Tuesday Talk: Let Us Eat Chocolate

With the rise in economic activity the global supply chain is slowly returning to "normal" in fits and starts. Some commodities are in short supply while inventories of others are flush. Some of this is due to weather and some to shipping. In a word "normal" or almost normal. The stock markets continue to review this return to activity positively, seemingly anxious to begin the much touted "roaring twenties", but concerns about the cost of Biden's infrastructure plan and commodity and money supply induced inflation have been reflected in some minor retreats from index highs.

Monday, the S&P 500 closed up 11.5 points at 4,193, the Dow Jones Industrials closed up 238 points at 34,113, while the Nasdaq Composite closed down 68 points at 13,985. Currently Nasdaq 100 futures are down 293 points at 13,599, Dow futures are down 269 points at 33,844 and S&P futures are down 48 points at 4,144.

TalkMarkets contributor James Roemer writing in a TM exclusive entitled, Why Cocoa Prices May Remain In A Bear Market For A While notes that while world weather conditions maybe causing concern for corn, this is certainly not the case for cocoa.

"Cocoa prices have been hurt by COVID demand worries, but also by a big La Nina type crop that poses little threat of any supply squeeze. This is in contrast to corn, soybeans, and soon-to-be coffee where tighter global stocks and recent weather problems have resulted in price rallies, particularly in grains. "

"As COVID ends and global demand increases cocoa prices could see some occasional buying. However, to garner a major bull market, this will take a supply deficit in 2021. Cocoa has a long history of rallying during an El Nino, as crops can be hurt by dry weather. However, during neutral or La Nina conditions, 70% of the time, cocoa is in a bear market. I expect occasional La Nina conditions to continue preventing any major supply disruption. This is in contrast to coffee where I am watching Brazil weather and some global weather problems."

So no shortage of chocolate on the immediate horizon, who says a bear market can't be sweet?

Other signs of business as usual activity is brought to our attention by Mish Shedlock in his column Epic Games Takes Apple On In Court: Who Will Win And Who Should Win? where we learn that Epic Games, the closely held publisher of the popular game Fortnite is suing Apple (AAPL) for monopolistic selling practices in its' App store.

Shedlock cites Politico as follows, in his column:

"Politico reports the Fight to Dethrone Apple Debuts in a California Courtroom.

Epic Games, the maker of the popular video game Fortnite, has captured the attention of regulators in Washington and Brussels with an antitrust lawsuit that could upend how the iPhone-maker does business. The federal civil trial in Oakland, Calif., focuses on Apple’s control over its App Store — the only way app developers can reach the world’s 1.5 billion iPhone or iPad users."

Shedlock notes that Apple is under investigation for antitrust activity in the E.U. as well. As to Apple's chances in court?

"In the US it's difficult to say. I have no particular insight other than antitrust cases are very difficult to win, and the result, no matter what, will be contested.

The EU nannycrats are more likely than US courts to rule against Apple. The EU would have killed Google (GOOGL), Apple, and Amazon (AMZN) long ago.

Excellent companies thrive in the US and not the EU for that reason. Google which started as a search engine has compelling phone technology, amazing navigation aids, Google Earth, and it led the charge on self-driving cars. The EU would have busted them apart before they even got going...Consumers immensely benefitted from technology by Apple, Google, and Amazon. Anyone who says otherwise is mistaken."

I find myself partially agreeing with Mish, but I am not thrilled that for one reason or another Apple seemingly compels me to buy a new phone every 3 years or so, though I'm currently going on 4 with my Apple 7.

![]()

Bitcoin (BITCOMP) may have crashed and dived momentarily but this week ethereum (ETH-X) is on a tear as Simon Peters explains in Ethereum Soars Through $3,400 To All Time High.

"The price has risen more than 25% so far this month, peaking at $3,423, and is currently trading just below that level at $3,350.

Ethereum has been moving in a sharp upwards trajectory since its latest hardfork as it continues to prove its use-case. The number of DApps (Decentralised Applications) continues to grow on the platform, and there is now growing demand from institutional investors for the ethereum cryptoasset itself.

Meanwhile bitcoin, the largest cryptoasset by market capitalization, continues to tread water somewhat, holding around the $55,000 mark over the weekend."

Peters also notes that banker JP Morgan is offering an actively managed bitcoin fund for private clients and that S&P Dow Jones Indices will begin tracking cryptoassets in 3 new indices.

"The crypto indices, S&P’s first ever, carry ticker symbols SPBTC, SPETH and SPCMC – one for bitcoin, ether and a “MegaCap” combo of the two."

Ironman reports on the latest United States median income figures for the month of March which have just been released, Median Household Income In March 2021.

"(The) initial estimate of median household income in March 2021 is $66,248, an increase of $244 (or 0.4%) from the initial estimate of $66,004 for February 2021. As expected, this change coincides with the lifting of coronavirus lockdowns imposed by several state and local governments in December 2020."

While this is ostensibly more good news, Ironman notes that inflation is outpacing rise in median income.

"With inflation rising faster than the median household income in the U.S., the typical American household has been losing purchasing power during the first three months of 2021."

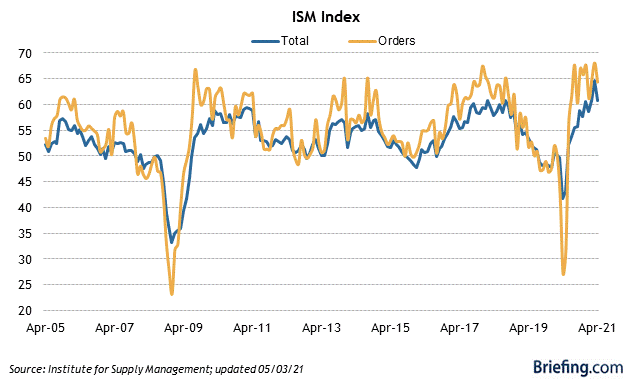

TalkMarks contributor New Deal Democrat closes out our column this week with a look at the heat in the manufacturing and construction sectors. Writing in ISM Manufacturing, Construction Spending Show Modest Declines, But The Boom Is Still Ongoing he finds the following:

"Manufacturing has been running not just red hot, but white-hot in the past few months. Although it pulled back a little in April, it is still in the range of historic highs."

"The leading new orders index is just below 65, which is slightly below its best levels of the past year, but above every other level but 5 months in every other year going back to 2005. The manufacturing Boom is still ongoing."

With regard to construction New Deal Democrat notes that, "When we deflate by the cost of construction materials, (construction) spending has actually declined since the beginning of the year", however "It is still running hot compared with the last 10 years."

Though many hard working Americans are still looking for work, the economic recovery news continues to be good. Let's hope that the digital drivers of the economy (who look to keep profits abroad and avoid paying taxes) and the opponents of Biden's infrastructure initiatives (no I am not saying it is without potential pork barrels) sit up and take notice and remember that as Charles Wilson famously said in his Senate confirmation hearing to become Eisenhower's Secretary of Defense "because for years I thought what was good for our country was good for General Motors, and vice versa", meaning that getting the country back in good shape is good for business, too.

Have a good week.