Tuesday Talk: The Rough Ride Continues

At the moment there seems to be no respite on the ride down, markets opened the week on Monday, by closing markedly down again. Market futures are still up heading into the open.

The S&P 500 closed below 4,000 on Monday, ending the day at 3,991, down 132 points, the Dow closed at 32,241, down 654 points and the Nasdaq Composite closed at 11,623, down 521 points. Currently S&P market futures are trading up 46 points, Dow market futures are trading up 293 points and Nasdaq 100 market futures are trading up 221 points.

The Staff at TM contributor JustForex writes that The US Stock Market Will Not Recover This Year.

"Credit Suisse last week lowered its forecast for the S&P 500 Index. Goldman Sachs Group Inc., Bank of America Corp., and Morgan Stanley also forecast that the stock market will struggle this year. The Federal Reserve is in the midst of a cycle of aggressive rate hikes that are expected to put pressure on US corporate earnings and economic growth. This is already weakening the support of the stock market, causing stock indices to decline steadily for weeks, while the dollar index shows growth...

High inflation, volatility in stock and commodity markets, and the war in Ukraine have become major risks to the US financial system, the Federal Reserve said in its Financial Stability Report on Monday. ..

Fed spokesman Bostic sees 2-3 interest rate hikes of 50 basis points in future meetings. On Monday, Minneapolis Federal Reserve President Neel Kashkari said that he was confident that inflation would return to normal, but it would take longer...Kashkari noted that the burden of tightening policy would fall on those at the lower end of the wage spectrum, that is, the poor. Financial analysts are already estimating the probability of a 75 basis point interest rate hike at the Fed's upcoming June 14-15 meeting at 79% (yesterday it was 75%)."

No good news to report there.

Contributor Mike Swanson says The Stock Market Decline Is Turning Into A Generalized Sell-Off.

"The price of oil came off its high and the price of gold fell 1.48%. The S&P 500 fell at twice that rate yesterday and the Nasdaq fell over 4% so gold is dipping less than the stock market is, but it is dipping with the markets now. Gold and commodities still remain well above their 200-day moving averages, but the S&P 500 is now below it and those moving averages are now trending down to act as major resistance in a stage four-cycle decline."

Swanson warns in his article that this cycle in the market can pose existential danger for many investors.

"The action is starting to hurt people who got into trading after the March 2020 market meltdown via Robinhood and have no real idea what they are doing. They are now in their anxiety and anger part of the decline. A Robinhood trader went nuts in Oregon and got himself arrested after making threats to harm Robinhood employees and management. He obviously is incapable of taking responsibility for his own decisions and is lashing out in anger and belongs in a rubber room.

But he is an extreme example of what millions are now feeling. This anxiety and anger phase will eventually morph into a mass panic and despondency phase, which will bring panic selling in the markets from small traders and individual investors. We aren’t there yet as they keep trying to buy, but that’s where things are heading and sadly I wouldn’t be surprised if we hear about some Robinhood people actually hurting themselves. It happened with daytraders after the 2000 tech bubble top and in 2008 and will probably happen again.

The problem is there is no sign of a real bottom in the markets that we can point to...

The S&P 500 could fall 20-30% from its highs before this is over. It’s down 16.65% year to date as of Monday’s close while the Nasdaq is down 26.02%.

Gold during that time is up 2.70%. That’s not a massive gain for gold, but it’s a massive outperformance relative to the S&P 500 that is only going to continue going forward.

No one can predict how much the stock market will decline here or when this drop will end, it could decline the way LQD has been doing for a while, but look for gold to fall a fraction of a percent of what the S&P 500 does and then bottom ahead of the stock market and soar like crazy.

Be careful and keep your helmet on. This is a tough time and a tough situation. Bonds are in a bear market.

Inflation is real.

The stock market blew up into a bubble along with crypto, NFTs, and even collectible cards and that bubble peaked months ago. That’s the macro driving this bear market. It’s as simple as that. What is happening is now that complicated."

Breathe deeply and have two cups of cofee.

TalkMarkets contributor Lance Roberts writing in Investor Sentiment Is So Bearish – It’s Bullish gives us a deep dive into investor sentiment. The article is worth a look. Below I have excerpted his attempt at a positive, long view of the current action.

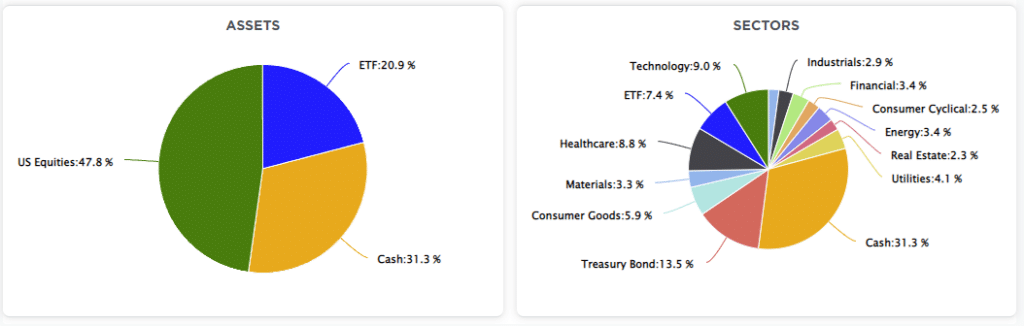

"The next few weeks, and even the next couple of months, will likely be frustrating. Markets are likely to remain rangebound with little progress made for either the bulls or the bears. We are maintaining our exposures to higher-than-normal levels of cash and underweight both equities and bonds.

There is little value in trying to predict market outcomes. The best we can do is recognize the environment for what it is, understand the associated risks, and navigate cautiously.

Leave being “bullish or bearish” to the media."

Contributor Marc Lichtenfeld writes that you should Let Dividend Stocks Protect You From The Bear Market, a topic we have brought to light more than once in recent columns. Here is what he suggests at the moment:

Photo by Thomas Lefebvre on Unsplash

"The market has been brutal in 2022, especially over the past couple of months.

The S&P 500 is down 16%, while the Nasdaq Composite has fared even worse, falling 25%.

But there’s been a place to hide.

Dividend stocks not only have given investors shelter from the raging storm but also have provided a hot meal and a comfortable bed for investors to rest their weary heads...

The iShares Core High Dividend ETF (NYSE: HDV) is up 4% year to date. The top three holdings of this exchange-traded fund (ETF) are Exxon Mobil (NYSE: XOM), Johnson & Johnson (NYSE: JNJ), and Verizon Communications (NYSE: VZ).

The SPDR Portfolio S&P 500 High Dividend ETF (NYSE: SPYD) is also in positive territory, up 2.8%. This ETF lists Seagate Technology (Nasdaq: STX), ConocoPhillips (NYSE: COP), and Iron Mountain (NYSE: IRM) as its top holdings.

And the WisdomTree U.S. High Dividend Fund (NYSE: DHS) has gained 4.6% year to date. Its top three holdings are Philip Morris International (NYSE: PM), Altria Group (NYSE: MO), and AbbVie (NYSE: ABBV)."

Lichtenfeld has a few additional suggestions in his article, as well. He suggests long term investors use the current bear state to pick up strong dividend stocks at low prices. Need to stack that against those warning against no bottom in sight.

Caveat Emptor, as always.

Seems we should say that at least twice in the current environment.

Caveat Emptor.

I'll see you on Thursday.

Support Ukrainian Relief Efforts