Top Names Update

Picjumbo/Pexels

Performance Update

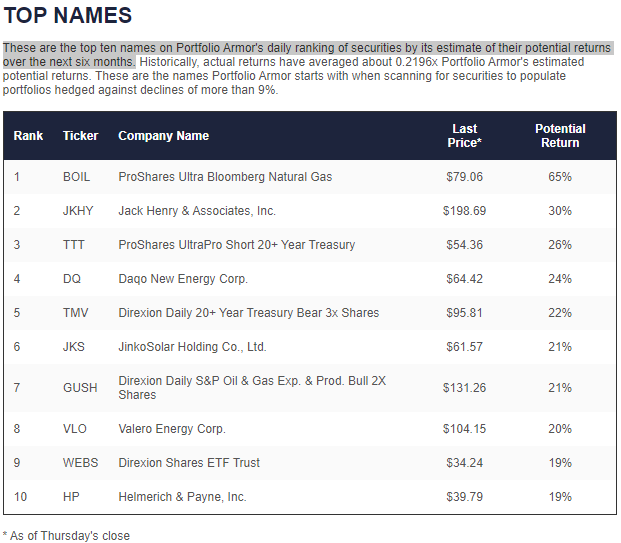

Each day the market's open, our system gauges stock and options market sentiment to rank securities by its estimate of their potential returns over the next six months. On June 24th, we added a new factor to our security selection process.

The new factor is based on historical data we've been tracking which shows that, all else equal, securities that underperformed over the last week and month relative to their historic averages, outperform ones that did well over the most recent week and month. So far, the new factor has gotten us better entries into volatile names, improving performance.

Internally, we track the performance of our selection process without the factors too (our "plain" top ten), so we can see how much our factors improve (or worsen) performance and adjust the factors accordingly. Here are a couple of examples.

Our Top Names From June 24th

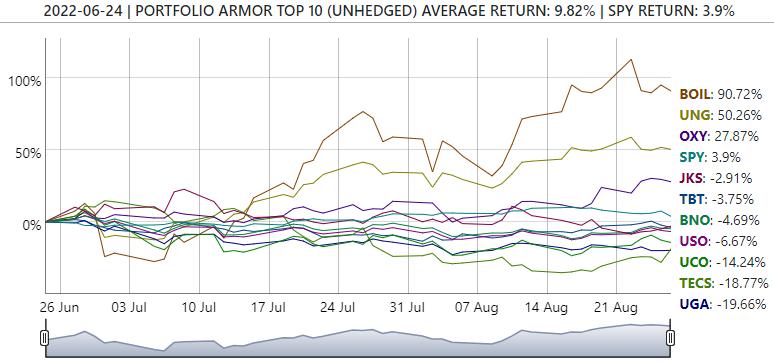

These were our top ten names on June 24th, the first top names cohort to include the new factor.

Image via Portfolio Armor on 6/24/2022

June 24th "Plain" Performance

Here's how our top ten names selected without factors on June 24th have performed so far.

They're up 9.82% so far. One thing holding back their performance is they got into a short technology ETF, the Direxion Daily Technology Bear 3X Shares (TECS), a little early, in hindsight. Note the best performer in this cohort so far, the ProShares Ultra Bloomberg Natural Gas ETF (BOIL). More on that below.

Our Top Names From June 30th

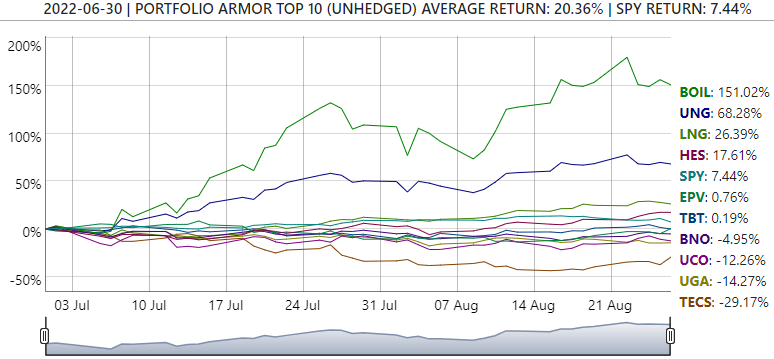

Image via Portfolio Armor on 6/30/2022

As you can see, BOIL appeared in our top ten (with factors) on June 30th.

And it's up a whopping 151.02% since. On average, the June 30th top ten is up 30.54%, versus 7.44% for SPY.

Now let's look at how the performance of our June 30th top names selected without factors have done since.

June 30th "Plain" Performance

Here's the performance of the top ten selected without factors on June 30th.

These are up 20.36% so far, on average. Again, the bearish tech ETF TECS was a drag on performance.

Still An All-Weather Approach

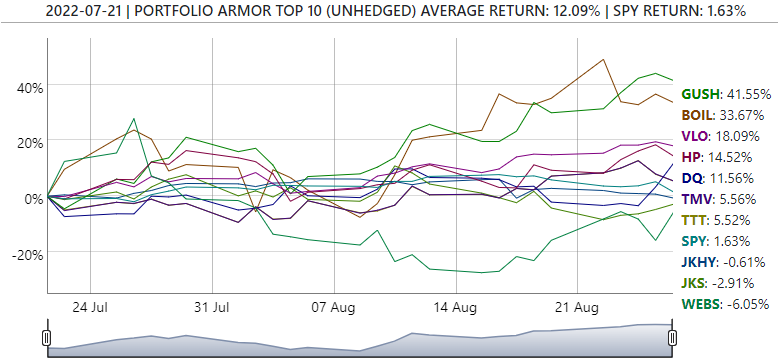

Although the new factor kept us out of TECS on June 24th and June 30th, it hasn't kept us out of bearish ETFs entirely. On July 21st, for example, it put us in a similar ETF to TECS, the Direxion Daily Dow Jones Internet Bear 3X Shares (WEBS).

Image via Portfolio Armor on 7/21/2022

WEBS was up 11.62% on Friday, as the market sold off, but it's still the worst performer in the July 21st top names cohort so far.

But it's down ~6% so far, not ~30% like TECS in the "plain" top ten above. An example of a better entry in a volatile name.

More By This Author:

Why Oil Can Spike Higher Despite A Recession

Performative War

Have Western Sanctions On Russia Failed?

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more