10-Year T-Yield Not Bothered By Tapering Talk; Of Late, Foreigners Warming Up To Treasury Notes And Bonds

At a time when the Fed is getting ready to taper its purchases of treasury bonds, foreigners are warming up to these securities. The 10-year yield cannot break through low-1.40s resistance.

(Click on image to enlarge)

In July, foreigners bought $10.2 billion in treasury notes and bonds. This was the second month in a row they bought these securities on a net basis – and in four out of the five.

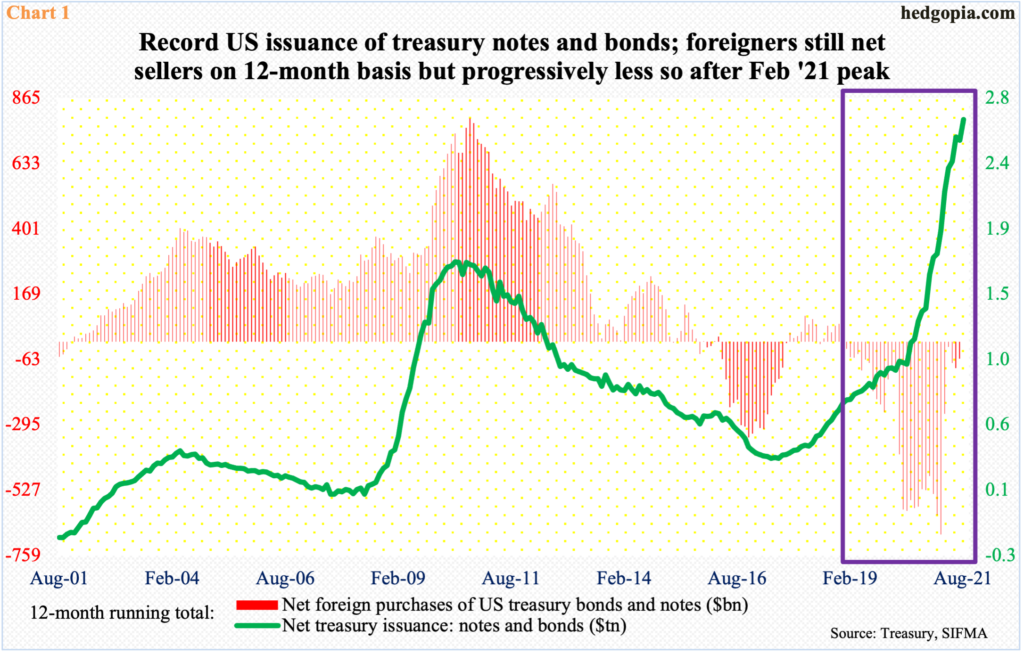

On a 12-month basis, they are still net sellers, with July sales of $60 billion, but the trend is improving. In February this year, 12-month sales reached a record $685.1 billion (Chart 1). They have been selling since January 2019.

Foreigners turned their back even as the issuance of treasury notes and bonds went parabolic in the wake of Covid-19. On a 12-month basis, in the early months of 2020, issuance hovered around $1 trillion, before beginning to go vertical in June; in July this year, it hit $2.7 trillion.

(Click on image to enlarge)

If foreigners continue to warm up to these securities and stay on the current trajectory, this will have come at a time when the Federal Reserve is getting ready to taper its bond purchases.

Every month, the central bank spends up to $80 billion in purchases of treasury notes and bonds and $40 billion in mortgage-backed securities. It is sitting on $8.45 trillion in assets, twice what it held in early March last year.

At the Jackson Hole symposium late last month, Chair Jerome Powell indicated that the central bank is getting ready to taper by the end of the year. After he made those comments, August’s jobs report came in much weaker than expected; consumer inflation, too, rose less than expected in that month. So, it is possible members would like to see September’s jobs report before they decide on a tapering timetable. But odds favor it begins sooner than later. The FOMC meets next week.

Amidst these supply-demand dynamics, the 10-year treasury yield (1.33 percent) continues to struggle to break through low-1.40s. In fact, it has faced stiff resistance at high-1.30s since August 12.

After rates bottomed at 0.4 percent in March last year, one after another resistance fell. In January this year, one percent gave way, followed by low-1.40s the next month. Rates then went on to rally to 1.77 percent by March (Chart 2). The drop from that high bottomed at 1.13 percent in July and August.

Rejection at high-1.30s – before even reaching low-1.40s – speaks of the momentum bond bulls (on price) currently have. It turns out foreigners were lending a hand. Right here and now, the bond market is not worried the imminent tapering will inflict a lasting damage to the supply-demand equation. It is bulls’ ball to lose.

Disclaimer: This article is not intended to be, nor shall it be construed as investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any ...

more