US & World Wheat Crops Up, But Small Corn & Bean Stk Changes

Market Analysis

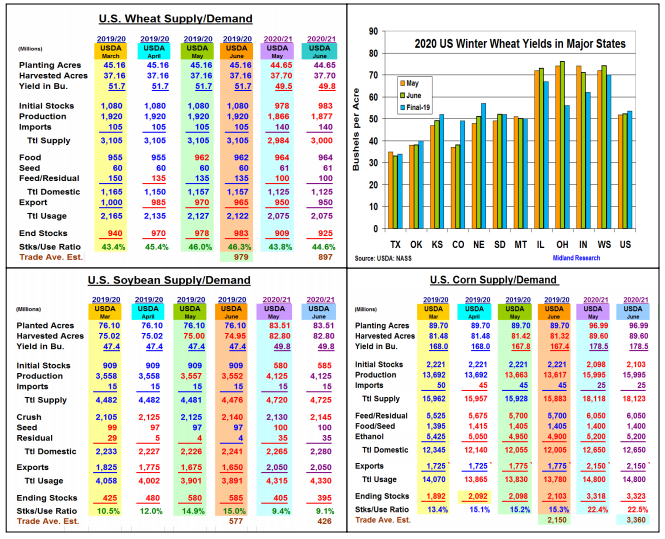

The latest monthly winter wheat production report had some twists while the US supply/demand revisions were generally modest this month. As expected, the USDA left its US 2020/21 planted & harvested levels unchanged waiting for the upcoming June 30 Acreage Survey for further information. The biggest surprise was the USDA’s 5 mmt rise in the world’s wheat supply and 6 mmt increase in 2020/21 stocks. Larger Indian, Chinese & Australian outputs (+7.2 mmt) overtook smaller Black Sea & European crops (-3.5 mmt) for this increase.

This month’s US winter wheat crop also had a head fake with an 11 million rise vs. an expected 17 million drop resulting in a 1.266 billion bu. update. Despite this year’s dryness & freeze in the western area of the S. Plains, this month’s hard red crop was raised 10 million bu to 743 million. Higher KS (+2), NE (+3) & SD (+3) yields from late May rain compensated for lower TX (-2) and MT (-1) yields. DC’s forecast for soft red was unchanged and up 2 million for white wheat for a 225.5 million bu. The USDA did slice 5 million from old-crop exports, but they left 20/21 demand levels unchanged so their US ending stocks advanced just 16 million to 925 million bu.

As expected, June’s US soybean crush was upped by 15 million bu to 2.14 billion and the recent slow pace of US bean exports prompted a 25 million drop in this old-crop demand. The twist was the 5 million cut in old-crop supplies because of a smaller ND crop that was finalized this month. The USDA also upping its new-cop crush outlook by 15 million to 2.145 billion which was a surprise that dipped 2020/21’s US stocks to 395 million.

This month’s 2019/20 corn stocks didn’t increase as much as expected. The USDA only sliced 50 million bu from ethanol demand while dropping 46 million bu. from old-crop supplies. A 100,000 drop-in harvested area & a 10 bu yield cut in ND’s late crop was the reason. Without any other old or new-crop demand changes, this month’s US stocks rose only 5 million bu.

What’s Ahead:

With small to modest changes in the latest US balance sheets, the market focus with likely switch to N. Hemisphere’s weather in the Black Sea, Europe, and Central US. Possible hot & dry forecasts could firm prices into recent $3.30-33 and $8.72-77 prices for 75% & 85% old-crop sales. Also, begin a 15% new-crop hedge sale at $3.46-49 and $8.82-90 levels. Hold wheat sales at 20 percent.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more