2020 Us Acreage Prospects, COVID -19 US Impact May Alter Plantings, But Weather Remains Key

Market Analysis

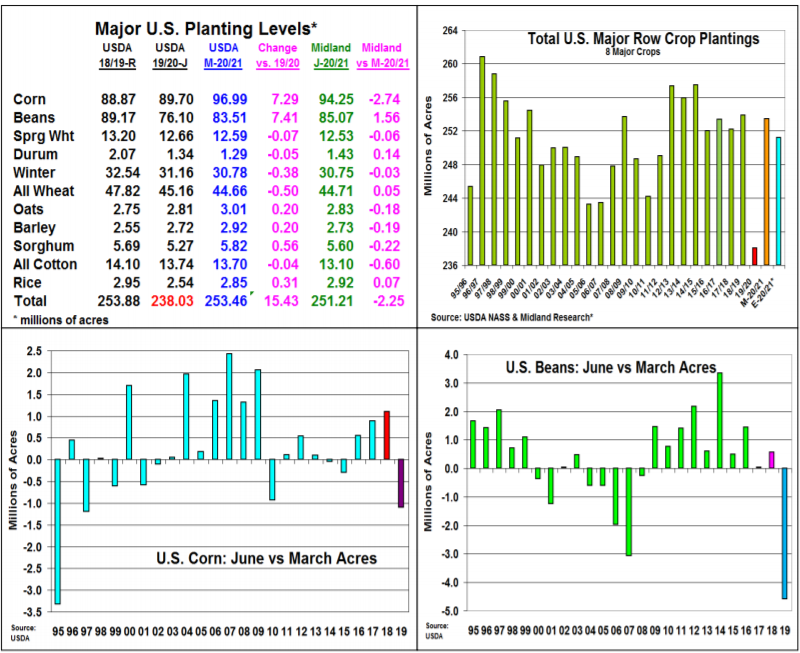

The USDA surveys US producers during the 1st half of June to see if their initial planting intentions were carried out each year. After last year’s bizarre US planting season that began with extreme flooding the Missouri River Basin in late March that eventually lead to 50 million acres (mainly in the ECB) still not being planted on June 9, 2020’s planting period was generally about normal on a national basis.

The WCB got off to a strong start in late April that led to a timely planting season. Unharvested 2019 corn fields and cold temperatures slowed the N Plains small grains and row crop seedings to near revenue insurance dates in some areas. Dryness in the W Plains and into Texas likely curtailed some dry land row crop plantings. The Delta & the ECB experienced a 2nd year of cold & wet May conditions that caused emergence problems and higher replanting of crops. However, the strong WCB start has the national corn & bean G&E ratings off to slightly higher level than their 5 yr averages.

The trade’s focus on next week’s USDA acreage report will be on the US corn & bean plantings. After this year’s March intentions, the impact of this spring’s stay-at-home orders on US energy & ethanol demand along with a pickup in Chinese interest in US soybeans quickly reversed the 2 crops price spread. 2019’s late harvest & adverse early US spring conditions provided producers more flexibility than previous years.

A sharp drop of 2.74 million acres is expected from March’s near record US corn plantings to 94.25 million; the largest June seeding decline since 1995/96. Corn’s limited June changes since 2011 has another camp cautious of a big acre change.

Soybeans will likely pick up 1.56 million of these acres, but prevent planting in N and W Plains will likely be utilized given their soil conditions. This will up US seedings to 85.07 million acres & follow the trend of 10 of past 11 years of higher June bean plantings than March.

What’s Ahead

Overall, the US major crop area could slip 2.25 million to 251.2 million acres vs. March. Dry & wet soils in the US Plains & other areas could cause higher use of RMA’s PP provision vs. 2 yrs ago. Lower corn plantings is a positive, but heat stress needed for a sustained rally.

Still, use $3.44-46 and $8.90-96 ranges to have 90% of old-crop sold and $3.55 & $8.90 to have 25% & 15% of your new-crop hedged.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more