10-Year Treasury Yield ‘Fair Value’ Estimate: 10 September 2021

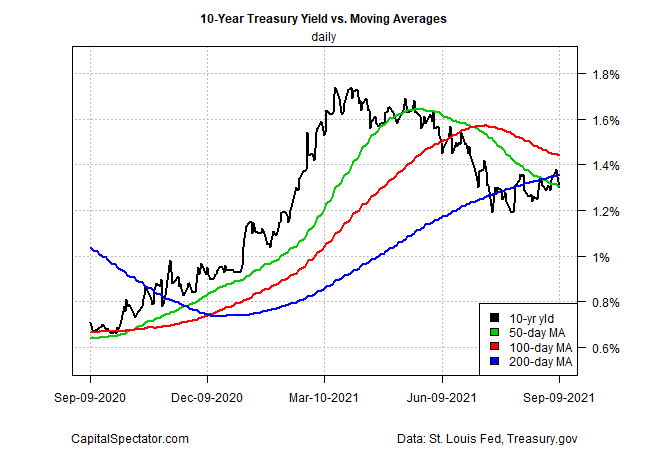

A new survey finds a majority of economists expecting that the Federal Reserve will begin raising interest rates sometime next year to combat inflation. Maybe, but the 10-year Treasury yield’s recent trend still reflects a flat to downside bias.

The benchmark rate ticked lower yesterday (Sep. 9), slipping to 1.30%, a middling level vs. the range over the past two months. The current rate is also well below the previous peak of 1.74% set in March.

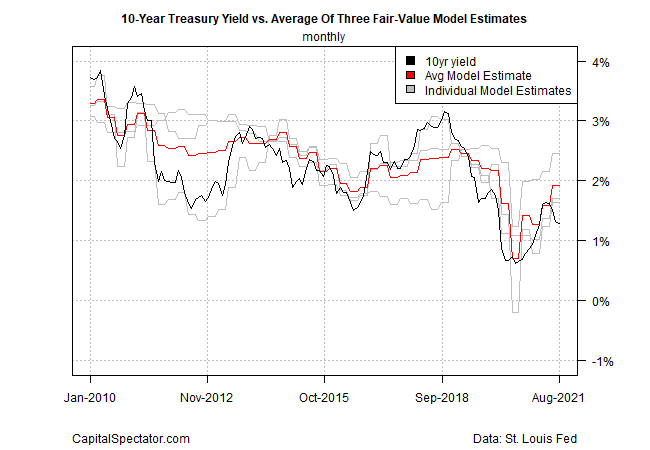

The current 1.30% rate looks a bit low vs. CapitalSpectator.com’s fair value estimates of the 10-year rate. The modeling takes the average of three fair-value estimates and uses the result as a rough proxy for the implied rate. On that basis, the 10-year yield should be closer to 2%, based on modeling through August. That’s essentially unchanged from last month’s estimate.

Although the fair-value estimates should be viewed cautiously, the results imply that the downside bias for the 10-year rate is limited and that an upside adjustment is stronger than recent market action suggests.

The main source of uncertainty is the Delta variant of the coronavirus, which has created headwinds for the economy, and the labor market specifically. Until this threat has passed, there’s still meaningful potential for downside surprises in the 10-year yield.

“The big downside miss in the August data on US payrolls is a reminder that macro risk linked to the pandemic still lurks over the economy, advises Mark Zandi, chief economist of Moody’s Analytics. “After adding close to 1 million jobs in both June and July, businesses added fewer than a quarter million jobs last month. That’s not bad in typical times, but not good when the economy is still down over 5 million jobs from before the pandemic.”

In sum, he observes that “the dramatic comedown in job growth was driven by businesses that either closed or lost sales due to the virus.”

Until it’s clear that the blowback from the Delta variant is fading, any upside adjustment in the 10-year yield will likely be limited. In theory, the rate should be higher, as our fair-value estimates suggest. But theory takes a back seat to real-world conditions in an ongoing pandemic.

On a positive note, yesterday’s jobless claims fell to another pandemic low last week and job openings rose to a record high in July. The labor market, it appears, remains resilient. But the economic path ahead is still overly dependent on the pandemic.

Unfortunately, the virus will remain a significant risk factor for the near term. “The endgame is to suppress the virus. Right now, we’re still in pandemic mode, because we have 160,000 new infections a day. That’s not even modestly good control … which means it’s a public health threat,” Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, said in an interview on Thursday. “In a country of our size, you can’t be hanging around and having 100,000 infections a day. You’ve got to get well below 10,000 before you start feeling comfortable.”

Disclosures: None.