden movement – preferably downward – in XLE so that the vega and delta values in the bought puts outpace that of the sold put. Such a movement will allow for a large profit to be seen in a short amount of time.

In addition, we are long theta, so time is on our side. The strategy is set up so that a move against us will not significantly hurt us. If volatility rises and XLE moves upward, we still have a chance of profiting from vega and theta.

Conclusion

These three trades are safe short ideas that leverage recent trends in three sectors. Through the use of options, we avoid the main problems with opening short positions: unlimited risk and interest paid on borrowed shares. With the market having more downside than up at the moment, short positions should be on our side, provided we know how to correctly open them.

While using options trades like those above is a great way of sbooking short-term gains, they do not replace owning high-quality income stocks that you can buy and hold forever. In the market right now there are a limited amount of options for investors looking to earn a growing income stream from safe investments. And, with the Federal Reserve punishing savers like they are right now, buying a safe CD that pays good interest is no longer an option.

So, what are investors to do with their portfolio’s?

Recently, Tim Plaehn, income expert with Investors Alley, met with the CEO of one of America’s fastest growing specialty banks, and what he told me just blew me away.

This bank didn’t take TARP money or other taxpayer bailouts–or any other bailouts for that matter–back in 2008 or ever.

This bank didn’t get tangled up in risky mortgage-backed securities, credit default swaps, stress tests, FDIC watch lists… you name it.

The CEO told Tim how his bank has been growing by leaps and bounds since even before the financial crash of 2008 and while impressive it’s not what stopped Tim in my tracks.

Disclosure: You could collect an average of $3,268 in extra monthly cash with ...

more