2020 US Prospective Plantings

Market Analysis

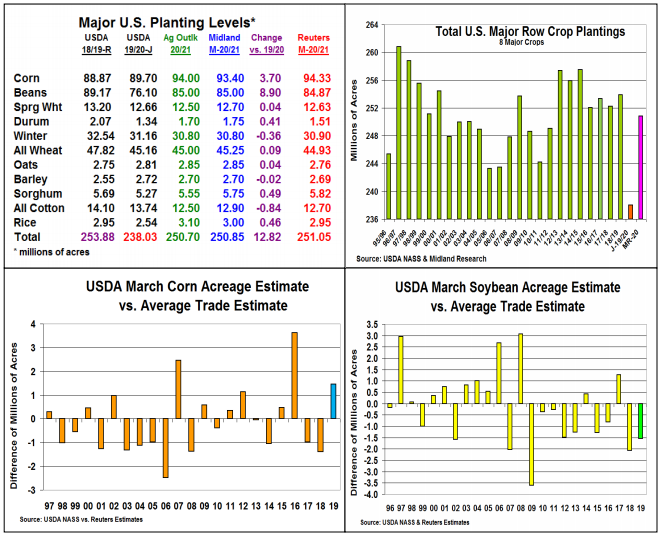

Each March, the USDA surveys U.S. producers to get an initial idea of their major prospective plantings for the upcoming year. The results of this sampling will be released on March 31. Because of last year’s late plantings & cool/ wet weather in the northern and western area of the Corn Belt, harvest results from 5 states will be updated yet this spring. After last year’s historic US prevent planting levels, both corn & soybean plantings are expected to rebound substantially in 2020. This was reflected in the USDA’s Ag Outlook Forum economic seeding levels last month. The recent sharp drop in crude oil prices & the expanding Coronavirus cloud has likely change producers planting ideas since earlier this month.

N. Plains producers normally compensate for smaller US winter wheat seedings which were down 355,000 acres to 30.8 million because of low US prices & cold/wet MT conditions last fall. We expect spring & durum seedings will be up 450,000 acres along with some very modest small grain increases. However, this winter’s erratic wheat prices & saturated N. Plains soils may derail these ideas.

Given 2019’s 9.6 million corn & 5.4 million soybean acres in prevent plantings, many northern acres could still be impacted by excessive soil moisture & erosion reducing the return of all these 15 million acres to production. Price relationships, crop rotations, crop input costs & spring weather all are part of the 2020’s producer planting mix. Industry estimates have ranged from 92 to 96 million acres vs. last year’s 89.7 million & the USDA’s Ag Outlook of 94 million. We favor a slightly lower 93.3 million corn level. Interestingly, March plantings have been mixed over the past 6 years with only 2016 having a big difference vs. the trade.

Lower input costs and crop rotation (beans off 13 million in 2019) has us expecting plantings at 85 million acres vs. 76.1 million. Logistical problems & S. Brazil dryness have surfaced recently. Historically, US March bean planting have been lower 8 out of last 10 years than the trade.

What’s Ahead:

Carryover soil issues from 2019’s prevent plant fields & this spring’s reduced profitability/ demand from the world Covid-19 health issue has us seeing just 250.85 million acres of the 8 major crops being planted, (off 3 million vs. 2018/19) Still move 10% of old-corn at May’s $3.63-67 range, 70-75% of your old-crop beans at $8.85-8.95 and up your July 2020 wheat sales to 20-25% at $5.60 & $5.00 in Chi/KC.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more