US: Jobs Shocker

A pretty woeful jobs report for April is likely more a reflection of structural rigidities and supply constraints rather than any meaningful weakening in demand for labor. The economy will regain all its lost output in the coming quarter and that should keep firms hunting for qualified staff.

Weak jobs report difficult to reconcile

Well – no-one saw that coming. Jobs growth of just 266k (consensus 1mn) while there were big downward revisions to March from 916k to 770k. Private payrolls rose just 218k with manufacturing employment actually falling 18k while trade and transport dropped 81k, retail fell 15k and temporary help fell 111k.

These falls are all more than a little strange given the strong performance of all these sectors, activity wise, over the past couple of months. Construction employment being flat on the month is also odd given the booming residential construction sector that is more than offsetting weakness elsewhere.

On the positive side leisure and hospitality rose 331k, reflecting the re-opening while government employment rose 48k, but even this is disappointing given the strength in spending the economy is experiencing.

Looking at the non-seasonally adjusted data employment rose 1.1mn after 1.2mn gains in February and March, so the only other thing will can possible argue is that there may be some seasonal adjustment issues given pandemic-related distortions, but we have no real proof.

Employment levels peak to trough and peak to current level (mn)

(Click on image to enlarge)

Sources: Macrobond, ING

This poor outcome was confirmed by the rising unemployment rate to 6.1% from 6.0% (consensus 5.8%) – remember that this works off a separate survey (payrolls asks business, unemployment asks households). We saw worker participation rise by 430k – people returning to the labour market – while employment rose only 328k. Wages, meanwhile rose 0.7% month-on-month versus expectations of zero change, which largely tells us that the jobs that were gained were paid more than the jobs that were lost given the way this survey is constructed.

Fed has it right?

The US economy has made great strides since the economic lows of the pandemic in April, by which point 22.4mn people had lost their job. Nearly two-thirds of workers have found employment with the net loss of jobs now “only” 8.2mn. Nonetheless, today’s report shows a clear slowdown. Federal Reserve chair Jerome Powell has made it clear that officials want to see a “string” of strong jobs reports before officials will consider shifting their policy stance and so it offers some support to their position that the first rate hike won’t come until 2024.

It’s all about supply

However, we think labour market softness is more of a supply issue than a demand issue at this point. Overnight we saw the National Federation of Independent Business which highlighted the structural rigidities in the jobs market that could last several months.

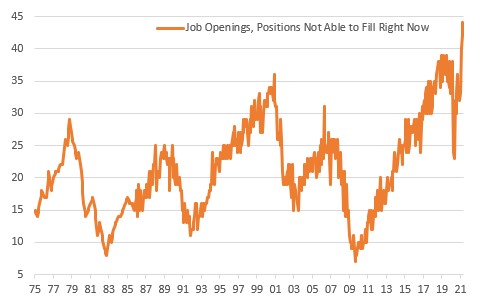

It is a survey of the small business sector, which is responsible for half of all jobs in the United States. This survey goes back 48 years and reported the third consecutive new all-time high reading for the number of small businesses that had job openings that they could not fill. 59% of small businesses reported hiring or trying to hire in April, but 92% of those firms reported few or no "qualified" applicants.

NFIB survey shows firms can't find workers

(Click on image to enlarge)

Sources: Macrobond, ING

This tells us that there is huge demand for workers, but it is the lack of supply that will potentially hold back jobs gains in the next few months.

The obvious reasons are ongoing child-care issues surrounding home schooling, which is forcing many parent to stay at home rather than go out to work. Then there are the extended and uprated unemployment benefits that will continue through until September. The extra financial inducement required to attract potential staff may well be putting a strain on companies that have struggled through the pandemic. Nonetheless, the NFIB reported a net 31% of firms reported raising compensation and a net 20% of owners plan to raise compensation in the next three months.

Still looking to the positives

We are set to see the US recover all of the lost output through the pandemic in the current quarter, but returning all the lost jobs is going to take many more months. As these structural rigidities ease we expect the see employment take-off and still forecast a December announcement of a QE taper with the risks skewed towards earlier Fed policy tightening than 2024.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more