US Durable Goods New Orders Unexpectedly Tumble In April

Analysts expected US durable goods orders to rise for the 12th straight month in April, but were significantly disappointed as the headline print (preliminary) tumbled 1.3% MoM (vs +0.8% MoM exp).

(Click on image to enlarge)

Source: Bloomberg

That is the first drop since April 2020's lockdown collapse.

There is a silver lining in the report however as Capital Goods Orders Non-Defense Ex Aircraft and Parts (a proxy for Capex) - surged 2.3% MoM - well above the 1.0% MoM expected - and March was revised higher.

(Click on image to enlarge)

Source: Bloomberg

That is the highest level of Capex spend increase since August which suggests that the dip in April is "transitory".

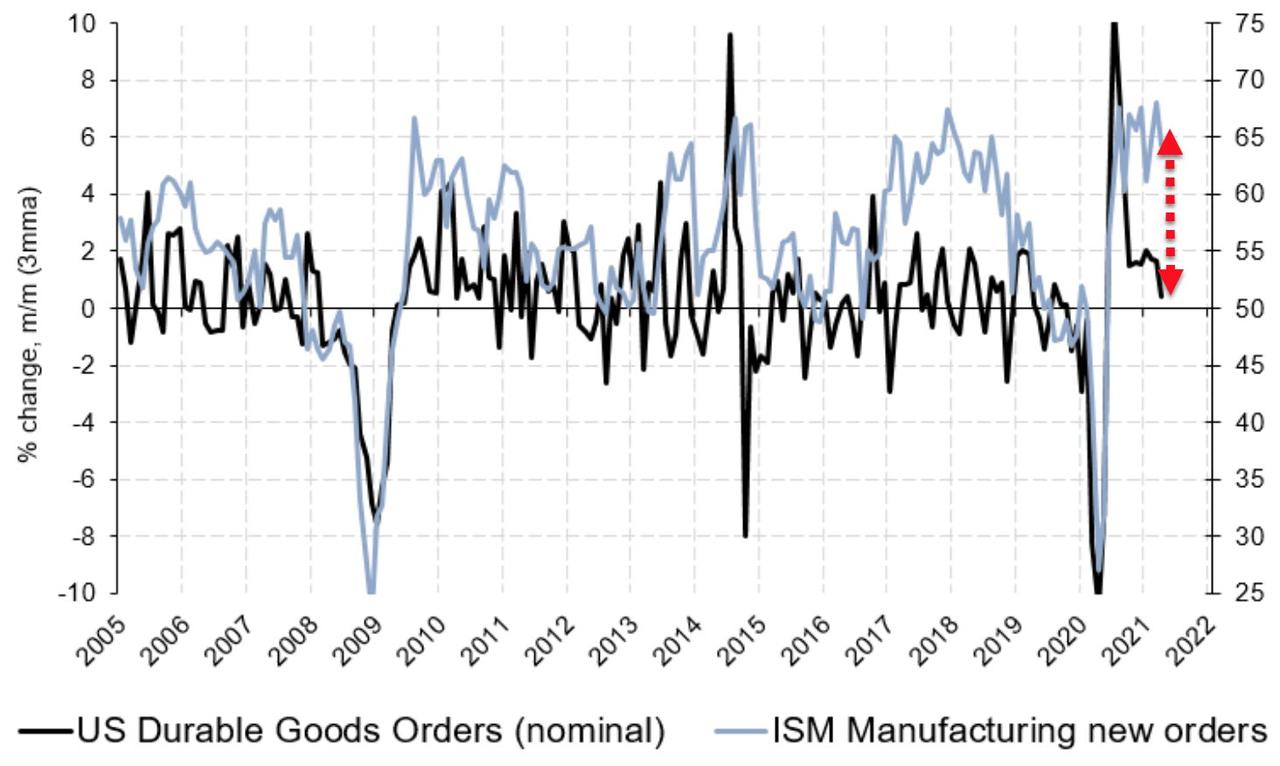

Perhaps most interesting is the major divergence between 'hard' data (actual orders) and 'soft' data (PMI/ISM surveys of orders)...

(Click on image to enlarge)

Remember 2017/18's exuberant 'soft' data spike? ... and 2015's? How many more times are we going to trust surveys over hard data?

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more