2019 US Winter Wheat Seedings

Market Analysis

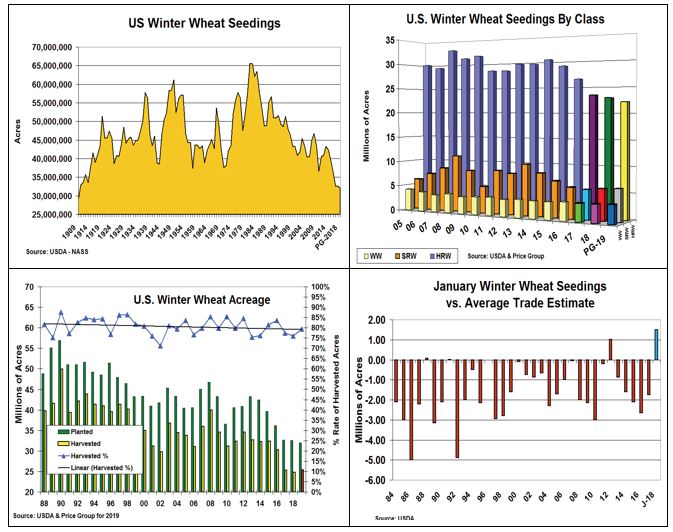

Despite last summer’s price spike on US and European reduced supplies, wheat values have retreated as Russia, the world’s leading producer, has moved a significant portion of its yearly output since July. However, this year’s total world wheat harvest declined by 25 mmt to 733 mmt as Australia experienced an El Nino-impacted harvest in the past world crop year. However, this year’s total output is just the 3rd smaller crop in the last 10 years. In this atmosphere, the US WW seedings have fallen by 10.7 million acres since 2013 to 32.5 million by 2018.

This trend in US winter wheat seedings likely continued this past fall. The combination of excessive moisture limited plantings and reduced available areas because of un-harvested sorghum and corn fields has left the Southern Plains wheat seedings behind normal. Because of these factors and the USDA’s late planting levels, 2019’s hard red seedings in the Southern Plains could be down sharply led by 500,000 acres in Texas, 300,000 in Kansas and 200,000 in Oklahoma. Better fall conditions further north in the Plains could reduce 2019’s HRW seedings decline to 795,000 acres and a 22.125 million total level. Soft red seedings also have likely increased by 140,000 acres to 6.21 million because of an open ECB. US white winter wheat plantings may likely increased by 80,000 to 3.62 million acres because of higher ID and OR seedings.

Overall, 2018’s US winter wheat seedings report on January 11 could decline by 575,000 to 31.96 million acres (-1.75%). If 2019’s harvested rate returns to trend at 79.5%, the US WW harvested area could be 25.41 million acres, 663,000 more than last year. This fall’s 55% G/E ratings don’t suggest a higher harvested area is likely. The other amazing fact has been the trade’s overestimating of the US initial winter wheat seedings. Only twice since the 1984/85 crop year has the USDA’s January level been substantially above the trade’s average estimate.

What’s Ahead

With the market’s focus on the US/Chinese trade discussions as direct talks resume on January 7, the USDA winter wheat seeding report probably won’t garner much pre-report attention. However, if 2019’s plantings are 1-1.5 million acres lower than last year, wheat could find some post-report support if this update is released on January 11. Hold sales for strength in KC March to $5.25-$5.40 area to push sales to 75%.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more