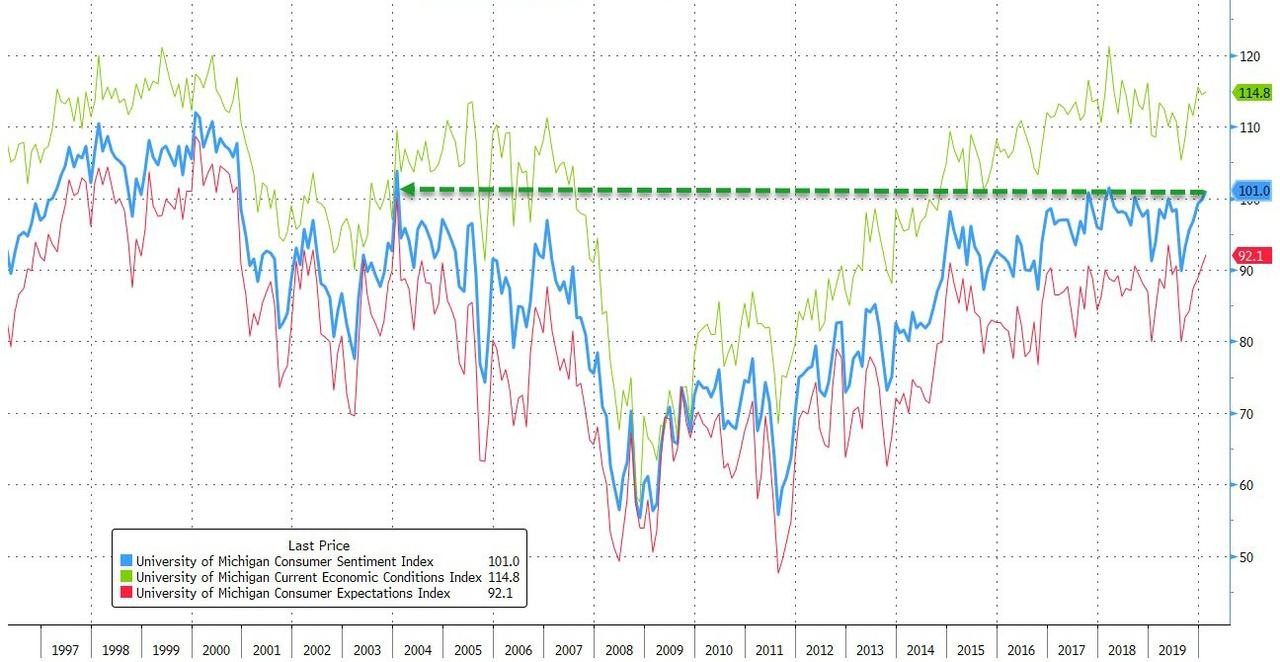

US Consumer Sentiment Soars Near 16 Year Highs (Before Virus Fears Rose)

While expectations dipped from the preliminary data, overall UMich sentiment jumped to almost its highest since 2004.

The gauge of current conditions increased from the prior month to 114.8 and the expectations index rose to 92.1, data showed Friday.

Source: Bloomberg

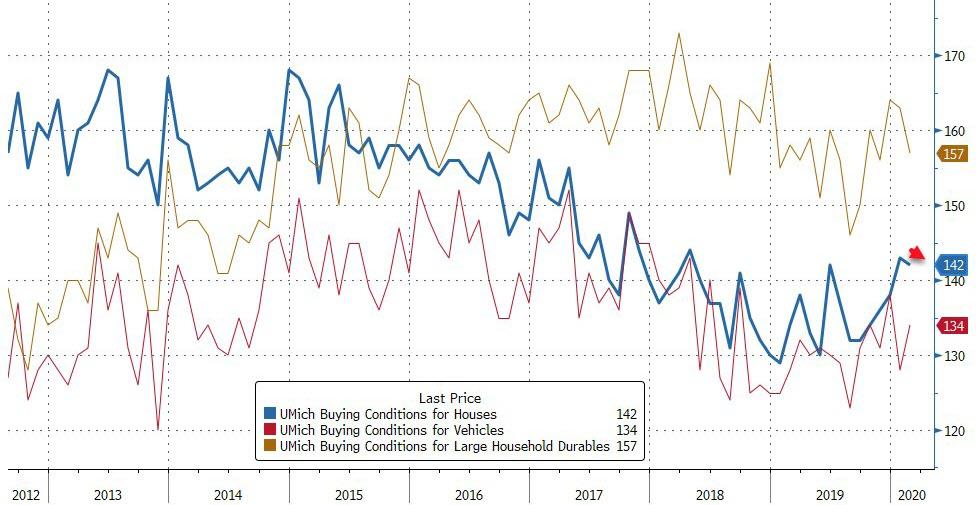

Appetite for buying houses dipped modestly in February...

(Click on image to enlarge)

Source: Bloomberg

Longer-term inflation expectations dropped to 2.3% this month from 2.5% in January. Federal Reserve officials watch this figure closely as Chairman Jerome Powell has warned lower expectations can drag actual inflation even lower. Inflation expectations for the year ahead fell to 2.4% from 2.5% in January. The preliminary February reading also was 2.5%.

The gauge of sentiment about current personal finances was the second-highest since 1998.

Notably, only 8% of all consumers in February mentioned the virus when describing the economic outlook, though the share rose to 20% in the final two days of the survey. Interviews were conducted on Jan. 29 through Feb. 25.

Still, “the domestic spread of the virus could have a significant impact on consumer spending,” Richard Curtin, director of the University of Michigan consumer survey, said in a statement.

“If the virus spreads into U.S. communities, consumers are likely to limit their exposure to stores, malls, theaters, restaurants, sporting events, air travel, and the like.”

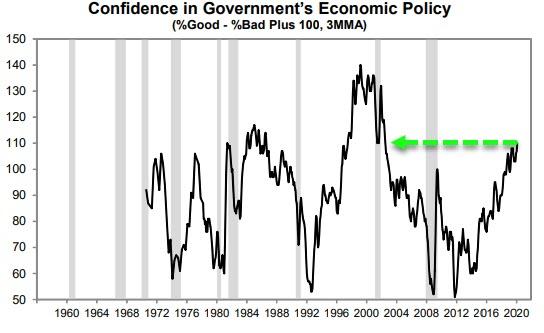

Panic is best avoided by a strong sense of confidence in local, state, and federal responses that aim to control the potential spread of the virus as well as limit any resulting damage to the economic welfare of consumers. The most effective fiscal and monetary policies include proposed reactions to the virus that are transparent, well understood, and act to maintain confidence in government economic policies close to its nearly two-decade high...

(Click on image to enlarge)

While the final February sentiment reading is the latest sign consumers remain a steady hand for the U.S. economy, a rapidly spreading coronavirus, the stock market collapse and the approaching elections nonetheless represent risks.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more