Tuesday Talk: Who's Got The Rebound?

Stocks rebounded sharply on Monday, following on Friday's up close, but who's got the rebound? While Omicron numbers are plunging, European inflation is rising and Russian intentions in the Ukraine continue to create fear, uncertainty and doubt.

Yesterday, the S&P 500 closed at 4,516, up 84 points or1.9%, the Dow Jones Industrial Average closed at 35,132, up 406 points or 1.2% and the Nasdaq Composite closed at 14,240, up 469 points or 3.4%. In early morning action, S&P futures are trading down 9 points, Dow futures are trading down 38 points, and Nasdaq 100 futures are trading down 26 points.

Though the CBOE Volatility Index (VIX) dropped during the day on Monday commensurate with the rally in stocks, with so much uncertainty in the air, it is blowing upwards overnight.

Currently market futures are jumping from red to green, S&P futures are trading down 8 points, Dow futures are trading down 54 points and Nasdaq 100 futures are trading up 2 points.

Yesterday's top gainers were Technology and Alternative Energy issues.

Chart: The New York Times

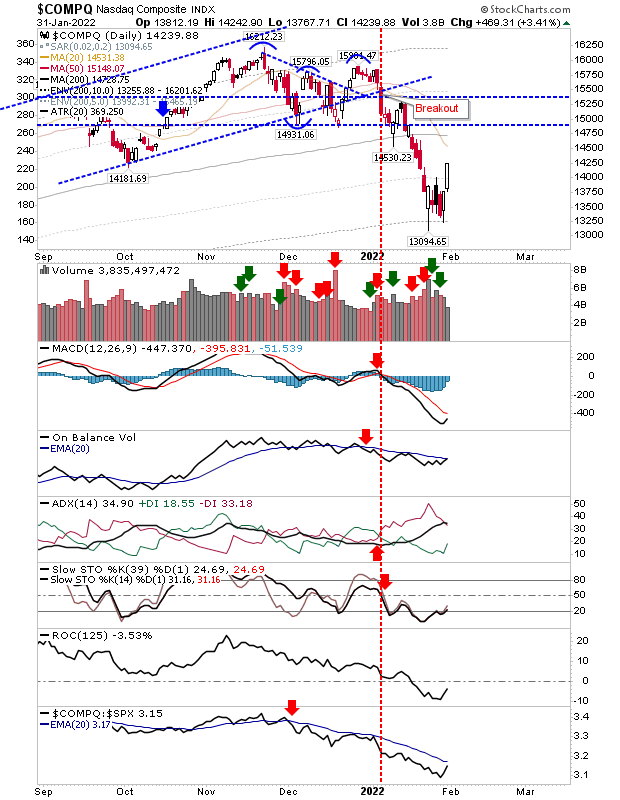

TalkMarkets contributor Declan Fallon opines And So It Begins, Markets Initiate A Rally with comments and charts as follows:

"Buyers stewed over the weekend and started Monday with a period of buying across lead inside. Buying volume was down on yesterday's (and recent buying) and given the Nasdaq gained over 3% it was a little disappointing not to see volume match the large percentage gain, although things were a little better for the S&P. For the Nasdaq, there was no fresh 'buy' signals, although On-Balance-Volume is on the verge of a new trigger."

The S&P edged above the December swing low and a return above its 200-day MA, although it was interesting to see the relative performance dip a little against the Russell 2000.

Regarding the Russell 2000 (IWM) Fallon says:

"While today was a solid start to a swing low we can expect a more neutral candlestick over the coming days. Once this occurs we will want to see indices retain their gains and not drift back into a retest of Friday's lows."

Contributor Michael Kramer notes Stocks Rise For A Second Day On January 31, Ahead Of Turnaround Tuesday but suggests that might be it for the time being.

"The S&P 500 managed to finish the day higher by 1.9%, and the Nasdaq finished the day higher by 3.2% on the Qs. But again, just looking at the charts, it seems like there is a high likelihood the rally has ended, and the ABC retracement pattern off of last Monday’s lows with wave A equal to the length of wave C. There could be another 10 points to go to the S&P 500 cash index, to 4,525, but I think that should be it. We will have to see what happens tomorrow."

SKEW Index

"The SKEW index also fell today, which is odd given that the VIX was down sharply. The takeaway is that the move down in the VIX was related to traders selling their puts positions again as the market went up and not due to traders selling volatility short. It is a sort of important caveat because short volatility sellers always rescued the market in the past."

Kramer noted that both Square (SQ) and Shopify (SHOP) were up on buy the dip action.

Regarding Square: "It seemed like a bottom feeder day, with all of the stocks that have been destroyed rising. Square, for example, rose by almost 11%. Could it increase back to $133, sure the stock is more than oversold enough for that to happen."

And as for Shopify: "Shopify also rose by nearly 11%, and it could just as quickly move back to $1032."

TM contributor Lance Roberts checks if we have hit Market Bottom? Is It In, Or More Downside Coming?

"So, is a bottom in? First, let’s look at the technical backdrop.

Technically Speaking – A Bottom Is In

In this past weekend’s newsletter, I made the case the market has likely made a short-term bottom.

The markets do look to be stabilizing, as shown below, and are holding the October lows. That 100% Fibonacci retracement, and multiple rally attempts, triggered a short-term buy signal. All of this is short-term bullish."

"However, while the technicals suggest a short-term bottom is getting established, we are concerned that may limit any bounce to a 50% to 61.8% Fibonacci retracement of the recent decline. From Friday’s close, such would entail a further rally of roughly 3-4% before the market runs into the broken 50-day moving average...At that juncture, most of the oversold indicators will be back to overbought, and we could potentially see a reversal to retest the recent lows. There are a couple of reasons we suspect such will be the case:

- There are a lot of “trapped longs” that will look to “sell” into the rally.

- A reversal of the previous tailwinds from earnings and economic growth, to tighter monetary policy, liquidity and inflation."

As usual, Roberts' article is full of historical references, and he devotes time to both the outlook for the dollar and its impact on stocks, as well as what may lie in store for the Fed. But the below advisory is worthy of note as well:

"With the markets extremely overbought, as shown below, such suggests that we could well be in the midst of a more significant correctional process. If such is the case, then we could be seeing a shift in market dynamics from “buying dips” to “selling rallies.”

As we have noted previously, there are more than just a few headwinds facing us in 2022.

- The Fed is reversing liquidity and tightening monetary policy.

- The fiscal policy supports no longer exist.

- Current inflation is impacting consumption

- Economic growth is slowing dramatically (Atlanta Fed GDP Now at 0.1% for Q1)

- Earnings growth will slow.

- Profit margins remain under pressure from higher input costs and wages.

- Valuations remain elevated

These challenges could lead to a more challenging investment dynamic this year.

But the Fed is likely the catalyst to the next correction."

Image: Bigstock

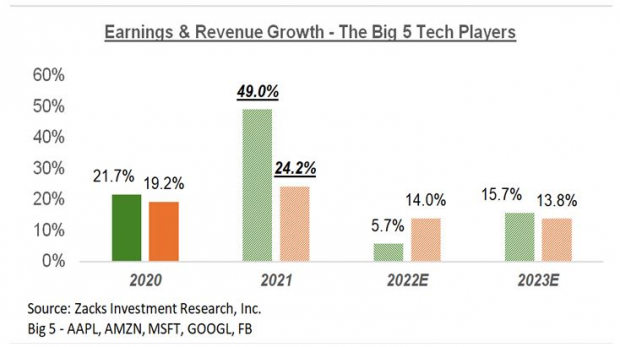

In a TalkMarkets Editor's Choice article entitled The Outlook For Tech Stocks In A Rising Rate Environment, contributor Sheraz Mian runs through the numbers and charts for the tech sector. The bottom line is that things look good, but not as good as 2021. Here is a short excerpt, for more, consult the full article.

"Microsoft, Alphabet, and Facebook aren’t as vulnerable to logistical bottlenecks as Apple and Amazon are, but they all have to pay up for those brainy engineers. The chart below that shows the group’s earnings and revenue growth on an annual basis.

Image Source: Zacks Investment Research

Look at the chart and note the growth trend from 2022 to 2023. In other words, whether the growth trend for these companies is decelerating or not is a function of your holding horizon. These companies are impressive growth engines in the long run."

In the "Where To Invest" Department today's column highlights two profiles, one in the Food and Agriculture sector and a second in Pharmaceuticals.

Contributor Jim Van Meerten takes note that ADM Hits All Time High.

"The Chart of the Day belongs to the agricultural commodities company Archer-Daniels-Midland (ADM). We are in the midst of a bull market in agricultural commodities and ADM is one of the largest players...Archer-Daniels-Midland Company procures, transports, stores, processes, and merchandises agricultural commodities, products, and ingredients in the United States and internationally...

Barchart Technical Indicators:

- 100% technical buy signals

- 41.55+ Weighted Alpha

- 49.19% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 12 new highs and up 10.39% in the last year

- Technical support level at 74.63

- Recently traded at 75.01 with a 50 day moving average of 67.19

Fundamental Factors:

- Market Cap $42.48 billion

- P/E 14.30

- Dividend yield 1.95%

- Revenue is expected to grow 1.00% this year and another 1.90% next year

- Earnings are estimated to increase 1.20% next year and continue to compound at an annual rate of 6.60% for the next 5 years

Analysts and Investor sentiment -- I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts issued 7 strong buy, 2 buy and 6 hold and 1 underperform opinions on the stock

- Some analysts have a price target as high as 80.00

- The individual investors following the stock on Motley Fool voted 1,856 to 136 for the stock to beat the market with the more experienced investors voting 253 to 22 for the same result

- 47,780 investors are monitoring the stock on Seeking Alpha

- Seeking Alpha gives the stock a Quant rating of 3.48 hold"

See Van Meertens' full column for additional details.

Contributor Bob Ciura in his column Dividend Kings In Focus: AbbVie examines (ABBV).

"AbbVie focuses on one main business segment—pharmaceuticals. It focuses on a few key treatment areas, including immunology, hematologic oncology, neuroscience, and more...AbbVie is coming off a multi-year period of excellent growth, thanks to the massive success of its flagship product Humira. There are questions regarding the company’s future growth due to increasing competition facing its flagship product Humira...AbbVie is expected to generate adjusted EPS of $12.65 for 2021, at the midpoint of guidance. At this EPS level, the stock is currently trading for a price-to-earnings ratio of just 10.8. Our fair value estimate for AbbVie is a price-to-earnings ratio of 10.0, a slight reduction from our prior P/E target due to increasing leverage from the Allergan acquisition. We view AbbVie as just slightly overvalued. A declining P/E multiple could reduce shareholder returns by approximately 1.5% per year over the next 5 years. In addition, we expect annual earnings growth of 3% through 2026. Lastly, the stock has a current dividend yield of 4.1%. In total, we expect annual returns of 5.6% per year over the next five years, making AbbVie stock a hold."

The above is heavily abbreviated. Please consult the full article for detailed charts and information about AbbieVie.

As always, caveat emptor.

I'll be back on Thursday.

Have a good week.