Unpopular Opinion: Amazon Is Undervalued

Amazon (AMZN) is one of the strongest companies in the world, that is beyond discussion to some degree. However, even a world-class business can be a mediocre investment if the purchase price is too high. If you pay a higher price than what the business is worth, then you will obtain disappointing returns from that investment, even if the company's fundamentals remain strong.

When discussing Amazon stock, one of the most common arguments among the bears is that the stock is already too expensive and the best is already in the past for investors in the company. However, that is not the case when looking at future cash flows, and the stock even looks undervalued from this perspective.

The Bearish Case

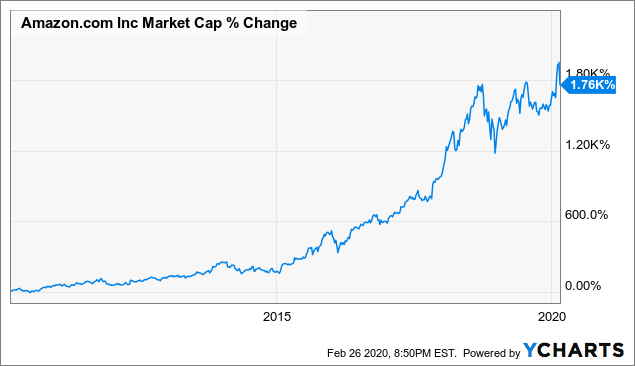

Amazon has delivered spectacular returns over the years, and it is now one of the largest companies in the world, with a market capitalization value that has recently surpassed $1 Trillion.

(Click on image to enlarge)

Data by YCharts

When a company reaches such a gargantuan size, it is reasonable for investors to wonder how much larger it can get in the middle term. Besides, if you believe that the stock market effectively incorporates all available information into stock prices, then it would be highly unlikely for such massively followed corporation to be undervalued.

Adding to the concerns, Amazon trades at a stratospherically high forward price to earnings ratio of 69 times earnings estimates for 2020. This ratio looks excessively expensive, even in comparison to other successful high-growth companies in the market.

In a nutshell, Amazon stock has appreciated exponentially in the past decade, and it has reached a gargantuan size at this stage. It is generally much more difficult to fund undervalued opportunities among the largest companies in the world. Furthermore, the stock looks aggressively expensive based on traditional valuation ratios such as price to earnings.

Focus On The Cash Flows

Amazon is aggressively investing its earnings in all kinds of initiatives to sustain long term growth. This has a negative impact on current earnings as measured by GAAP accounting standards, but aggressive investing is the right thing to do in order to maximize long term cash flow generation.

Founder and CEO Jeff Bezos has been quite clear about this strategy since the beginning. From Amazon's first letter to shareholders in 1997:

When forced to choose between optimizing the appearance of our GAAP accounting and maximizing the present value of future cash flows, we'll take the cash flows.

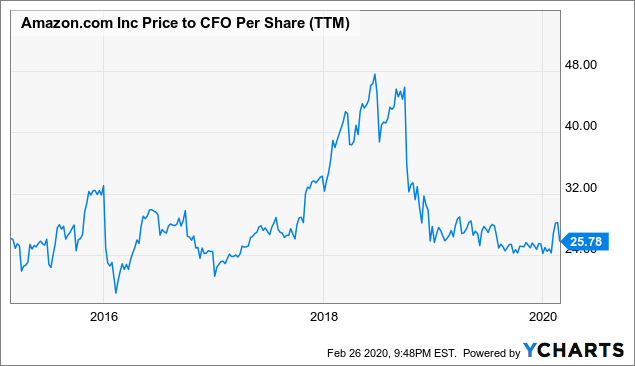

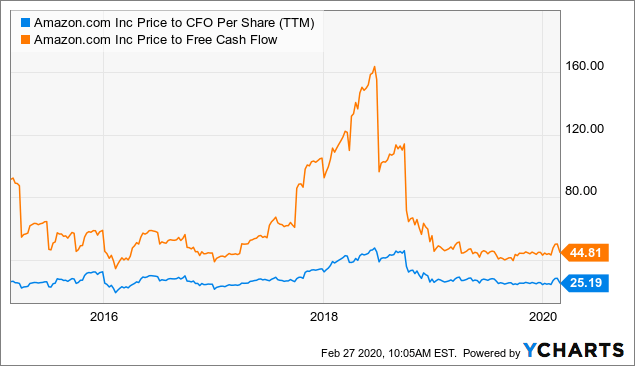

If we take a look at cash flow from operations, Amazon is currently trading at a price to cash flow ratio of 25.78, this is more than reasonable, and it is even near the low end of the historical range for the company over the past five years.

(Click on image to enlarge)

Data by YCharts

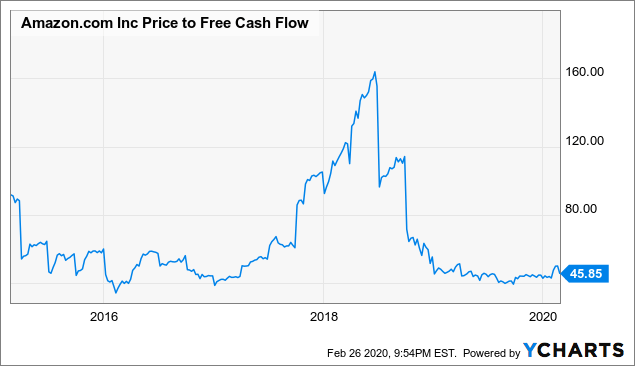

Free cash flows are much thinner and more volatile than operating cash flows because of the impact of capital expenditures. The price to free cash flow ratio is also low in comparison to the company's history, but still quite elevated in comparison to other stocks in the market.

(Click on image to enlarge)

Data by YCharts

However, the true value of the business depends on the cash flows that the company is going to produce in the future as opposed to the cash that is has produced in the past. When looking at future cash flow generation for Amazon, things get much more interesting.

Outstanding Cash Flow Growth

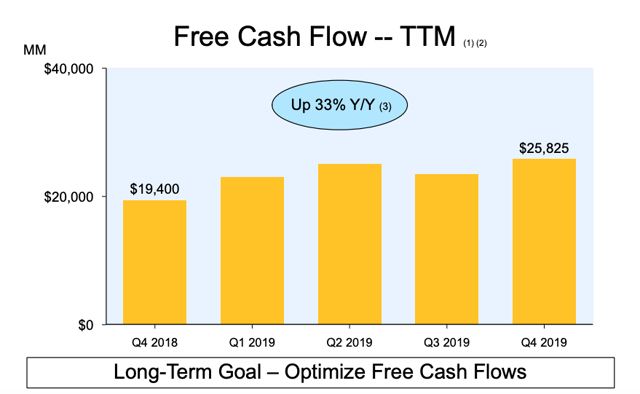

Amazon is doing a great job at increasing free cash flow, with the business generating $25.8 billion in free cash flow over a trailing 12 months period, a big increase of 33% year over year.

(Click on image to enlarge)

Source: Amazon

Free cash flow is growing at a faster rate than revenue, showing that Amazon is retaining a larger share of revenue as free cash flow for investors.

It is important to keep in mind that revenue grew by 20% last year, and Wall Street analysts are expecting a 19.19% increase in revenue for 2020. Rapid revenue growth, in combination with a larger share of revenue being retained as cash flow, will provide a double boost to cash flow expansion going forward.

The expansion in the free cash flow margin comes through two big venues: Growing operating cash flow margin and a reduced impact of capital expenditures on free cash flow.

The expansion in the operating margin is particularly compelling. Amazon Web Services is growing at a much faster rate than the retail business, with revenue from AWS increasing by 34% year over year last quarter. This segment is enormously profitable, with operating margin standing at around 26% of revenue.

Even if Amazon will face growing competition in cloud infrastructure in the years ahead, everything indicates that AWS will account for a larger share of total revenue in the future, and this will have a widely positive impact on the company's margins and cash flow generation capabilities.

In addition to this, higher adoption of Amazon Prime, a larger share of online retail sales coming from third parties, new subscription services across multiple categories, scale advantages, and accelerating expansion into online advertising are other factors that will most likely drive higher operating margins in the future.

The reduced impact of capital expenditures is quite easy to see. Amazon has made huge investments in areas such as data centers, distribution networks, storage, and green energy generation, among many other areas over the past several years.

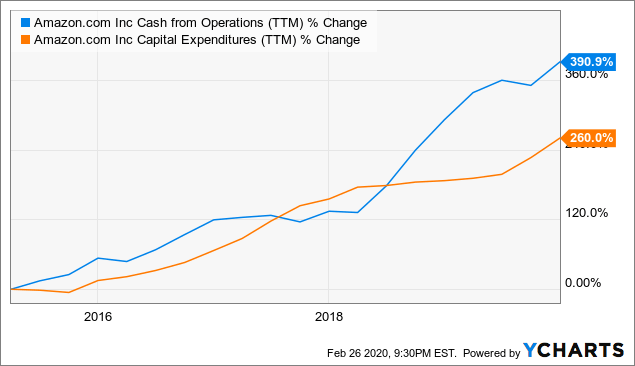

Chances are that the company will continue making big investments in the future, but if you expect rapid and sustained growth in operating cash flow, the probabilities are that capital expenditures will grow at a much slower rate than operating cash flow.

This trend is already visible in financial statements, operating cash flow is growing at a faster rate than free cash flow, and chances are that this difference is going to continue increasing.

(Click on image to enlarge)

Data by YCharts

Crunching Some Numbers

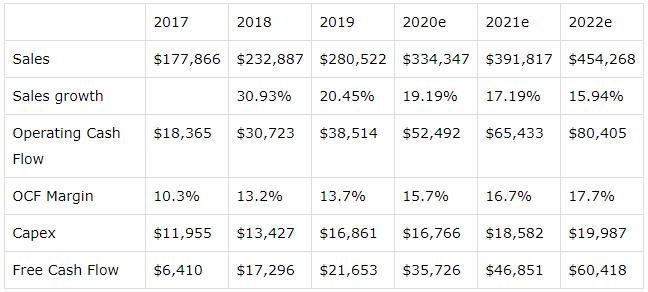

The table below is an unapologetically simple financial model for Amazon in the next three years. The numbers are basically taking Wall Street assumptions for revenue and capital expenditures, and allowing some room for expanding margins at the operating level.

I am fully aware of the fact that these estimates always carry a large degree of error, and the idea is not to accurately forecast revenues or cash flows for Amazon in the years ahead. The point is assessing if the stock is attractively valued or not based on reasonable assumptions for cash flow generation in the future.

(Click on image to enlarge)

Data in $Millions Source: SEC Filings and author's estimates

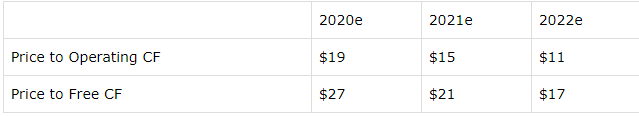

Assuming 1.5% dilution in shares outstanding, we get the following valuation ratos for Amazon based on price to operating cash flow and price to free cash flow ratios.

(Click on image to enlarge)

As a reference, the price to operating cash flow for the company has mostly remained above 25, with the price to free cash flow ratio staying above 45 most of the time over the past five years.

(Click on image to enlarge)

Data by YCharts

Even assuming that valuation ratios should come down as the business matures over time, the projected levels in the table look more than attractive for one of the strongest companies in the world with abundant potential for sustained growth in the long term.

In a nutshell, Amazon may look expensive based on earnings, but cash flow is a far more appropriate metric to assess valuation, and the stock looks very reasonably priced in terms of current cash flows. Even better, when you project Amazon's cash flows going forward, the stock looks downright undervalued.

Disclosure: I am/we are long AMZN.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more