Under The Spotlight: Canadian National Railway

Canadian National Railway is a true backbone of the economy transporting more than C$250 billion worth of goods annually for a wide range of business sectors, ranging from resource products to manufactured products to consumer goods, across a rail network of approximately 20,000 route-miles spanning Canada and mid-America. Canadian National Railway Company, along with its operating railway subsidiaries, serves major cities and ports in Canada along with mid-western cities and ports in the United States with connections to all points in North America.

INDUSTRY LEADER

Celebrating its 100th anniversary in 2019, Canadian National Railway (CNI) has evolved from a collection of various railways into a major transportation and logistics company with a network that reaches from the Pacific to the Atlantic to the Gulf of Mexico. Since de-regulation of the rail industry—first in the United States in 1980 and later in Canada in 1987 and 1996—the overall rail industry has embarked on a transformational journey with CNI becoming an industry leader in North America. Once a largely Canada-only enterprise, CNI’s operations today transport freight traffic over an approximately 20,000 mile rail network that handles more than C$250 billion of goods annually with over 25,000 employees.

Operating the largest rail network in Canada and the only transcontinental network in North America, the company serves close to 75% of the period, the company has invested nearly $14 billion in capital expenditures to expand their network and build for the future. U.S. population and all major Canadian markets. CNI carries more than 300 million tons of cargo for exporters, importers, retailers, farmers and manufacturers. CNI’s freight revenues are derived from seven commodity groups representing a diversified and balanced portfolio of goods transported between a wide range of origins and destinations. This product and geographic diversity better positions the company to face economic fluctuations and enhances its potential for growth opportunities.

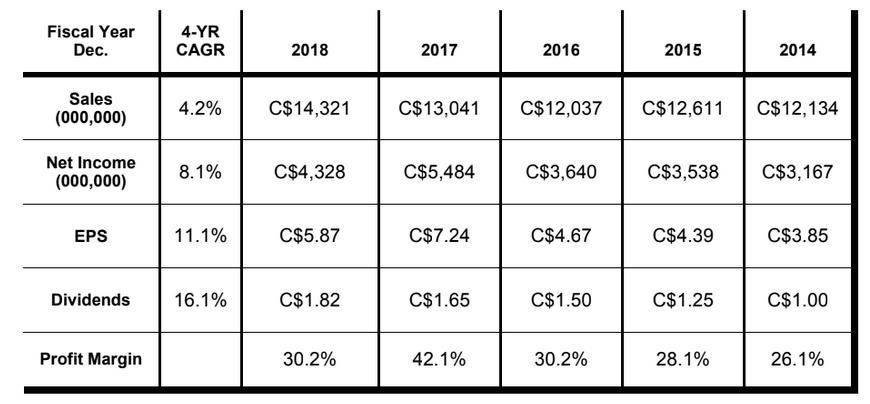

CNI is committed to long-term shareholder value creation through strong financial performance, dividend payments and share repurchases. The railroad is loaded with strong free cash flows, which have totaled more than $12 billion over the last five years. CNI has boosted its dividend for 23 straight years with the dividend compounding at a 16% annual growth rate since 1995. In addition, Canadian National Railway has repurchased C$9 billion of its common stock over the last five years. Canadian National Railway leads the North American rail industry in terms of efficiency and operating margins. Scheduled Railroading and Supply Chain Collaboration Agreements with ports, terminal operators and customers helps Canadian National Railway drive efficiencies across the entire supply chain.

PROFITABLE OPERATIONS

With a business model focused on cost efficiency and asset utilization, CNI generates highly profitable operations. Net profit margins have approximated 26% or better over the last five years. Over the same time period, the company has invested nearly $14 billion in capital expenditures to expand their network and build for the future.

CNI is committed to long-term shareholder value creation through strong financial performance, dividend payments and share repurchases. The railroad is loaded with strong free cash flows, which have totaled more than $12 billion over the last five years. CNI has boosted its dividend for 23 straight years with the dividend compounding at a 16% annual growth rate since 1995. In addition, Canadian National Railway has repurchased C$9 billion of its common stock over the last five years.

THIRD QUARTER RESULTS

Despite a softening economy, Canadian National Railway reported third quarter revenues chugged ahead 4% to C$3.8 billion with net income up 5% to C$1.2 billion and EPS up 8% to C$1.66. Excluding gains from asset sales in 2018, adjusted net income increased 8% and EPS increased nearly 11%.

During the quarter, the company generated C$700 million in free cash flow, up 20% from last year, due to working capital efficiencies and lower capital expenditures as track capacity projects near completion. During the first nine months of 2019, CNI generated nearly C$1.5 billion in free cash flow with the company returning more than C$2.4 billion to investors through share repurchases and dividends. For 2019, management expects growth across a range of commodities, particularly in Canadian coal exports, refined petroleum products and natural gas liquids, Canadian grain and petroleum crude. The company also expects lower volumes of U.S. coal exports, forest products, potash and frac sand compared to 2018 and now expects inter-modal traffic volumes to be lower than 2018. Management expects full year 2019 EPS growth in the high single-digit range.

Long-term investors should hop aboard Canadian National Railway, a high-quality industry leader generating solid growth and profitable operations while also rewarding shareholders with growing dividends and share buybacks. Buy.