12 High Dividend Stocks That May Be Reasonably Valued

High dividend stocks are attractive if they can be bought for a reasonable valuation. There is always a balance to find when looking for such stocks. We do not want to pick out the very high yielders, as they may indicate a company in distress and where the dividend may be unsustainable.

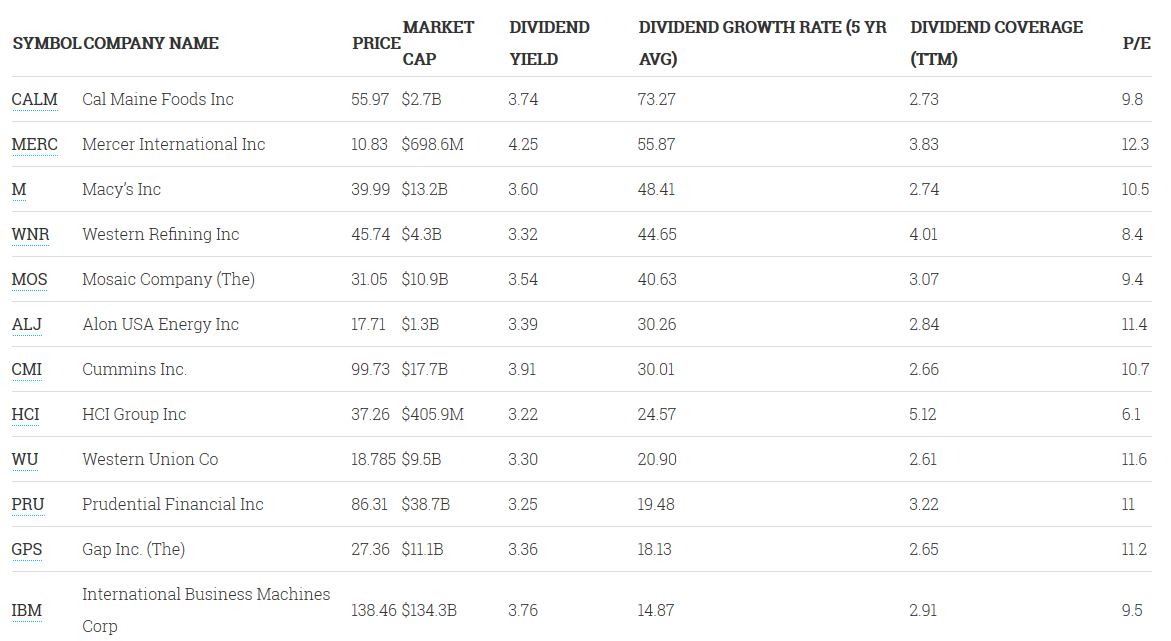

The following list of 12 stocks includes companies that yield comfortably more than 3%. In the current low interest environment, this is a very good dividend yield. 10 year treasury notes today yield about 2.22% so these stocks have a dividend yield that is about 100 bps or more higher than the 10 year treasury benchmark.

High Dividend Stocks and Dividend Safety

Sometimes high dividends can be transient as the business may not be able to support it long term. In compiling this list, we have also considered the safety of the dividend and this is indicated by a high dividend coverage ratio. These companies have also grown their dividends at a nice clip over the last 5 years which shows their commitment to dividend payments and shareholder returns. While nothing is certain, this is a great list to start with and conduct further research in each of these stocks to figure out if they are good investments for your portfolio or not.

(Click on image to enlarge)

Brief Description

I have listed brief description of the first 5 stock ideas. You may wish to review the entire list, as this list is in no particular order. No recommendation is implied as further due diligence is required.

CALM: Cal Maine Foods Inc.

The company pays a dividend that tends to be different each quarter. In the last quarter, the company paid 98 cents/share dividend which was almost triple the dividend amount in each of the previous 3 quarters. If annualized, the last dividend represents a 7% yield. The egg producer has benefitted tremendously from record high egg prices this year with revenues in the previously reported quarter up 79% from the comparable period. Whether this is sustainable or not is the question, and will be the primary determinant of the investment thesis behind this stock.

MERC: Mercer International Inc.

The Vancouver Canada based company produces pulp for paper and paper products industry. The business is steady and the company has set its quarterly dividend to 11.5 cents/share giving it an yield of 4.25%. This may be a hidden stock that eludes many screens due to adverse EPS comparison from last year which benefitted from a non cash credit.

M: Macy’s Inc

Retail sales and profits have suffered as more and more consumers shop online. As we wait for the company to figure out a strategy for the changing times, investors can enjoy a 3.6% dividend yield that is amply covered by the earnings. The valuation of the stock also reflects the reduced expectations on the business performance. The stock price is down almost 36% in the last 52 weeks.

WNR: Western Refining Inc.

The company owns oil refineries, distribution and transportation assets, as well as convenience stores. The stock has gained about 13% in the last 52 weeks despite the free fall in the oil prices as the company has stayed profitable and the revenue declines have been contained.

MOS: Mosaic Company

The company produces potash and phosphate fertilizer and related products. I like the valuation and the dividend and long term I believe that food/crop stocks will do well as the world becomes more populated. Also, the prospect of inflation bodes well. The industry is commoditized though, so efficiencies of scale and scope matter to maintain and grow operating margins.

Disclosure: Please note that the HCI more