US Jobs Bounce, But We Need More Workers

An upside surprise for US jobs in June, but there remain 6.7mn fewer people in work versus pre-pandemic levels. The demand for workers is obvious, but major supply issues are making life difficult for corporate America. Compensation is rising and will add to inflation pressures that will likely lead to an earlier Federal Reserve policy response.

Jobs post decent gain, yet unemployment rises

The US economy saw 850,000 jobs created in June, above the 720,000 consensus and the strongest gain since the 1.58mn figure posted last August. There were also a net 15,000 upward revisions to the past two months with gains broadly spread across sectors.

This is undoubtedly a better than expected outcome, which could have been helped by the surge in the student workforce now that the summer holiday season is upon us. We all know companies are desperate for staff and students could have certainly helped to fill gaps.

Private payrolls rose 662,000 versus expectations of 615,000 with leisure and hospitality recording a 343,000 rise, trade and transport was up 99,000 and manufacturing increased 15,000. There was, however, a third consecutive fall in construction employment (and the fourth fall in the past five months), which is a surprise given the decent activity data from the sector. Financial services reported a 1,000 fall after a 3,000 decline in May. Government workers increased by 188,000, which could be related to seasonal adjustments as normally workers would be laid-off with school closures, but given remote teaching, this won’t have happened to the same degree this year.

That said, the household survey was softer. It reported that employment actually fell 18,000 and with the labor force increasing 151,000 this meant that the unemployment rate rose to 5.9% from 5.8% - worse than the consensus 5.6% prediction.

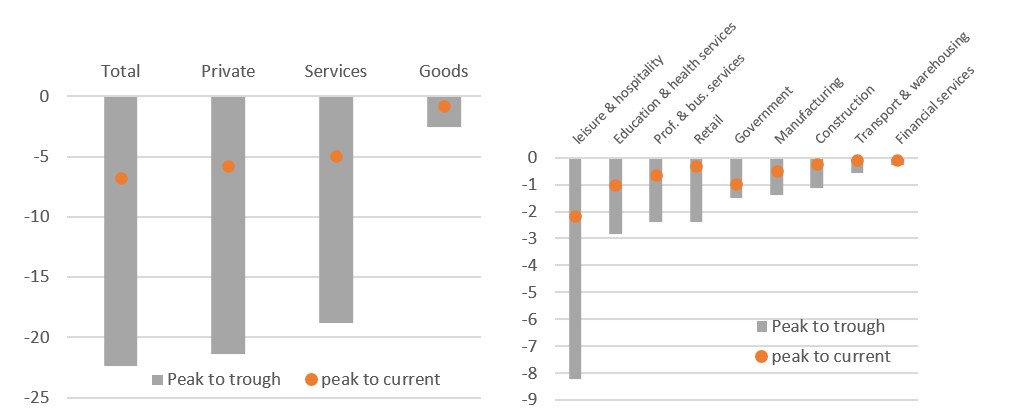

Peak to trough and peak to current employment changes by sector (000s)

(Click on image to enlarge)

Source: Macrobond, ING

Moreover, we have to remember that total US nonfarm payrolls remains 6.764mn below the level of February 2020 with every major sector still in deficit versus that pre-pandemic starting point. While the economy has almost certainly made back all the lost output in the second quarter, there is still a long way to go before the labor market has fully healed.

Labour supply holding back the recovery

That said, this remains a supply-side issue, not a demand-side problem and the implication is that wages will end up being pushed higher as firms look to expand and take advantage of the strong economic environment.

The struggle to find staff was highlighted by yesterday's ISM manufacturing report showing that despite booming orders and production, the employment index dropped into contraction territory in June as companies failed to recruit and they themselves had employees retire or be poached by other companies.

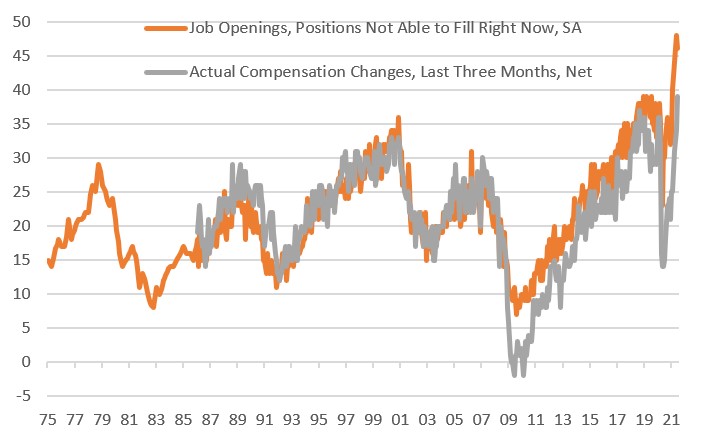

This message was reinforced by the National Federation of Independent Businesses reporting a few hours later that 46% of small business owners had job openings they could not fill. This was down two points from May, but as the chart shows it is a remarkable figure that is way, way above the 48-year historical average of 22%.

NFIB Survey: Companies can't find workers and are hiking pay to try and attract them

Source: Macrobond, ING

With companies desperate to recruit and expand to take advantage of the reopening and the stimulus-fuelled growth environment, companies are increasingly taking the decision to pay more to attract staff. This was reflected in a new all-time high for the proportion of companies raising compensation. A net 39% of small businesses are now raising pay rates, up five points from May and well above the average rate, again of 22% through the lifetime of the survey.

Wage and inflation pressures continue to build

The lack of labor supply will only ease gradually - the student boost is only going to be a temporary help. Certainly, more than half of states have or are in the process of ending the additional Federal unemployment payments, which should increase the financial incentives to seek employment. However, with the summer holiday season upon us, the issues with parents having to stay home to look after children is going to persist through to at least September.

Moreover, evidence suggests a marked increase in retirement given that surging equity markets have boosted the value of 401k plans. This means potentially 2.5 million people have permanently left the labor force, which will be a major headwind to employment gains. Consequently, we believe the struggle to find suitable workers could last a number of quarters.

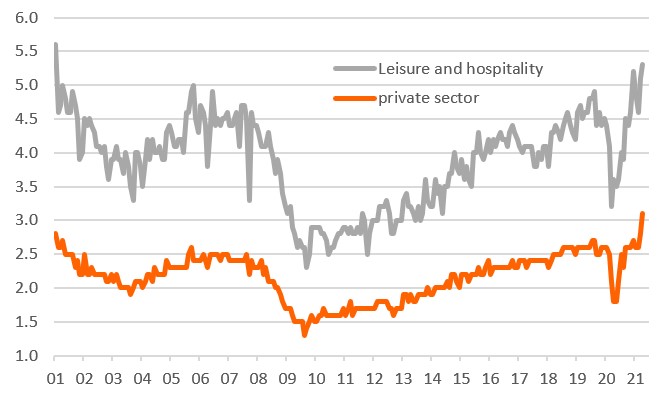

The US "quit rate" - the proportion of workers quitting their job to move to a new employer

Source: Macrobond, ING

Given the strength of the US growth story we are expecting next week’s JOLTs data (Job Openings and Labour Turnover statistics) to show that the “quit rate” – the proportion of workers quitting their job to move to a new employer has hit a new all-time high. This is further bad news for US companies with the implication being that we expect to see companies not only having to pay more to recruit new staff, but also raise pay more broadly in order to retain staff.

If this materializes this will be a key factor that will mean inflation stays elevated for even longer. We believe headline inflation will stay above 4% well into 2022 and take the view that it is increasingly probable the Federal Reserve will end up raising interest rates in 2022.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more