T&T Capital Management Q1 Review

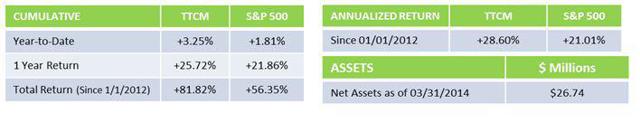

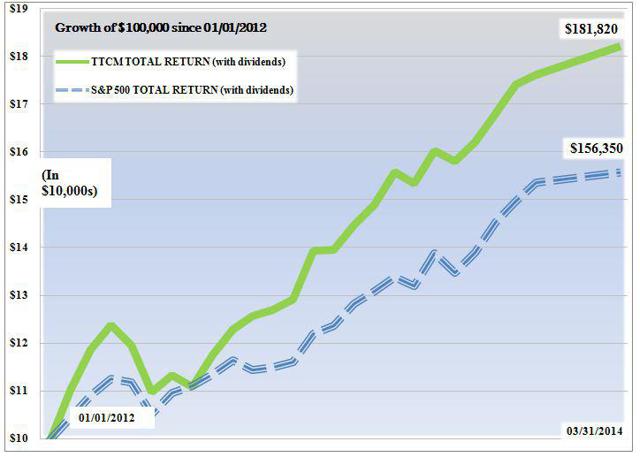

I’m pleased to report a strong 1st quarter start for T&T Capital Management (OTCPK:TTCM), with total account gains of 3.25% in the quarter, versus 1.81% for the S&P 500. Cumulatively from January 1, 2012, TTCM is now up 81.82% versus 55.57% for the S&P 500. It is very important to not pay too much attention to the performance of any one quarter, or any one year. We take a much longer-term perspective in our investments; the value of our investment proposition will only be adequately seen in a five year time horizon, which allows for a variety of market cycles. It is important to highlight this when our performance is significantly better than the market, to build the proper expectations that there will assuredly be periods of underperformance in the future.

The key is buying securities of businesses that we know and understand, at deep discounts to their intrinsic value. We have little control over the timing of when the undervaluation will correct itself; by only buying securities that have a large margin of safety, we believe we are positioning ourselves to maximize growth at the least risk possible. At TTCM, we concern ourselves most with the risk of permanent losses of capital, as opposed to volatility risk, which we make far less effort to minimize because it is generally counterproductive to long-term investment returns to try and reduce it. We utilize strategies such as cash-secured puts and covered calls to generate income and reduce the risk in the portfolio. These options have been very profitable thus far in 2014 and because many are long-term in nature, we should benefit as time continues to elapse. Investors should take comfort that unlike being only long stock, by selling the cash-secured puts, we can often generate attractive returns even in a flat to slightly down market.

Many of our best gainers in the quarter were stocks that we have owned for years now. Some examples are Teva (NYSE:TEVA), Devon Energy (NYSE:DVN), Assured Guaranty (NYSE:AGO), and AIG (NYSE:AIG). Even the hated Sears Holdings (SHLD) has performed quite well and we still believe the company offers the cheapest way to play real estate in the United States. Teva Pharmaceuticals rallied as consolidation in the generic drug industry at record valuations has finally cast a light on the dirt cheap price that Teva, the market leader, has been trading at. We bought the stock at around 7 times earnings and free cash flow, when many of its peers traded over 20 times. Teva has had a variety of manufacturing problems and boardroom changes that have reduced investors’ confidence in the company. Also, the company’s blockbuster drug Copaxone is likely to be coming off patent this year, which will likely cause a significant reduction in profitability. These problems have masked Teva’s leading businesses in generic drug manufacturing and biosimilars, which ultimately should help restock the pipeline to make up for the loss of Copaxone. It has been our belief that Teva is likely to engage in a merger of equals at some point with a company like Valeant Pharmaceuticals (VRX), which has benefited from superior management and capital allocation to become a leader in the space from very modest beginnings.

Old technology names such as Microsoft (NASDAQ:MSFT) and Hewlett-Packard (NYSE:HPQ) have performed quite well for us. These were companies that we bought at single-digit multiples of earnings and free cash flow adjusted for their net cash positions, when the news was filled with stories of the death of the PC. Meg Whitman has done a wonderful job rebuilding the balance sheet of HPQ and reducing the revenue declines in many of its core businesses. Microsoft has benefitted from the retirement of Steve Ballmer and the hiring of Satya Nadella, who is already making long overdue moves such as offering Microsoft Office for Apple (NASDAQ:AAPL) computers and tablets. Financials have performed reasonably well but are still without a doubt the most attractive area in the market. We are well-positioned to benefit from them as margins improve and for when the yield curve gets more favorable. Much ado has been made by the Federal Reserve’s rejection of Citigroup’s (NYSE:C) capital allocation plans, due to supposed concerns about how the bank was calculating its figures, as opposed to concerns about the bank not having enough capital to withstand a record recession and still buy back stock and increase the dividend. While I find it frustrating that Citigroup is still struggling with regulators, I don’t view this as being that significant of an event in determining the long-term intrinsic value of the company, which I believe is well in excess of $65 per share. We have taken profits on various investments and reallocated towards our most attractive names in the financial and energy industry, most of which trade at deep discounts to our appraisal of liquidation values, let alone intrinsic values.

The first quarter of 2014 can best be described as choppy, which shouldn’t be too surprising after the explosive gains that we have seen over the last two years. As of April 2nd, the 10-year Treasury rate was 2.82%; interest rates continue to be kept artificially low in an attempt to bolster economic growth. The trailing twelve month P/E ratio for the S&P 500 is about 17.69, while the Russell 2000 trades at some of the most expensive levels since the Tech Bubble in the late 1990s. It seems quite obvious that there will be significant carnage when the day of reckoning comes for some of these glamour Cloud, social media and biotech stocks.

The Shiller P/E, which adjusts for inflation, is 25.8, which is 56.4% higher than the historical average. The current price to book value ratio of the S&P 500 is 2.78. This is extremely notable because six of our eight largest investments actually trade at discounts to book value and our two largest investments trade at discounts to tangible book value. This, in addition to our utilization of cash-secured puts to manufacture cheaper entry prices and to generate income, should give us a high level of divergence from the performance of the overall index over time. This will be beneficial because I believe a long stock or bond only portfolio is unlikely to do better than 3-4% a year over the next decade. We can still thrive in that type of environment, but volatility is to be expected as we make no attempt to outperform every quarter in our long-term investment approach.

Weather has been one of the dominant themes in 2014, as a historically cold winter has undeniably slowed down the economic growth of the United States. There is an excellent chance that things should pick up as the year progresses, but I believe the economic forecasts were overly optimistic going into the year. Like just about any time, there are significant risks that linger in the periphery. Chinese growth is slowing and the government is having to resort to stimulus once again, which has tended to direct capital towards unproductive uses in many instances, setting the stage for future problems. Europe over the short-term is facing substantial threats of deflation, which the ECB might very well have to fight with its own aggressive quantitative easing program. Russia has once again burst onto the scene as the primary threat to global stability, with its invasion and annexation of Crimea.

With all of this said, it is important to not let fear run your investment portfolio as there is always bad news. The key to successful investing is focusing on the things that you can control and always demanding a large margin of safety before making any investment.

Disclosure: I am long TEVA, AGO, AIG, SHLD, DVN, MSFT, HPQ, and C. I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is ...

more