US Home Prices Soar To New Record – No End In Sight

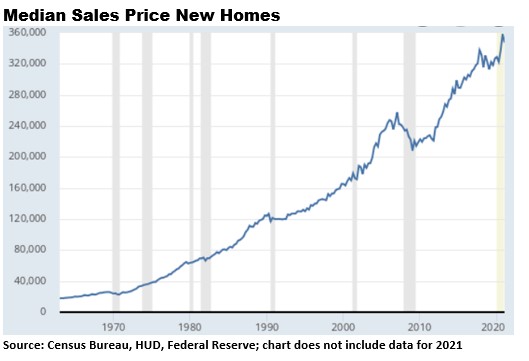

US home prices jumped the most on record in April. Nationally, the S&P CoreLogic Case-Shiller Index of property values jumped 14.6% from a year earlier in April, the biggest monthly gain since data have been kept. That came after a 13.2% increase in March and was the 11th straight month that US home price gains accelerated.

Home prices in the 20 largest US cities, meanwhile, jumped 14.9%, beating the median estimate in a survey of Bloomberg economists and was the biggest monthly gain since 2005. All 20 cities saw increases versus last year with Phoenix (+22.3%), San Diego (+21.6%), and Seattle (+20.2%) seeing the biggest gains.

Realtor.com now estimates that home sales jumped another 15.2% on an annual basis in May as the inventory of new homes for sale continues to decline. The May national median new home sale price soared to $374,400 also a new record high.

In some popular cities, the numbers are far higher. In Austin, TX, for example, the median sales price is a whopping $586,000, a 37.5% increase compared to a year ago. Nearly 150 new people relocate to Austin every day, and the metro population has doubled in the last decade to a whopping 2.3 million.

One reason for the surge in home prices nationwide, in addition to soaring demand, is the fact that only 1.23 million homes were for sale at the end of May, a 20.6% drop from a year earlier. This is less than a 2½-month supply, the lowest in decades.

“April’s performance was truly extraordinary,” said Craig Lazzara, global head of index investment strategy at S&P Dow Jones Indices. “We have previously suggested that the strength in the U.S. housing market is being driven in part by reaction to the Covid pandemic, as potential buyers move from urban apartments to suburban homes. April’s data continue to be consistent with this hypothesis.”

Low mortgage rates and demand for properties in the suburbs have fueled the US housing market for more than a year, with a shortage of homes to buy helping to push prices higher. Many buyers are having trouble finding properties they can afford.

Still, home prices are expected to remain elevated. Builders cite high materials prices, supply shortages and a limited number of skilled workers as ongoing challenges as they race to complete new homes.

“The forces that have propelled home price growth to new highs over the past year remain in place and are offering little evidence of abating,” said Matthew Speakman, an economist at Zillow Group Inc. “The number of available homes for sale remains historically small, particularly given the elevated demand for housing.”

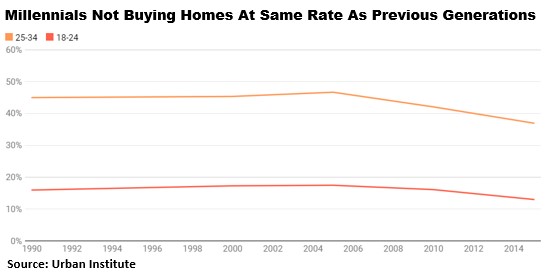

Millennials Being Priced Out of the Housing Market

Owning a home has been part of the American Dream for decades, and it is one of the biggest investments many people plan for in their lifetimes. However, there is one demographic group which isn’t necessarily setting its sights on the milestone of homeownership right away, even in today’s low interest rate environment. In fact, more Millennials (ages 25-40) are delaying the purchase of their first homes or giving up altogether.

As a rule, monthly mortgage payments should not be more than 20-25% of a homeowner’s monthly gross income. With home prices having increased as much as they have over the last few years, many Millennials simply cannot afford to buy a home.

Another factor that can affect qualifying to buy a home is the fact that Millennials are delaying getting married and having children. The changing dynamic of getting married and having children later means Millennials are staying at home with family longer and delaying the purchase of their first homes.

Record student debt is another limiting factor. Student debt hit almost $1.6 trillion in the US last year. As such, it’s now become a burden on Millennials trying to enter the housing market. According to the National Association of Realtors, more than 50% of home buyers under the age of 36 said student debt delayed their home buying.

Finally, Millennials continue to flock to big cities in large numbers. Pew Research found in 2018 that 88% of Millennials lived in metropolitan areas. Whether it is a social movement or the lure of greater work opportunities, Millennials are moving to regions with a higher proportion of renters compared to homeowners. This trend is pushing rental prices higher in the urban centers where they prefer to live which, in turn, pushes home prices higher as well.

For all these reasons and more, home prices continue to move higher. While all trends come to an end sooner or later, it’s hard to see this trend changing until we hit the next recession.