10-Year Treasury Yield ‘Fair Value’ Estimate: 13 October 2021

Last month’s estimate of “fair value” for the US 10-year Treasury yield suggested that an upside bias for this benchmark rate was likely, or at least plausible. A month later, that outlook turned out to be spot on. Today’s update still suggests that more upside for the 10-year rate is still a reasonable view.

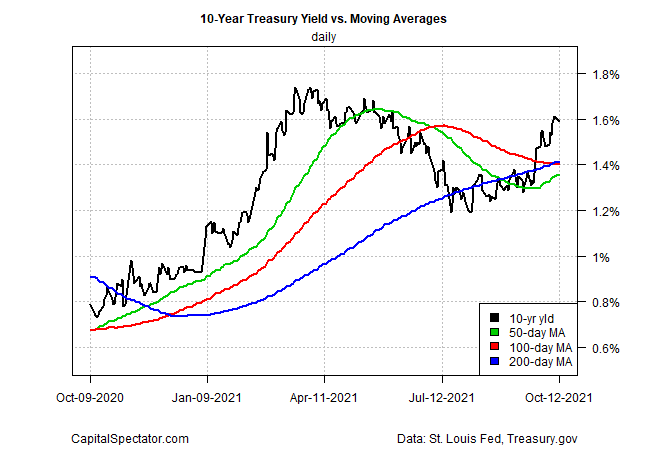

Since the last column (Sep. 10), the 10-year yield climbed from 1.35% to 1.59% (Oct. 12). A new run of fair-value estimates suggests that the macro backdrop still favors a case for higher rates, or at least keeping the current rate steady.

CapitalSpectator.com’s fair value estimate of the 10-year rate ticked up to 1.99% for September, just slightly above August’s 1.92%. The model reflects the average of three fair-value estimates and uses the result as a rough proxy for the implied rate. On that basis, there’s still a macro tailwind supporting modestly higher rates relative to the current market level.

The caveat, of course, is that Mr. Market is under no obligation to reprice the 10-year yield in line with any model. But as the worst of the pandemic-triggered recession effects continue to wane, albeit unevenly and often slowly, a degree of normalization is returning to the bond market.

Deciding how fast the normalization unfolds is as uncertain as ever. Nonetheless, there are relatively hawkish voices at the Federal Reserve pushing for tapering the central bank’s bond-buying program, an act that would be widely seen as a prelude to hiking interest rates at some later point.

“I’d support starting the taper in November,” St. Louis Federal Reserve President James Bullard told CNBC on Tuesday. “I’ve been advocating trying to get finished with the taper process by the end of the first quarter next year because I want to be in a position to react to possible upside risks to inflation next year as we try to move out of this pandemic.”

Today’s September inflation data for the consumer sector will be closely read for fresh clues on managing expectations. A hotter-than-expected inflation report would suggest that the Fed’s monetary policy needs to play catch-up with real-world events. On the other hand, economic activity proper may be telling a different story. The IMF now projects that growth will be softer than expected for the US and the world in 2021, which supports the inflation-is-transitory narrative to a degree.

The IMF cut its growth estimate for the US by a full percentage point to 6% for this year, the biggest decline for a G7 economy in yesterday’s release of the fund’s World Economic Outlook. “Rapid spread of Delta and the threat of new variants have increased uncertainty about how quickly the pandemic can be overcome,” the IMF advised. As a result, “policy choices have become more difficult,” due to several risk factors, including softer employment growth, higher inflation and supply-chain bottlenecks.

The upcoming third-quarter GDP report for the US also falls in line with the downside bias for growth expectations. As CapitalSpectator.com reported last week, the nowcast for Q3 growth continued to tick lower. Although the estimate still reflects a solid gain for the July-through-September period, the persistent slide in Q3 nowcasts suggests that output will continue to ease through the end of the year.

In other words, making a forecast about the 10-year yield has never been more challenging. Accordingly, a cautious way to interpret today’s fair value estimate is to see it as a factor for expecting the current market rate to remain relatively stable.

Then again, if the softer trend in US economic activity persists, which appears likely, the bond market could reassess the outlook and the 10-year rate could ease.

Considering all these factors suggests that 10-year yield will hold in a 1.5%-to-2.0% range for the near term until or if incoming data makes a strong case to think otherwise.

Disclosures: None.