Tuesday Talk: War And Bounce

Despite continued concerns surrounding the ongoing war in Ukraine, stocks bounded higher in late session trading on Monday. One of yesterday's leaders was Tesla, which jumped 8% on positive reaction to a possible stock split.

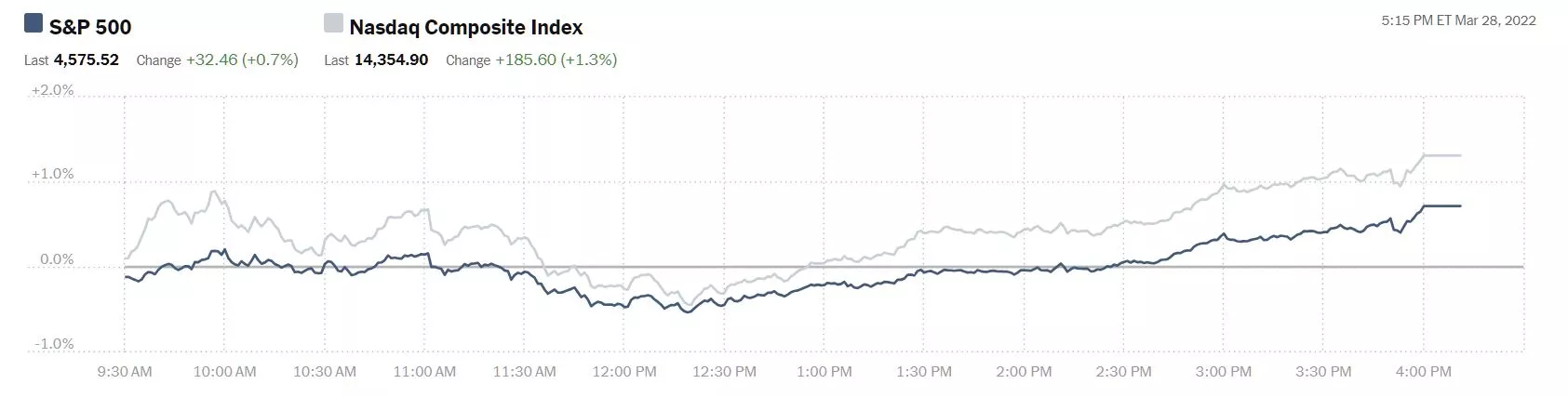

The S&P 500 closed at 4,576, up 33 points, the Dow closed at 34,956 up 95 points and the Nasdaq Composite closed at 14,355, up 186 points, yesterday's clear winner, as can be seen in the chart below.

Chart: The New York Times

Top gainers led by Tesla (TSLA) were across sectors.

Chart: The New York Times

In early morning trading stock futures are moving higher with S&P 500 futures trading up 11 points, Dow futures trading up 85 points and Nasdaq 100 futures trading up 25 points.

Energy and economics contributor Gail Tverberg writes in a TalkMarkets Editor's Choice column that No One Will Win In The Russia-Ukraine Conflict. Concerned that demand for dwindling natural resources will be the cause for continuing and future conflict, Tverberg looks at the devastation in Ukraine as an accelerator in a downward spiral with serious consequences for the world economy.

"In my view, we are basically dealing with a no-win situation. No matter what the outcome, the world economy will be worse off after the fighting stops. The problem the world economy is up against is the depletion of many kinds of resources simultaneously."

"In a world with inadequate resources relative to population, conflicts are likely to become increasingly common. The Russia-Ukraine conflict is one example of a resource-associated conflict. The allies underlying the NATO organization have chosen to escalate the Russia-Ukraine conflict, in part, because the existence of the conflict helps to hide resource shortages and accompanying high prices that are already taking place. No matter how the war is stopped, the underlying resource shortage issue will continue to exist. Therefore, the conflict cannot end well."

"The big depletion issue is affordability of end products made with high-priced resources. The cost of extraction rises, but the ability of the world’s citizens to pay for end products made using these high-cost resources doesn’t rise. Commodity prices do not rise enough to cover the rising cost of extraction. When this affordability limit is hit, it is the resource extracting countries, such as Russia, that find themselves in a terrible situation with respect to the financial well-being of their populations...As a result, commodity exporters, such as Russia, are caught in a bind: They cannot raise prices enough to make new investments profitable."

"We are likely facing a collapsing world economy because of the limits being reached. Adding sanctions against Russia will further push the world economy in the direction of collapse...We have become used to efficient air travel, but sanctions against Russia make this less possible, especially for flights to Southeast Asia. A Bloomberg article called Siberian detour requires airlines to retrace cold war era routes gives the example of direct flights from Finland to Southeast Asia being canceled because they have become too expensive and are too time-consuming with the required detours."

There is more of this in Tverberg's in depth column. As promised in the title, she does not close on an upnote.

"A major issue is the huge amount of debt most countries of the world have. With a rapidly slowing world economy, repaying debt with interest will become impossible. Debt defaults will further wreak havoc with the world economic system.

We don’t know the exact timing of how this will play out, but the situation does not look good."

TM contributor Stefan Gleason examines some ways sanctions against Russia are affecting currency and precious metals markets in his article Currency Wars Center On Russia’s Gold.

"...the Biden administration is attempting to prevent Russia from using gold as an alternative medium of exchange...U.S. officials want to prevent Russia from selling gold in order to fund its war machine...Russia declared that “unfriendly” countries must now pay for Russian gas and other products in rubles or in gold – a move that boosted the value of the beleaguered currency."

"“If they want to buy, let them pay either in hard currency, and this is gold for us, or pay as it is convenient for us, this is the national currency [Russian rubles],” said Pavel Zavalny, chairman of the Russian Duma Committee on Energy. Zavalny is also urging China to de-dollarize and switch to settlements in gold, rubles, or yuan. China, India, and the Far East are pivotal players in the global currency wars. If they opt-out of the increasingly expansive U.S. sanctions regime, a new bipolar monetary order could emerge."

"The petro-dollar is now at risk of losing its hegemony. While the U.S. has historically been able to use its financial and military might to keep Middle Eastern countries in line, it may be overplaying its hand in trying to force the entire world to shun Russia. As with waging any war, however, justified it may be, there will be blowback. The overt weaponization of the financial system against Russia will result in counterattacks directed at the Federal Reserve Note."

Behind this is advocacy for holding gold, which has been coming down off its highs of late.

Many TalkMarkets contributors have been writing about the right combination of investments to best weather the current storm. Contributor Herb Blank takes a look at several ETFs, skewering some and savoring others along the way to finding his current recipe for value in Beware Of BITO And GSG: Which ETFs Are True Stores Of Value During Market Declines?

It's an excellent and thorough piece which I suggest you read, especially for those of you who may be crypto ETF-inclined. Below are a few highlights and Blank's recipe.

"In the short time it has been in existence, nothing about BITO’s price history in general or on days, weeks or months when SPY declines suggest to me that it is a store of value. In the market decline this year, BITO’s return has been worse than the market and all of the other ETFs profiled here that are bought by investors as hedges against equity declines."

"Financial instruments tied to energy instruments have done well during some other stock market downturns such as 1974. However, GSG is extremely volatile and was the worst performer by far among these “stores of value” in both the 2018 and the 2008 downturns. The tremendous weighting toward oil has led some institutions to seek products tied to more evenly weighted commodities futures."

"My counsel would be to consider reducing a 60-40 allocation equity/bonds allocation to 50-30-20 with 20 being allocated to alternatives such as IAUM, GDX, and GUNR. This will mitigate against drawdowns with a digestible opportunity cost when the S&P 500 inevitably emerges from its decline. That said, I would not liquidate my entire allocation to bonds. From a long-term stability perspective, bond allocations continue to serve their purposes."

Reporting in with good news is contributor Jill Mislinski with the March Regional Fed Manufacturing Overview - Monday, March 28.

The five Federal Reserve Regional Districts which publish monthly data on regional manufacturing, ( Dallas, Kansas City, New York, Richmond, and Philadelphia) have come out with their latest report.

Mislinski tells us: "The latest average of the five for March is 14.9, up from the previous month." Good news indeed. See Mislinski's chart below:

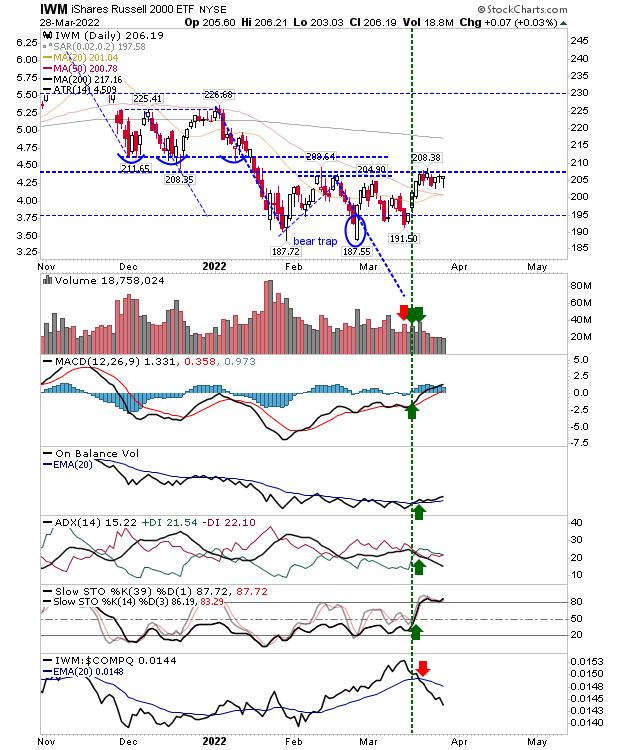

Closing out the column with a bounce TalkMarkets contributor Declan Fallon writes that the Russell 2000 Is Ready To Breakout.

"Another day passes with the Russell 2000 (IWM) primed to breakout. Today saw another small bullish 'hammer' just below resistance even as relative performance against the Nasdaq and S&P continued to plummet. Buying volume was light, so this is an index biding its time until it's again noticed."

"The Nasdaq added just over 1% as the rally off March lows makes its way to its 200-day MA. Relative performance against the S&P also gained ground. Traders are sticking with Tech stocks for now, but the Russell 2000 offers the best value."

Fallon also includes the latest charts for the Nasdaq Composite and S&P 500 in his column.

Caveat Emptor.

I'll be back on Thursday.

Contribute to Ukrainian Relief