3 Oil Stocks To Pick Up While Oil’s Cheap

The plunge in oil and the related steep sell-offs in energy stocks have provided once in a decade entry points that every investor should take advantage of. Here are Bret Jensen’s top three picks poised to reward patient shareholders with big profits.

November saw the biggest monthly percentage decline in West Texas Intermediate (WTI) since December 2008 when the globe was plunging into worldwide recession.

The steep declines in exploration and production (E&P) plays remind me of the Internet bust in early 2000 where one sector of market is imploding while most of the rest of the market is doing okay.

No one knows where and when the bottom in oil prices will ultimately be just as few if any analysts were predicting an over $40 a barrel plunge in oil prices this summer. However, unless we are entering another global recession oil feels much closer to a bottom than not.

No one likes to catch a “falling knife” but if oil stabilizes and eventually rises some of the E&P plays are offering great entry points for long term investors willing to wait for normalcy to return to the oil patch. I have started to slowly and incrementally add to some positions across the sector. Let’s take a look at some names that have sold off recently but feel like they are getting very oversold at current levels. Since it takes courage right now to buy anything in the energy sector, we will profile three good accumulation picks in the E&P space that start with the letter C.

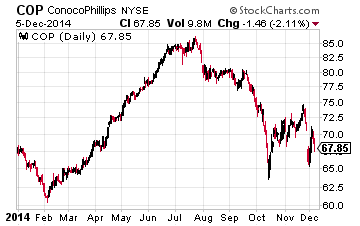

Let’s start with energy major ConocoPhillips (NYSE: COP). Conoco is one of the lower beta plays in the sector due to its size and financial resources. Conoco is in no danger of going bankrupt or even sustaining losses, something that cannot be said about many players in the small E&P sector, especially those firms with significant debt loads and/or high breakeven points.

Let’s start with energy major ConocoPhillips (NYSE: COP). Conoco is one of the lower beta plays in the sector due to its size and financial resources. Conoco is in no danger of going bankrupt or even sustaining losses, something that cannot be said about many players in the small E&P sector, especially those firms with significant debt loads and/or high breakeven points.

A good portion of Conoco’s overall production also comes from natural gas, a commodity has seen prices actually hold over the past couple of months as the price of oil has plunged. Conoco could also benefit from the recent plunge in oil prices. Prices for oil services and material (Ex, frac sand) have or will come down which will lower production costs. The company will also be able to expand its North American profile if it wants as the price of productive additional acreage is a fraction of what it would have cost just a few months ago.

Conoco has a low-risk international position, with a majority of production in long-lived assets in OECD countries compared with the other energy majors. Conoco yields a bit over four percent at these levels which should help provide a floor under the stock. The stock is cheap from a long term perspective at ten times trailing earnings.

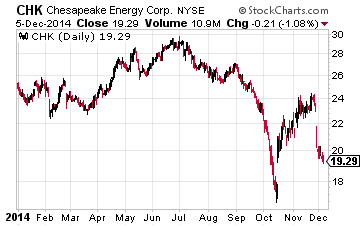

Next let’s move on to mid-major Chesapeake Energy (NYSE: CHK). I have an investment in this oil and gas producer as it is in a middle of a transformation that should create significant shareholder value over time. The company brought in a well-regarded executive from Anadarko Petroleum (NYSE: APC) to cut costs, reduce debt and become more “oily” in its overall production.

Next let’s move on to mid-major Chesapeake Energy (NYSE: CHK). I have an investment in this oil and gas producer as it is in a middle of a transformation that should create significant shareholder value over time. The company brought in a well-regarded executive from Anadarko Petroleum (NYSE: APC) to cut costs, reduce debt and become more “oily” in its overall production.

Chesapeake was fortunate to have sold almost $5.4 billion in non-core assets just before the recent plunge in oil prices. The proceeds will be used to significantly buttress its balance sheet as well as provide financial flexibility to pick up new acreage on the cheap should good strategic acquisitions that could boost oil production become available. Once energy prices stabilize, I expect credit ratings agencies to upgrade the rating on Chesapeake’s remaining debt. This should help reduce interest costs further and provide a positive boost to the stock as well.

Like Conoco, a good portion of Chesapeake’s production still comes from natural gas and this exploration and production company should remain solidly profitable even with oil prices down more than $40 a barrel since summer. The market was rewarding Chesapeake’s efforts bidding the stock up past $30 a share before the plunge in oil prices took the shares down to just under $20 apiece providing a solid entry point to start to accumulate a stake.

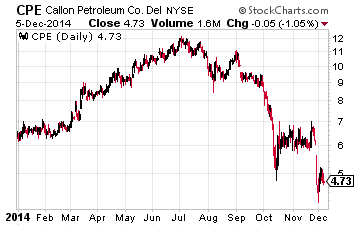

My last pick is the riskiest and the stock will make the biggest moves, up and down, with every fluctuation of oil prices. It is a small E&P play named Callon Petroleum (NYSE: CPE). Callon is focused on growing production and reserves from its oil-weighted multi-play, multi-pay assets in the Permian Basin. 100% of their acreage is operated by Callon thus providing better margins and flexibility.

My last pick is the riskiest and the stock will make the biggest moves, up and down, with every fluctuation of oil prices. It is a small E&P play named Callon Petroleum (NYSE: CPE). Callon is focused on growing production and reserves from its oil-weighted multi-play, multi-pay assets in the Permian Basin. 100% of their acreage is operated by Callon thus providing better margins and flexibility.

The stock was selling north of $12 a share this summer but the plunge in oil prices has driven the shares down to just under $5 apiece. After breaking even in FY2013, Callon is tracking towards 35 to 40 cents a share in profit this fiscal year. Depending on where energy prices go, Callon should deliver another earnings boost in FY2015 as production should again increase substantially in the New Year.

I have been adding a few more shares on each dip in the energy sector over the past few months in Callon as I believe this independent oil and gas provider with robust production growth will end up rewarding my patience. Insiders have also started slowly adding new shares recently as well. Roth Capital initiated the stock as a “Buy” last week and put a whopping $13.50 a share price target on the shares.

In addition to regular shares of oil stocks many investors are looking at these dips in oil prices as an opportunity to pick up high yield, high quality MLPs. My colleague Tim Plaehn from The Dividend Hunter has recently released a pretty exhaustive report on his top 5 MLP picks going into 2015. Click here to request your copy.

Positions: Long CHK, COP and CPE