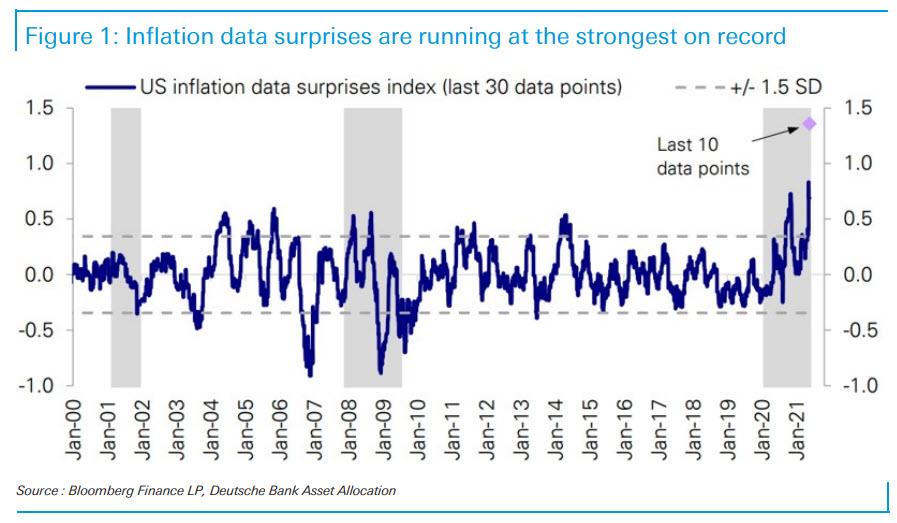

US Inflation Surprises Are The Highest On Record

As we noted over the weekend, positive US data surprises seem to be normalizing (i.e. the Citi US econ surprise index has flatlined) due to a combination of analysts catching up with the prior stronger pace of growth, and also due to some evidence that the rate of change of US growth is peaking out (JPMorgan disagrees).

(Click on image to enlarge)

However, as DB's equity strategist Parag Thatte points out in his latest positioning piece, "US inflation data surprises are at their highest in the 20-year history of the series with the last 10 data points almost 'off the chart'."

(Click on image to enlarge)

As DB's Jim Reid points out, inflation surprises during the Global Financial Crisis were sharply negative and didn't positively overshoot after. During the pandemic, we didn't undershoot and are now overshooting massively.

As the credit strategist continues, "while it is easy to blame transitory factors, these were surely all known about before the last several data prints and could have been factored into forecasts. That they weren’t suggests that the transitory forces are more powerful than economists imagined or that there is more widespread inflation than they previously believed."

To be sure, all such ‘surprise’ indices always mean revert so the inflation one will as well. However, as Reid concludes, "the fact that we’re seeing an overwhelming positive beat on US inflation surprises in recent times must surely reduce the confidence to some degree of those expecting it to be transitory. "

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more