US Jobs: Everything You Could Want And More

The US jobs market has posted a solid set of figures for July with employment gains exceeding expectations, unemployment falling, wages accelerating and the participation rate increasing. Momentum is building toward early Federal Reserve policy action.

Jobs & wage gain boost case for stimulus withdrawal

The US economy saw 943,000 jobs created in July, well above the 870,000 consensus forecast with an extra 119,000 jobs added through upward revisions to recent history. Private payrolls rose 703,000 with leisure and hospitality recording a 380,000 rise, trade and transport was up 47,000 and manufacturing increased 27,000. There was also good news for construction, which posted an increase in employment after three consecutive falls. Government workers increased by 240,000 with the only disappointment coming in retail, which saw 6,000 job losses.

This broad strength was also reflected in the household survey used to calculate the unemployment rate. It showed a 1.043mn increase in the number of people classifying themselves as employed. There was also a slight increase in worker participation which has left the unemployment rate at 5.4% versus 5.7% in June.

Rounding out a really strong set of figures we have wage growth of 0.4% month-on-month/4% year-on-year, a tenth of a percentage point higher than expected. With more people in work and at higher rates of pay this means the outlook for household incomes is very positive, which should help to keep household spending motoring along.

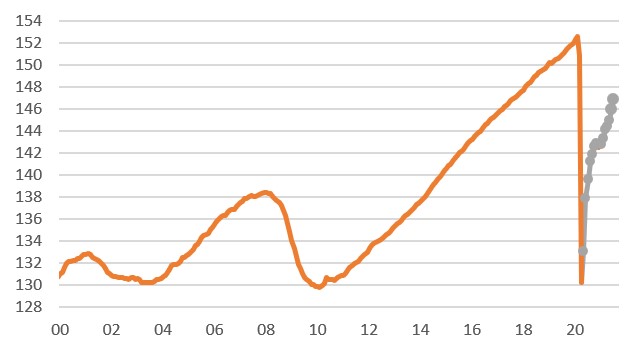

Nonetheless, we have to remember that total US non-farm payrolls remains 5.702mn below the pre-pandemic level of February 2020. Last week’s GDP report showed the economy has already made back all the lost output but, there is still some way to go before the labour market has fully healed.

US non-farm payrolls levels (mn)

Source: Macrobond, ING

Labour supply still holding back the recovery

That said, the slower pace of the jobs recovery remains a supply side issue, not a demand side problem. The most recent Federal Reserve Beige Book stated that “labour shortages were often cited as a reason firms could not staff at desired levels… All Districts noted an increased use of non-wage cash incentives to attract and retain workers. Firms in several Districts expected the difficulty finding workers to extend into the early fall.”

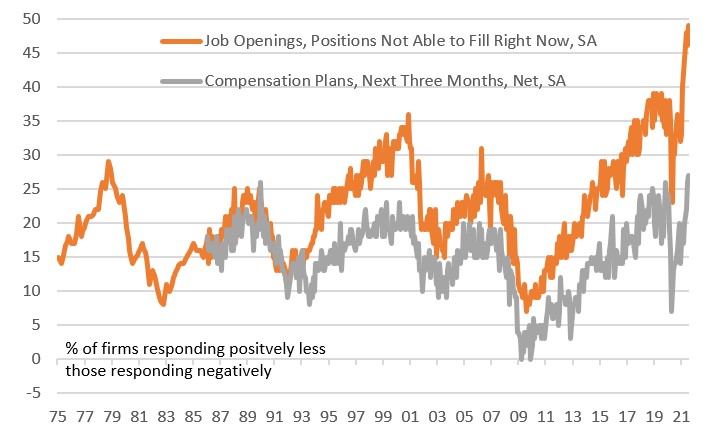

This message was reinforced by the National Federation of Independent Businesses labour data, released yesterday, showing that a new record 49% of small business owners had job openings they could not fill.

With companies desperate to recruit and expand to take advantage of the reopening and the stimulus-fuelled growth environment, companies are increasingly taking the decision to pay more to attract staff. This was reflected in a new all-time high for the proportion of companies expecting to raise compensation (see chart below).

NFIB reports record difficulty in finding workers with wages rising in response

Source: Macrobond, ING

Wage pressures set to intensify

We are of the view that labour supply will only improve gradually. We acknowledge that more than half of states have or are in the process of ending the additional Federal unemployment payments, which should increase the financial incentives to seek employment. However, with the summer vacation season still upon us, the issues with parents having to stay home to look after children is going to persist through to at least September. The rise of the Delta Covid variant could also mean that those workers who have been hesitant to return to work for health fears, further delay seeking employment.

Moreover, the Federal Reserve acknowledged in their recent Monetary Policy Report a marked increase in early retirement given that surging equity markets have boosted the value of 401k plans. Some estimates suggest more than 2 million people have permanently left the labour force for this reason. Consequently, we believe the struggle to find suitable workers could last a number of quarters.

Keeping inflation higher for longer

This is a challenging situation for US companies with the implication being that we expect to see companies not only having to pay more to recruit new staff, but also raise pay more broadly in order to retain staff.

With consumer price inflation possibly hitting a new high next week, rising employee costs could be a key factor to watch that will mean inflation stays higher for even longer. As such we continue to see the risks skewed towards earlier Federal Reserve stimulus withdrawal with a QE tapering announcement before year end and the first interest rate hikes coming next year.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more