Tuesday Talk: Zig-Zag-ing Away

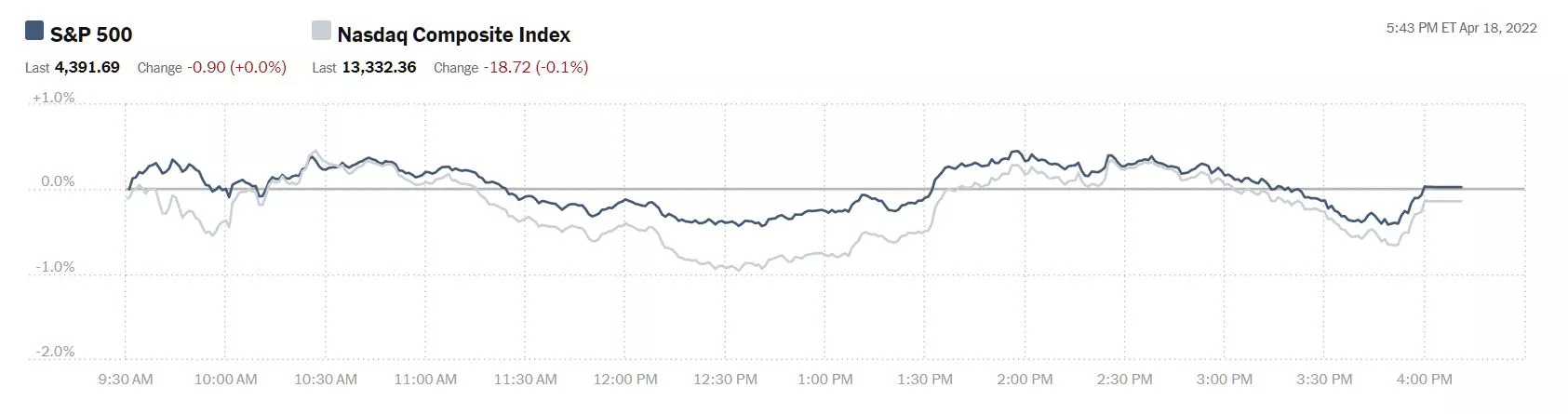

The market returned from the Good Friday long weekend by starting up then turning down then turning up, turning down, up again and down again, before closing out the day nearly unchanged.

Chart: The New York Times

The S&P 500 closed at 4,392, down .9 points, the Dow closed at 34,412, down 39 points and the Nasdaq Composite closed at 13,332, down 19 points.

Most actives, led by Twitter (TWTR) were largely on the upside and were across sectors.

In early morning trading S&P market futures are down 7 points, Dow futures are trading down 47 points and Nasdaq 100 futures are trading down 30 points.

TalkMarkets contributor Ironman who has been tracking growth and contraction in the world economy by charting global carbon dioxide emissions has an update in Ukraine Invasion, COVID Spread In China Shrink World Economy.

"In just a month, the global economy has gone from showing signs of stalling growth to providing strong evidence the Earth's economy has resumed shrinking. That's evident from the sharp drop in the pace at which carbon dioxide is increasing in the Earth's atmosphere recorded at the remote Mauna Loa observatory during the last month."

"There are two driving factors behind this development. First, Russia's 24 February 2022 invasion of Ukraine has disrupted coal, oil and especially natural gas flows from Russia to the European Union, as many EU nations are boycotting or have implemented economic sanctions against Russian firms.

The second major factor is China's increasing use of lockdowns as the government struggles to prevent the spread of COVID-19 within the country, which is also the world's largest emitter of carbon dioxide. The lockdowns have shut down the country's largest economic center and are now spreading to more regions along with coronavirus infections."

Writing in an exclusive for TalkMarkets, contributor Stephen Innes finds Negativity About The US Economy Is Pervasive.

"US equities little changed in thin trading Monday, S&P flat. the bond sell-off extended further, US10yr yields up 3bps to 2.85%, highest since December 2018...Equities continued to trade mixed, but the tape is better for sale following last week's massive underperformance in growth. And, investors believe that the path of least resistance remains lower due to the backup in bond yields, persistent inflation shock, the looming quantitative tightening, and waning fiscal stimulus...One of the biggest problems is that finding a dissenting voice on the global procession to recession is getting increasingly rare. The negativity about the economy is pervasive, and that alone can keep stock pickers sidelined."

See Innes' article for updates on oil, gold and the Yen.

TM contributor Mish Shedlock who has been beating the recession drum on a more or less constant basis of late writes Forget About A Soft Landing, What's The Shape Of The Hard Landing?

"A recession and hard landing are on the way. What will it look like?"

"I believe the soft landing proponents at the Fed and Goldman Sachs are in Fantasyland...The Fed had such amazing success in bringing about inflation. Did it ever stop to take a bow? I think not, and what a travesty to have such unglorified success. But what's next?

Competing Economic Theories

- Domino Theory: Proponents of this theory believe things will take a while to play out. Things fall one by one, but the big decline comes after a long wait. This scenario is very orderly until the final chaos.

- Spiral Theory: In contrast to the Domino Theory, Spiral Theory proponents expect things to be very disorderly right from the start. And once a decline does start, no one will believe the Fed has anything under control.

- Tipping Point Theory: This scenario will happen fast. The Fed will appear to be in control until one rate hike too many and then the whole damn thing suddenly tips over. This will happen much faster than a Domino Theory collapse.

- Fantasyland Theory: Soft landing"

"Before people start getting fired or laid off, hiring will slow. Then employers will cut hours. I do not expect to see the sustained mass firings and layoffs that we saw in 2008-2009...One of the many problems the Fed faces is de-globalization. Interest rate hikes are a very blunt instrument and the Fed is in a bad setup largely of its own making."

Shedlock has cobbled together a number of interesting sources and tweets for his column, check it out.

Contributor Simon Peters who covers the cryptocurrency beat, finds Bitcoin And Ethereum Battling Key Resistance Levels.

"Both bitcoin (BITCOMP) and ether (ETH-X) are battling key resistance levels at the moment, after considerable weakness in the past week. Bitcoin saw its price swing last week, reaching above $41,000 on Thursday, before sinking to below $38,500 on the eToro platform on Monday. It is back just above the $40,000 level at the moment. Ether likewise saw a rally on Thursday, rising above $3,100 before a flash crash took it within reach of $2,900. Today however it has rebounded to trade just above $3,000."

"A cascade of events following the pandemic, including rising prices and interest rates, geopolitical trouble, and other issues around the globe are conspiring to send investors toward ‘real’ assets such as commodities, including gold and others. Cryptoassets are having to work hard in this environment but for now, seem to be holding ground. The market will be watching for expectations around prices and rates to begin to soften, and for relief from tension in Eastern Europe. The former seems possible at the moment but the latter seems a far way away still."

See Peters article for additional crypto news.

In the "Where To Invest Department" today, in another TalkMarkets exclusive, contributor Aristofanis Papadatos picks 3 DRIP Stocks With Rising Dividends.

"DRIP stands for Dividend Reinvestment Plan. When investors are enrolled in DRIP stocks, their incoming dividend payments are automatically used to purchase more shares of the issuing company. In this way, they compound their dividends by investing them in their favorable holdings. This is a great way for investors to compound the income stream they receive."

"(Here are) three high-quality, no-fee DRIP stocks, namely Exxon Mobil (XOM), AbbVie (ABBV) and Aflac (AFL).

Exxon Mobil

Exxon Mobil is the second-largest oil and gas company in the world, behind only Saudi Aramco, with a market capitalization of $371 billion. It produces oil and natural gas at a 60/40 ratio and is one of the most integrated oil majors, with significant contribution from its refining and chemicals segments...Exxon is a Dividend Aristocrat, with 39 consecutive years of dividend growth. Due to the high cyclicality of the oil industry, there are only two Dividend Aristocrats in the oil industry, namely Exxon and Chevron (CVX)...Exxon is currently offering a 4.0% dividend yield. As long as the sanctions of western countries on Russia remain in place, the oil giant will keep thriving. Management has stated that the dividend is sustainable even at oil prices around $41 thanks to the high-grading of the asset portfolio of the company, which now includes primarily low-cost reserves. Overall, the dividend of Exxon has a wide margin of safety for the foreseeable future.

AbbVie

AbbVie is a biotechnology company focused on developing and commercializing drugs for immunology, oncology and virology. It was spun off by Abbott Laboratories in 2013.

AbbVie has a short history as a standalone company but it has an impressive performance record. Since its spin-off, AbbVie has grown its earnings per share every single year, at a 19% average annual rate. In addition, thanks to the essential nature of its products, the company has proved resilient throughout the coronavirus crisis. To be sure, the pharmaceutical giant grew its earnings per share by 18% in 2020 and by 20% in 2021.

Even better, business momentum has improved further this year. Management has provided guidance for earnings per share of $14.00-$14.20 in 2022. At the mid-point, this guidance corresponds to 11% growth vs. 2021...The only point of concern for AbbVie is the imminent patent expiration of its blockbuster drug, Humira, in the U.S. in 2023. Humira is used in the treatment of rheumatoid arthritis and currently generates 31% of the total revenue of AbbVie. Its patent expired in Europe in late 2018 and caused a 31% plunge in revenues in 2019 and a 14% decrease in revenues in 2020...AbbVie has raised its dividend every single year since its spin-off, at an average 5-year annual rate of 17%. The stock is currently offering a 3.5% dividend yield, with a low payout ratio (40%). Given its healthy payout ratio, its solid balance sheet and its resilience to recessions, AbbVie has ample room to keep growing its dividend at a fast pace for many more years.

Aflac

Founded in 1955, Aflac is the largest underwriter of supplemental cancer insurance in the world. The diversified insurer also provides accident, short-term disability, critical illness, dental, vision, and life insurance. Aflac generates approximately 70% of its pre-tax earnings from Japan and the remaining 30% from the U.S...Aflac has proved rock-solid throughout the coronavirus crisis. Although low interest rates continued to exert pressure on investment income, the insurer grew its earnings per share by 12% in 2020 and by another 21% in 2021, to a new all-time high. The strong performance resulted primarily from high investment gains...Income-oriented investors have greatly benefited from the resilient business model of Aflac, as the company raised its dividend by 18% in 2020 and by another 21% in 2021. The company has thus grown its dividend for 40 consecutive years. Moreover, given its remarkably low payout ratio of 26%, Aflac can continue raising its dividend meaningfully for many more years."

Please see the full article for additional details. The above excerpts have been heavily edited.

Caveat Emptor, as always.

Have a good week. I'll see you on Thursday.

Please support Ukrainian relief efforts