10 Best Dividend Paying Stocks For The Enterprising Investor – March 2019

There are a number of great companies in the market today. By using the ModernGraham Valuation Model, I’ve selected ten undervalued companies for the Enterprising dividend stock investor. These companies have the highest dividend yields among the undervalued companies reviewed by ModernGraham which are suitable for Enterprising Investor according to the ModernGraham approach.

Defensive Investors are defined as investors who are not able or willing to do substantial research into individual investments, and therefore need to select only the companies that present the least amount of risk. Enterprising Investors, on the other hand, are able to select companies that present a moderate (though still low) amount of risk. Each company suitable for the Defensive Investor is also suitable for Enterprising Investors.

The companies selected for this list may not pay what some consider to be a huge dividend, but they have demonstrated strong financial positions through passing the requirements of the Enterprising Investor and show potential for capital growth based on their current price in relation to intrinsic value. As such, these defensive dividend stocks may be a great investment if they prove to be suitable for your portfolio after your own additional research.

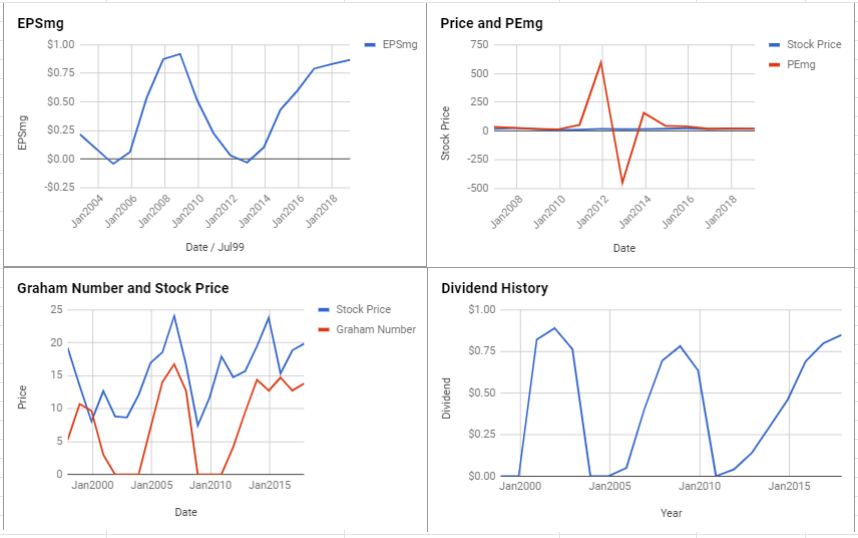

Host Hotels and Resorts Inc (HST)

Host Hotels and Resorts Inc is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with the insufficient earnings stability or growth over the last ten years, and the poor dividend history, and the high PEmg ratio. The Enterprising Investor is only concerned with the level of debt relative to the net current assets. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $0.43 in 2014 to an estimated $0.87 for 2018. This level of demonstrated earnings growth outpaces the market’s implied estimate of 6.13% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into Host Hotels and Resorts Inc revealed the company was trading above its Graham Number of $13.82. The company pays a dividend of $0.8 per share, for a yield of 4.4%, putting it among the best dividend paying stocks today. Its PEmg (price over earnings per share – ModernGraham) was 20.75, which was below the industry average of 81.61, which by some methods of valuation makes it one of the most undervalued stocks in its industry. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-3.88.

Host Hotels and Resorts Inc performs fairly well in the ModernGraham grading system, scoring a B. (See the full valuation)

(Click on image to enlarge)

LyondellBasell Industries NV (LYB)

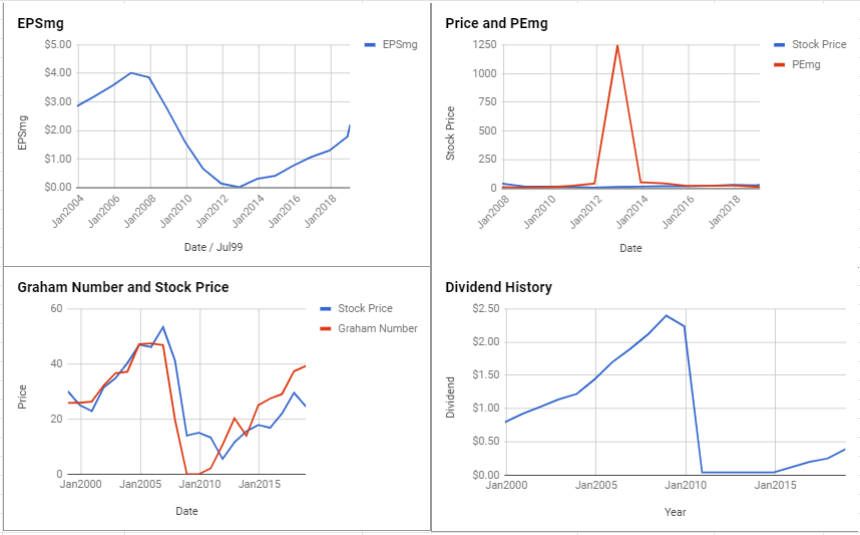

LyondellBasell Industries NV is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with the low current ratio, insufficient earnings stability or growth over the last ten years, and the poor dividend history. The Enterprising Investor is only concerned with the level of debt relative to the net current assets. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $6.13 in 2014 to an estimated $10.84 for 2018. This level of demonstrated earnings growth outpaces the market’s implied estimate of 0.41% annual earnings loss over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into LyondellBasell Industries NV revealed the company was trading above its Graham Number of $77.64. The company pays a dividend of $3.55 per share, for a yield of 4.3%, putting it among the best dividend paying stocks today. Its PEmg (price over earnings per share – ModernGraham) was 7.68, which was below the industry average of 20.47, which by some methods of valuation makes it one of the most undervalued stocks in its industry. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-16.01.

LyondellBasell Industries NV performs fairly well in the ModernGraham grading system, scoring a B. (See the full valuation)

(Click on image to enlarge)

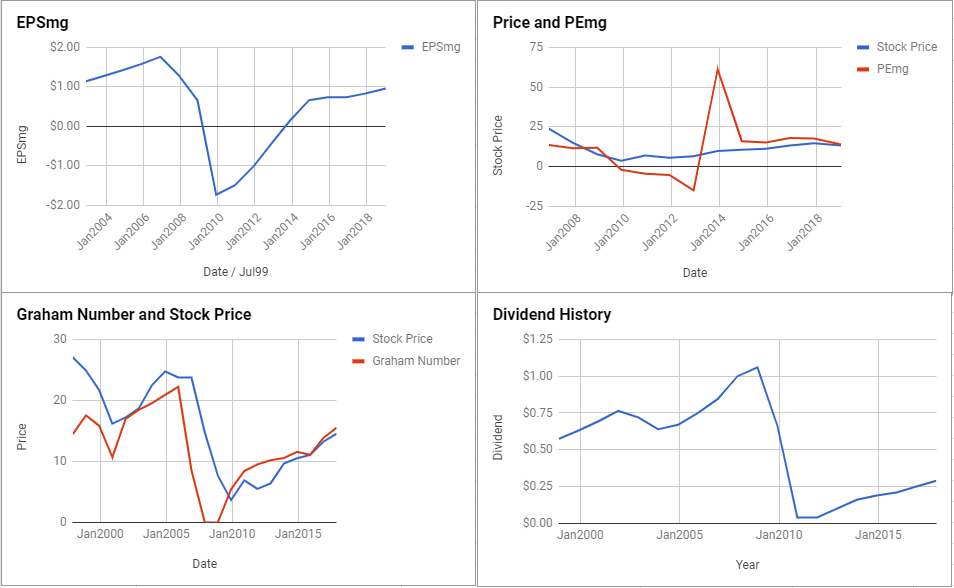

Citizens Financial Group Inc (CFG)

Citizens Financial Group Inc is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with the insufficient earnings stability over the last ten years, and the poor dividend history. The Enterprising Investor has no initial concerns. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $-0.08 in 2015 to an estimated $3.21 for 2019. This level of demonstrated earnings growth outpaces the market’s implied estimate of 1.47% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into Citizens Financial Group Inc revealed the company was trading below its Graham Number of $60.22. The company pays a dividend of $0.98 per share, for a yield of 2.7%, putting it among the best dividend paying stocks today. Its PEmg (price over earnings per share – ModernGraham) was 11.44, which was below the industry average of 16.24, which by some methods of valuation makes it one of the most undervalued stocks in its industry.

Citizens Financial Group Inc fares extremely well in the ModernGraham grading system, scoring an A-. (See the full valuation)

(Click on image to enlarge)

Duke Realty Corp (DRE)

Duke Realty Corp is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with insufficient earnings stability or growth over the last ten years. The Enterprising Investor is only concerned with the level of debt relative to the net current assets. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $0.79 in 2015 to an estimated $1.58 for 2019. This level of demonstrated earnings growth outpaces the market’s implied estimate of 5.09% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into Duke Realty Corp revealed the company was trading above its Graham Number of $11.21. The company pays a dividend of $0.82 per share, for a yield of 2.8%, putting it among the best dividend paying stocks today. Its PEmg (price over earnings per share – ModernGraham) was 18.69, which was below the industry average of 61.92, which by some methods of valuation makes it one of the most undervalued stocks in its industry. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-7.22.

Duke Realty Corp performs fairly well in the ModernGraham grading system, scoring a B. (See the full valuation)

(Click on image to enlarge)

Huntington Bancshares Incorporated (HBAN)

Huntington Bancshares Incorporated is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with insufficient earnings stability or growth over the last ten years. The Enterprising Investor has no initial concerns. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $0.66 in 2014 to an estimated $0.96 for 2018. This level of demonstrated earnings growth outpaces the market’s implied estimate of 2.68% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into Huntington Bancshares Incorporated revealed the company was trading below its Graham Number of $15.53. The company pays a dividend of $0.35 per share, for a yield of 2.6%, putting it among the best dividend paying stocks today. Its PEmg (price over earnings per share – ModernGraham) was 13.86, which was below the industry average of 14.65, which by some methods of valuation makes it one of the most undervalued stocks in its industry.

Huntington Bancshares Incorporated fares extremely well in the ModernGraham grading system, scoring an A-. (See the full valuation)

(Click on image to enlarge)

Texas Instruments Incorporated (TXN)

Texas Instruments Incorporated is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with the high PEmg and PB ratios. The Enterprising Investor has no initial concerns. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $2.33 in 2015 to an estimated $4.43 for 2019. This level of demonstrated earnings growth outpaces the market’s implied estimate of 7.79% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on the Benjamin Graham value investing formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into Texas Instruments Incorporated revealed the company was trading above its Graham Number of $31.69. The company pays a dividend of $2.63 per share, for a yield of 2.5%, putting it among the best dividend paying stocks today. Its PEmg (price over earnings per share – ModernGraham) was 24.07, which was below the industry average of 35.5, which by some methods of valuation makes it one of the most undervalued stocks in its industry. Finally, the company was trading above its Net Current Asset Value (NCAV) of $-0.05.

Texas Instruments Incorporated performs fairly well in the ModernGraham grading system, scoring a B. (See the full valuation)

(Click on image to enlarge)

KeyCorp (KEY)

KeyCorp is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with insufficient earnings stability or growth over the last ten years. The Enterprising Investor has no initial concerns. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $0.91 in 2014 to an estimated $1.24 for 2018. This level of demonstrated earnings growth outpaces the market’s implied estimate of 2.16% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into KeyCorp revealed the company was trading below its Graham Number of $22.58. The company pays a dividend of $0.38 per share, for a yield of 2.4%, putting it among the best dividend paying stocks today. Its PEmg (price over earnings per share – ModernGraham) was 12.83, which was below the industry average of 14.65, which by some methods of valuation makes it one of the most undervalued stocks in its industry.

KeyCorp fares extremely well in the ModernGraham grading system, scoring an A-. (See the full valuation)

(Click on image to enlarge)

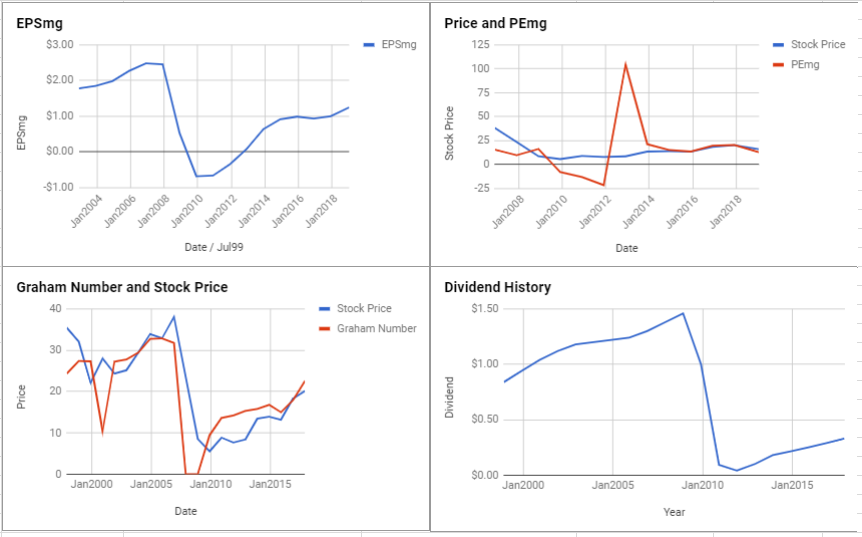

Morgan Stanley (MS)

Morgan Stanley is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with insufficient earnings stability over the last ten years. The Enterprising Investor has no initial concerns. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $1.23 in 2014 to an estimated $3.46 for 2018. This level of demonstrated earnings growth outpaces the market’s implied estimate of 1.9% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into Morgan Stanley revealed the company was trading below its Graham Number of $63.69. The company pays a dividend of $0.9 per share, for a yield of 2.1%, putting it among the best dividend paying stocks today. Its PEmg (price over earnings per share – ModernGraham) was 12.29, which was below the industry average of 18, which by some methods of valuation makes it one of the most undervalued stocks in its industry.

Morgan Stanley fares extremely well in the ModernGraham grading system, scoring an A-. (See the full valuation)

(Click on image to enlarge)

Regions Financial Corp (RF)

Regions Financial Corp is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with insufficient earnings stability or growth over the last ten years. The Enterprising Investor has no initial concerns. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $0.52 in 2014 to an estimated $1.1 for 2018. This level of demonstrated earnings growth outpaces the market’s implied estimate of 2.75% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into Regions Financial Corp revealed the company was trading below its Graham Number of $21.6. The company pays a dividend of $0.32 per share, for a yield of 2% Its PEmg (price over earnings per share – ModernGraham) was 13.99, which was below the industry average of 14.65, which by some methods of valuation makes it one of the most undervalued stocks in its industry.

Regions Financial Corp fares extremely well in the ModernGraham grading system, scoring an A-. (See the full valuation)

(Click on image to enlarge)

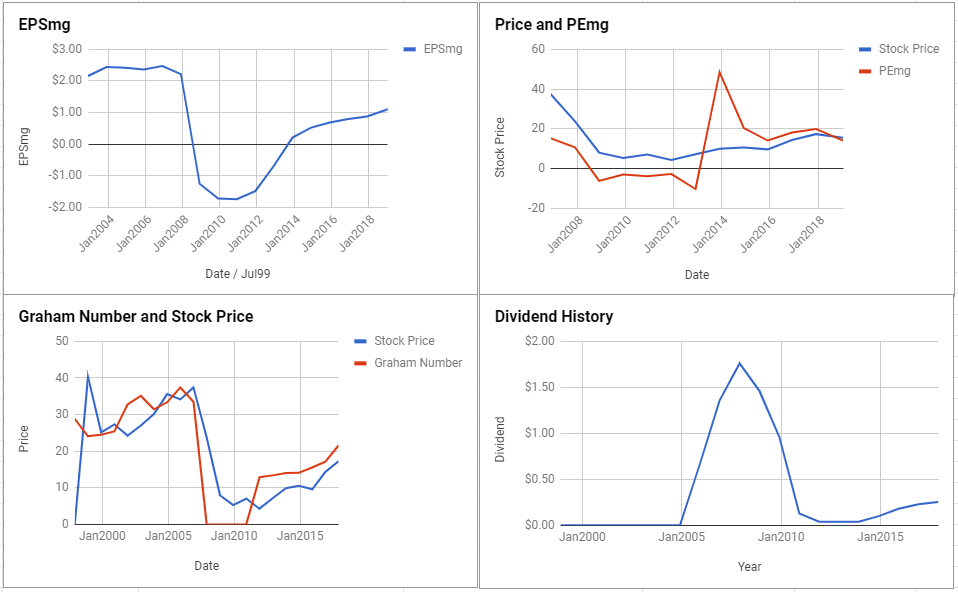

Bank of America Corp (BAC)

Bank of America Corp is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with the insufficient earnings stability or growth over the last ten years. The Enterprising Investor has no initial concerns. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $0.76 in 2015 to an estimated $2.2 for 2019. This level of demonstrated earnings growth outpaces the market’s implied estimate of 2.46% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price.

At the time of valuation, further research into Bank of America Corp revealed the company was trading below its Graham Number of $39.29. The company pays a dividend of $0.54 per share, for a yield of 1.8% Its PEmg (price over earnings per share – ModernGraham) was 13.42, which was below the industry average of 14.65, which by some methods of valuation makes it one of the most undervalued stocks in its industry.

Bank of America Corp performs fairly well in the ModernGraham grading system, scoring a B+. (See the full valuation)

(Click on image to enlarge)

Disclaimer: The author held a long position in Ford Motor Company (F) and Western Refining Inc (WNR) but did not hold a position in any other company mentioned in this article at the ...

more