Trade Turmoil Sparks Worst Week Of 2019, Wipes Over $2 Trillion Off Global Stocks

A couple of tweets, and just like that $2.5 trillion of global equity market cap evaporates...

(Click on image to enlarge)

As stocks went from 'everything is awesome' to the worst week of the year in an instant...

With global money supply failing to support the illusion...

(Click on image to enlarge)

As stocks began to catch down to the far less exuberant global systemically important banks...

(Click on image to enlarge)

***

China's National Team refused to let stocks fall overnight (following the tariffs) and obviously lifted the market dramatically. However, it was still the worst week of the year...

(Click on image to enlarge)

An ugly week in Europe too with France and Italy worst...

(Click on image to enlarge)

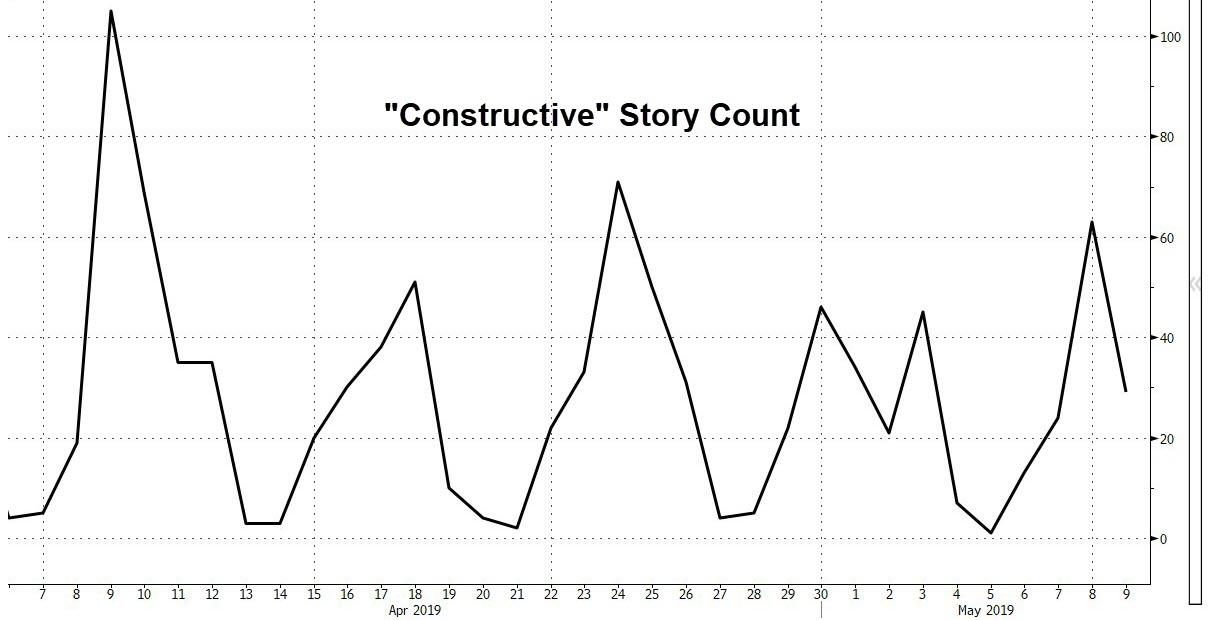

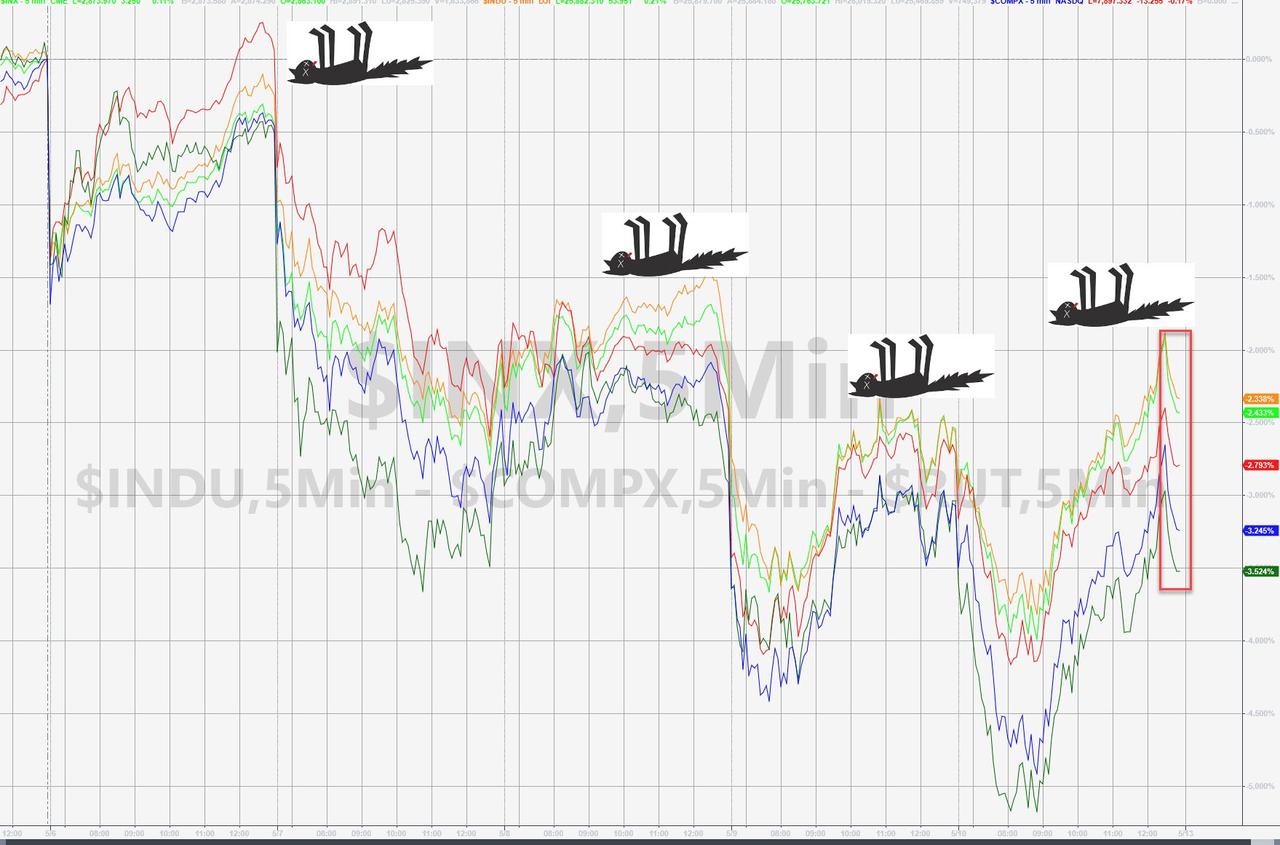

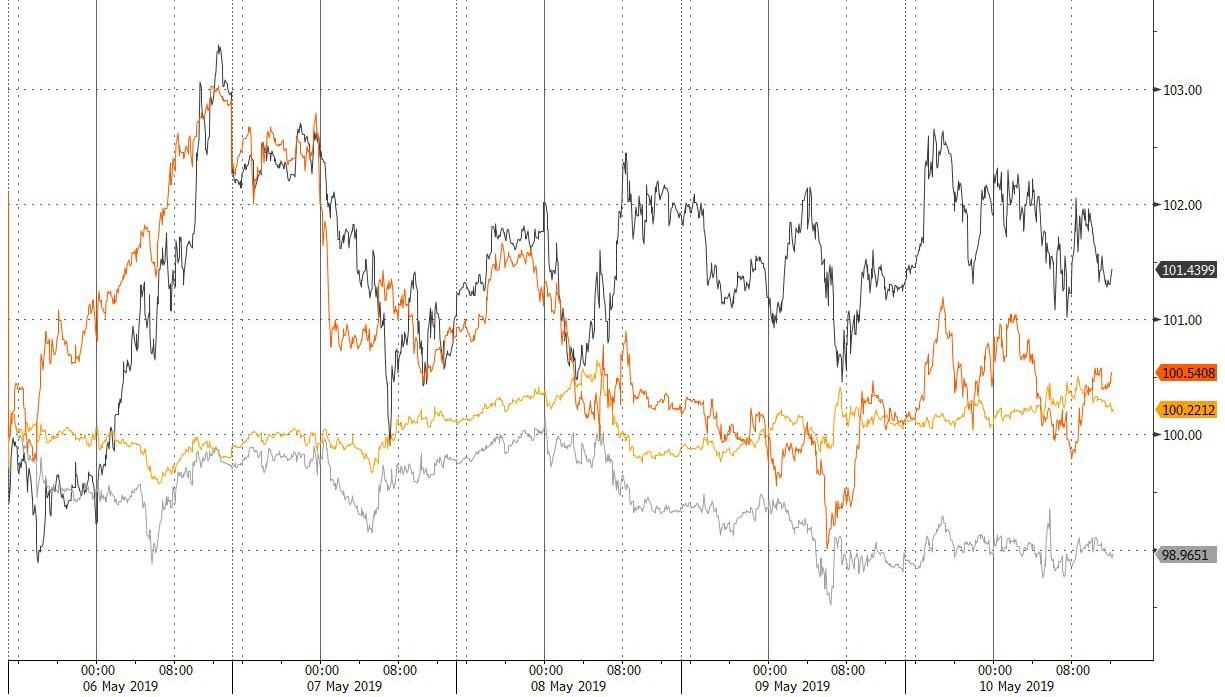

The week in US equity markets has been dominated by algos chasing headlines about trade talks with dead cat bounces giving way to reality checks...

(Click on image to enlarge)

NOTE - today's "constructive" talks headline prompted the 4th biggest buy program of the month (PPT?).

(Click on image to enlarge)

It seems it took the algos a long time to actually read He's and Mnuchin's comments:

- Liu He: "No talks are scheduled from here"

- Steve Mnuchin: "No future talks planned as of now"

But when they did, stocks rolled over...

(Click on image to enlarge)

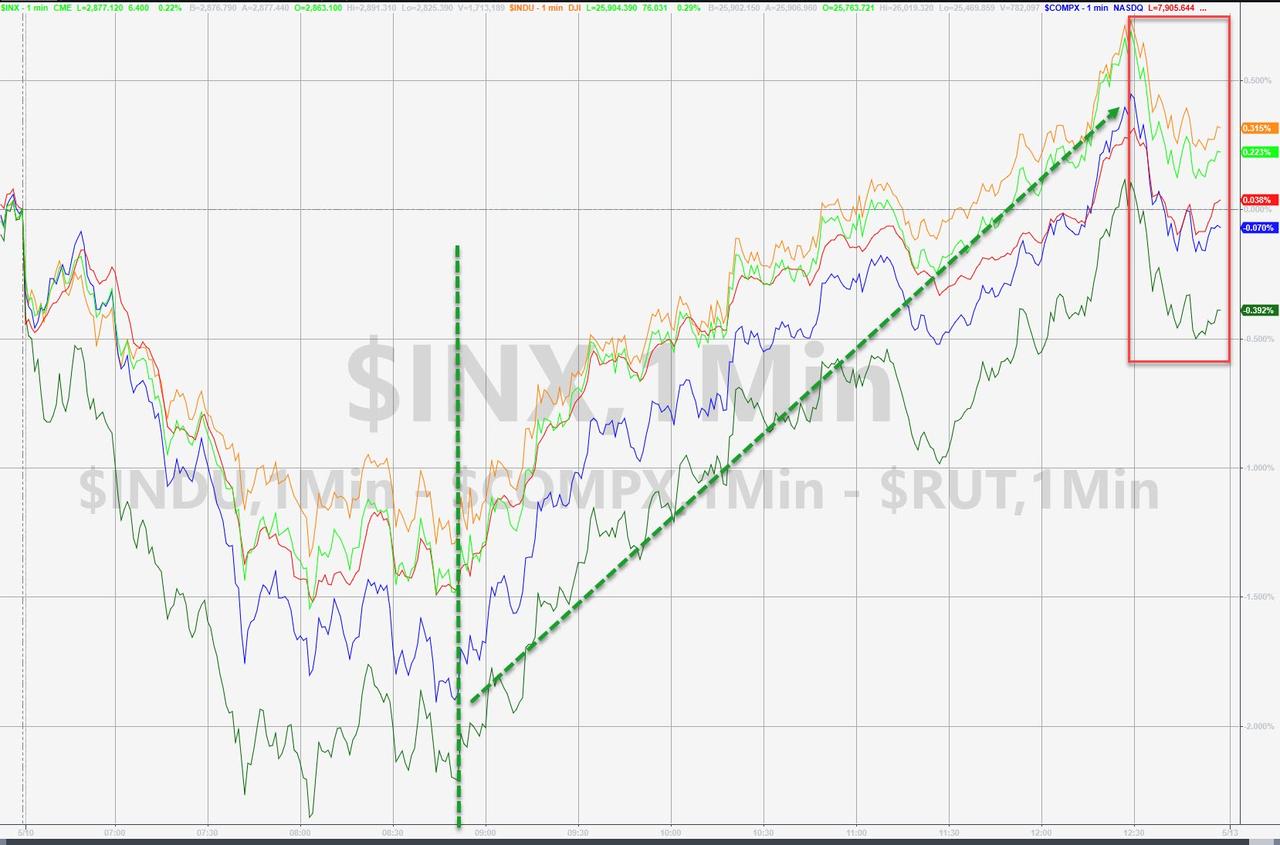

Smells like PPT turned up after Mnuchin's comments as VIX flash-crashed (signaled) at 0830ET today then fell after Mnuchin's comments...

(Click on image to enlarge)

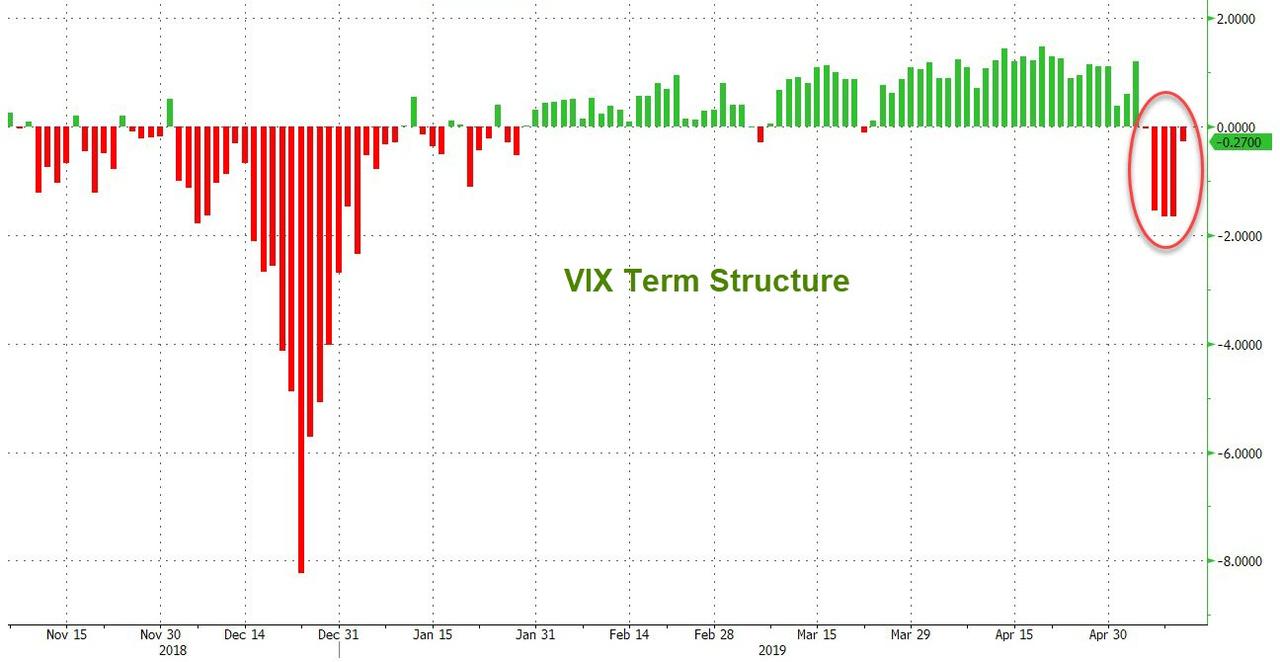

VIX has been inverted all 5 days this week...

(Click on image to enlarge)

Prompting a huge short-squeeze lift. just like on Monday (fail) and Thursday (fail)...

(Click on image to enlarge)

This is the seventh Friday in a row where a sudden panic bid lifted stocks...

(Click on image to enlarge)

The Dow ended below its 50DMA for the 3rd day in a row but the rest of the majors scrambled back above the key technical level...DMA

And then of course, there's UBER...

(Click on image to enlarge)

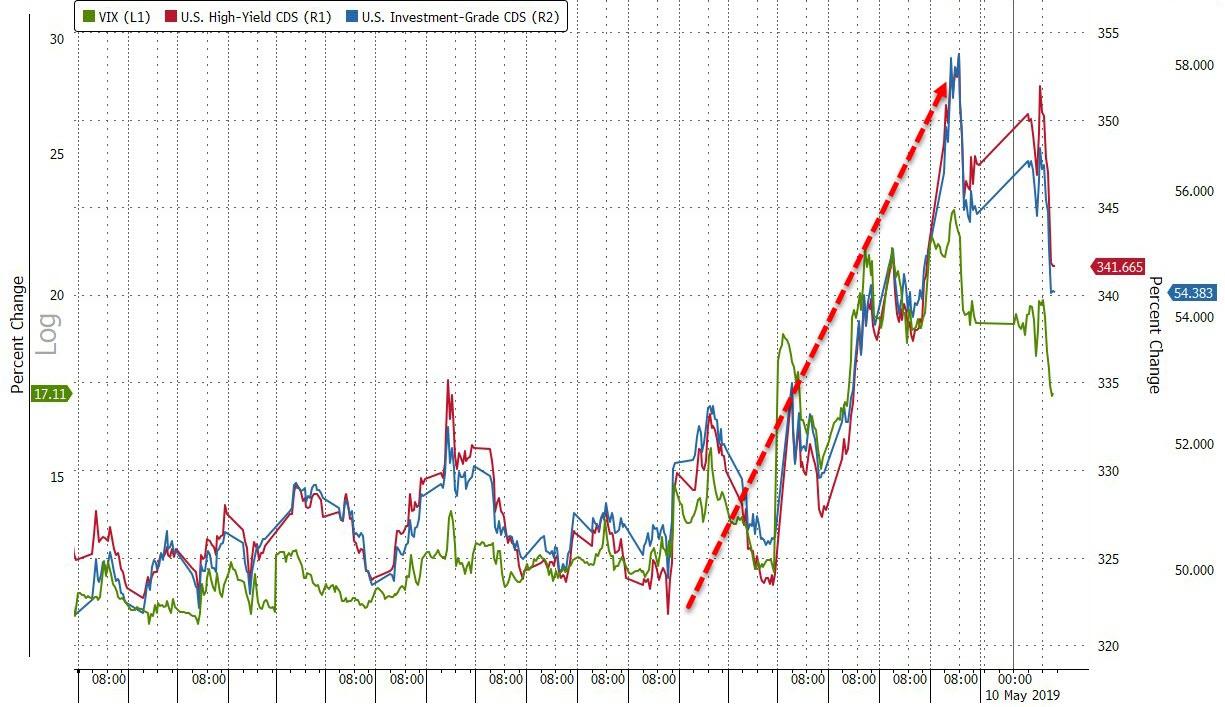

Second worst week of the year for credit markets...

(Click on image to enlarge)

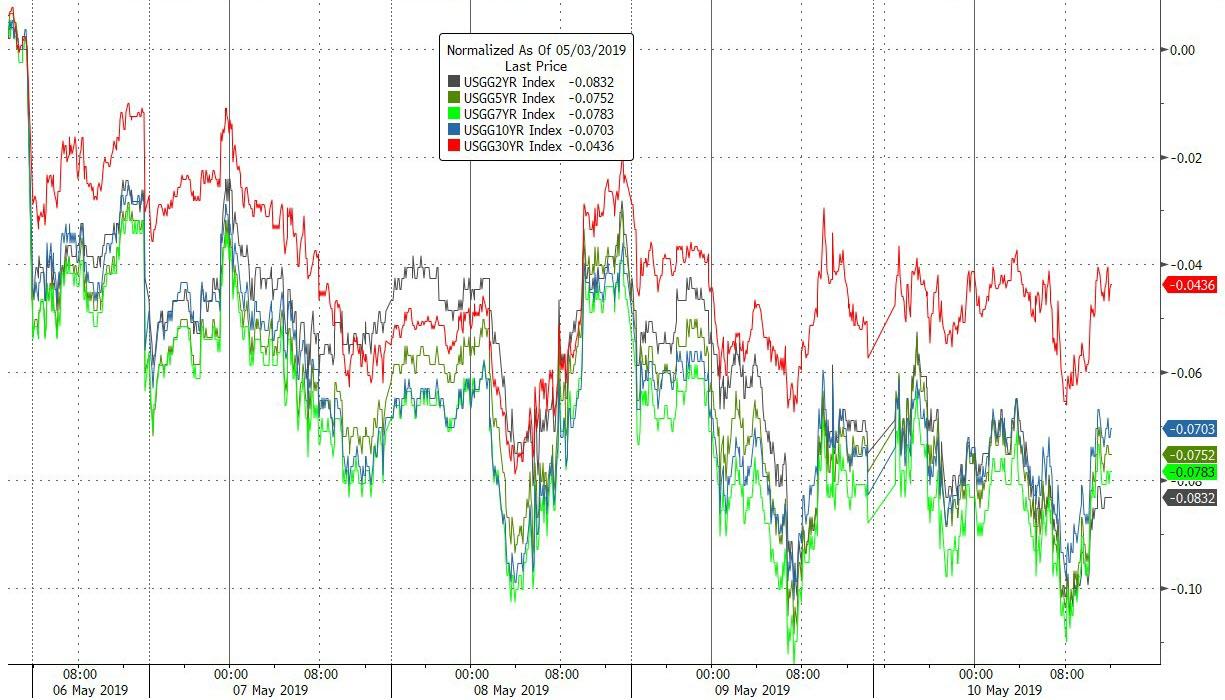

Treasury yields fell across the curve this week but the long-end notably underperformed...

(Click on image to enlarge)

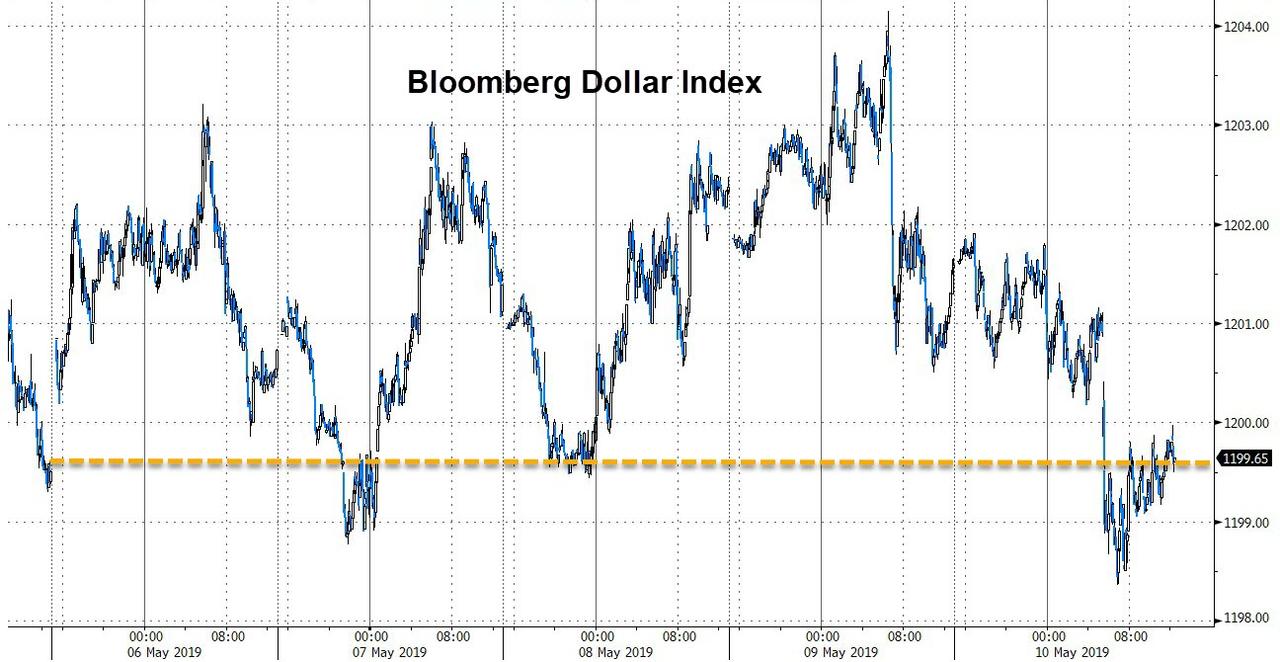

The Dollar ended the week unchanged...

(Click on image to enlarge)

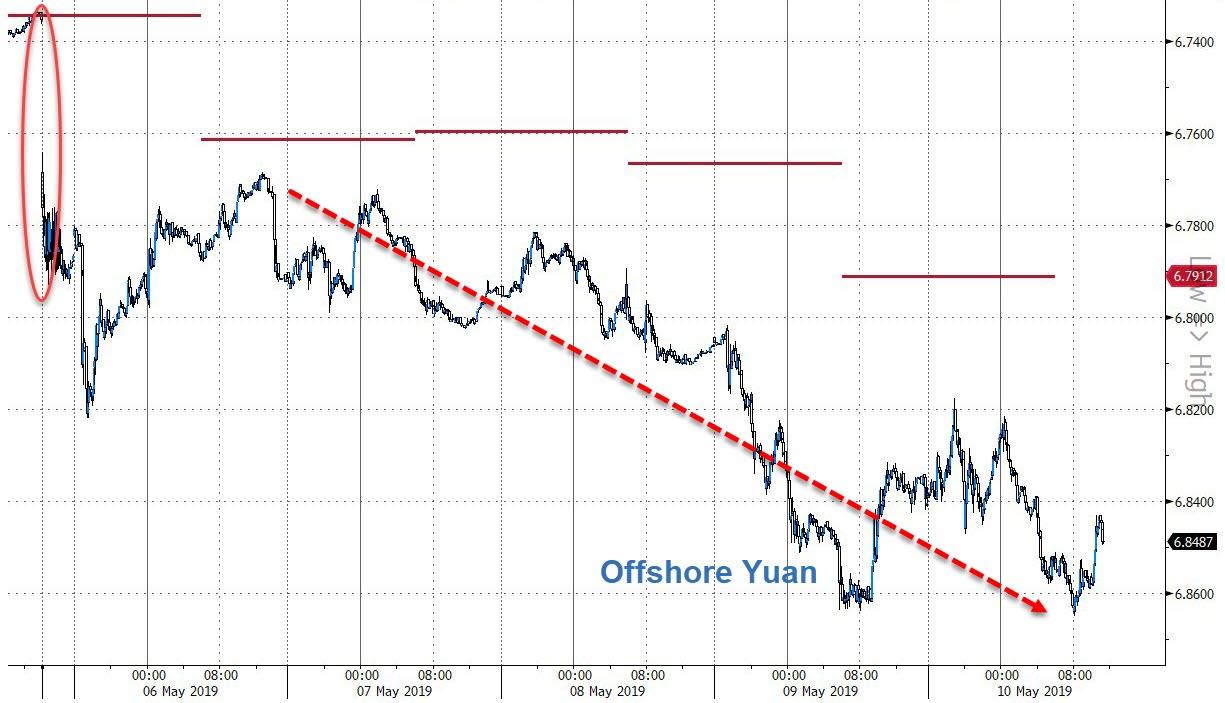

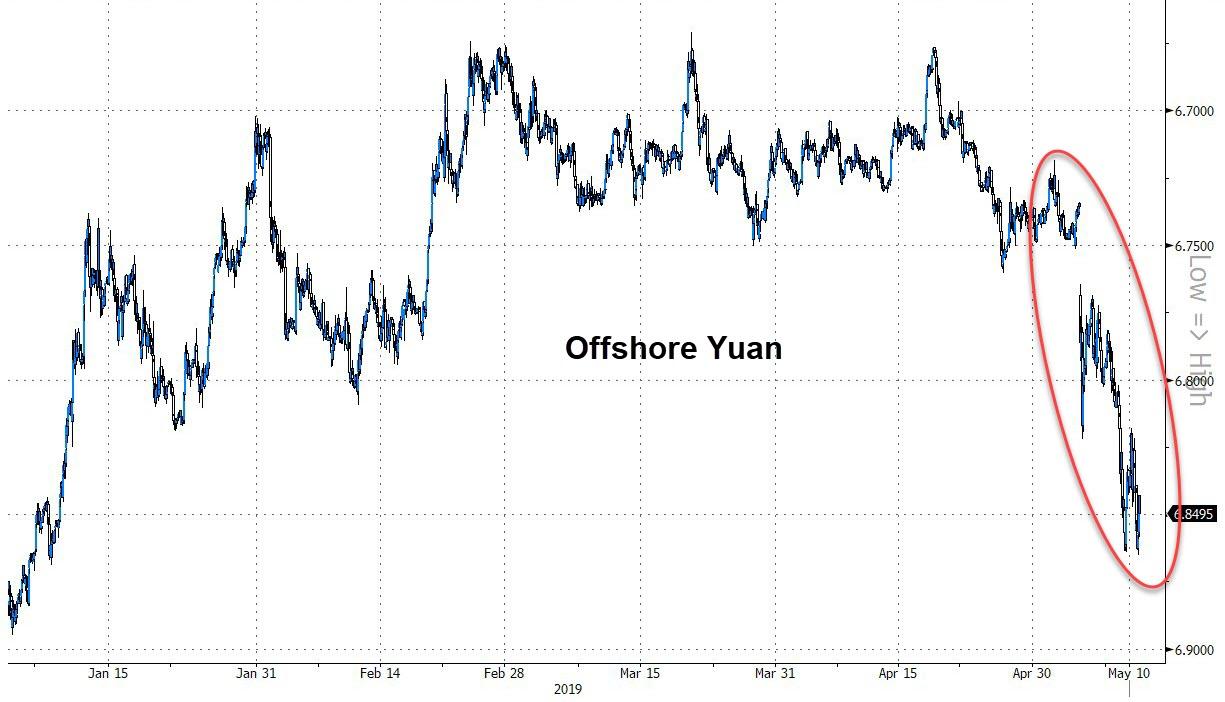

Yuan fell all week...biggest weekly drop in yuan against the dollar since June 2018

(Click on image to enlarge)

Yuan tumbled to 4-month lows...

(Click on image to enlarge)

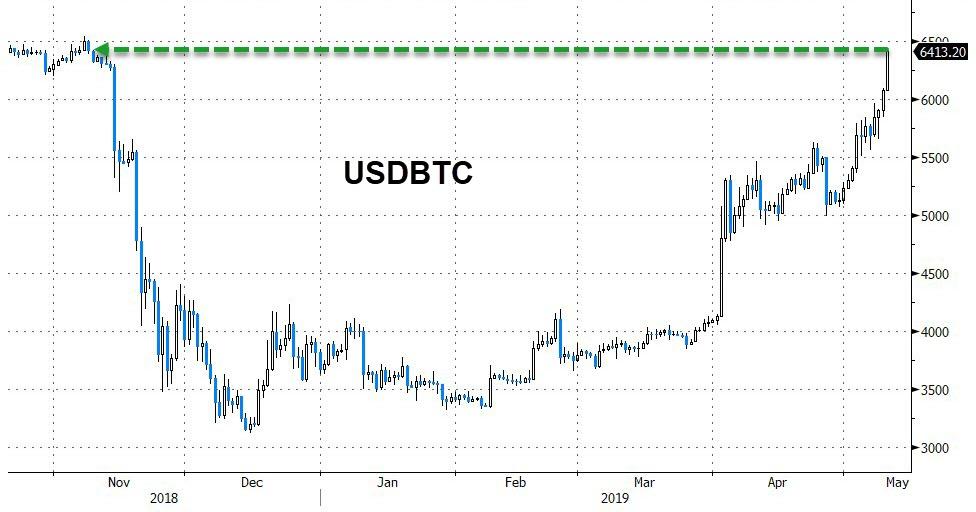

Bitcoin soared on the week, along with Ethereum...

(Click on image to enlarge)

Bitcoin rallied above $6400 as trade tensions escalate...

(Click on image to enlarge)

Despite the dollar's flat week, silver slumped and crude managed gains...

(Click on image to enlarge)

And finally, it appears "constructive" is the new 'put'...

(Click on image to enlarge)