2 Refiners That Are A Rare Bright Spot In Energy Sector

It has been a brutal six months for most investors in the energy sector. Thanks to the collapse in crude and weak natural gas prices many sub-sectors of the energy complex have been decimated, and their immediate return seems highly unlikely. Small exploration and producers have largely been crushed and many will file for bankruptcy within the year if oil stays at these levels, especially those with high debt loads and negative cash flow. Investors want to avoid the majority of these stocks for the time being.

Energy services stocks have also been very weak and the offshore drillers have been sold off brutally as offshore exploration is one of the highest cost methods for developing new oil fields. Many of the smaller names here could also be heading for bankruptcy court if oil does not find a bottom soon. It seems that the carnage in the energy sector has no end.

But, there is one bright spot within the energy industry right now includes the refiners. These firms are benefiting from a fairly wide divergence between WTI (West Texas Intermediate) the domestic benchmark and Brent, the European benchmark where most refined products prices are based on. This is providing for a very high “crack spread” in the first few months of 2015 and refiners should report very strong results when first quarter earnings start filing in. The growth prospects within this space are real and investors who get in now will be able to reap the benefits of these growing companies.

This divergence should continue given production in the United States continues to climb even as rig count has been dropping consistently for months. Barring a full reversal of the policy of banning oil exports, this gap could remain for the foreseeable future. This ban has been in place since the 1970s and it is unlikely to be repealed given the acrimony between Congress and the administration as well as the strength of support from special interests that are benefiting from low domestic energy prices such as manufacturers and chemical producers.

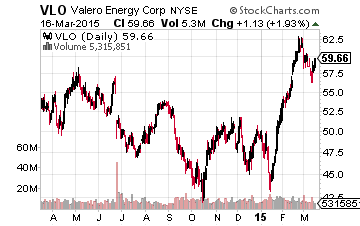

Even with the sector’s outperformance compared with most of the rest of the energy sector, some of the refinery stocks still look cheap here. Let’s start with Valero Energy (NYSE: VLO), the largest refinery concern in North America and a “best of breed” pick in the space. It also has been a solid performer since being added to the Blue Chips Gems portfolio (shameless plug) in the February edition of this investment newsletter.

Valero gets over 20% of its revenue from exporting refined products overseas as its facilities (15 refineries) are well-positioned to continue to benefit from America’s growing energy bounty. The company should continue to benefit from its geographical footprint and export growth should continue to increase at a solid pace.

The company has done a great job over the years reducing leverage and currently has little debt. Valero has been using its cash flow to increase its dividend at a prodigious rate. The stock’s yield now stands at 2.7% after Valero hiked its dividend payout by over 45% in January of this year. The company is projected to have its capital expenditures drop some 20% annually over the next two years, likely leading to further dividend increases.

Finally, Valero continues to drop assets into its own limited partnership, Valero Energy Partners LP (NYSE: VLP), which it smartly established late in 2013. By dropping lower yielding assets into this entity the company raises its return on invested capital which should over time lead to higher multiples in the market and increased earnings as well. Valero easily surpassed expectations during its last quarterly report and was upgraded by Goldman Sachs and Deutsche Bank in mid-February. The shares are also not expensive, trading at approximately nine times trailing earnings.

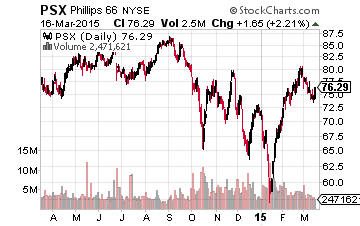

My other recommendation in this space is another major refinery, Phillips 66 (NYSE: PSX), which was spun off from energy giant ConocoPhillips (NYSE: COP) in 2012. The shares are fairly cheap considering the stock has more than doubled since the spin off.

The shares currently go for just under $75. Credit Suisse recently raised its price target to $100 from $85 a share on Phillips 66 as it believes the company’s “longer-term upside looks strong and intact”.

Like Valero this refiner has easily beat the quarterly earnings perspective for the past two quarters and also yields 2.7% and the company has raised its dividend payout by 150% over the past two and a half years. In addition, the company has also created a limited partnership, Phillips 66 Partners LP (NASDAQ: PSXP) that it is dropping lower yield assets into to improve return on investment.

Phillips is not expensive at 11 times trailing earnings in an overall market that currently sells for 18 times trailing earnings. The company will probably provide another dividend hike over the next few months as its last raise was in May of last year and the company has a relatively low payout ratio.

With no bottom in sight for crude prices, investors who still want to keep an allocation in the energy sector should consider the refiners like the selections profiled above. They are attractively priced, provide solid dividend yields and will continue to benefit from the divergence in price between WTI and Brent benchmarks.