Too Many Individuals On The Sidelines

In the blog post I wrote about a year ago commenting on the October 2019 Job Openings and Labor Turnover Survey (JOLTS), I noted the employment market was extremely strong and there were not enough workers to fill job openings. At that time, the unemployed workers per job opening ratio was .81.

In other words, there were more job openings than unemployed. Fast forward one year later to the October 2020 JOLT survey released last week, that ratio now stands at 1.66. Too many potential workers are now out of the labor force.

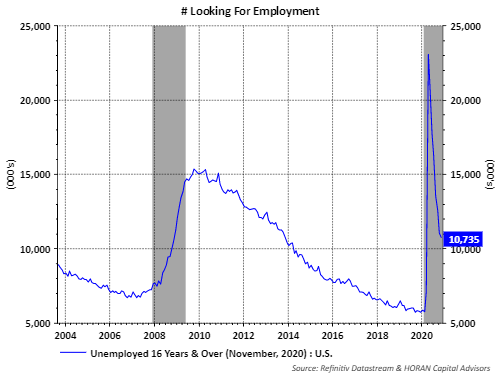

Clearly, as the following chart shows, the number of individual looking for employment, 10.7 million, remains nearly double the level prior to the pandemic induced recession.

A couple of positive metrics from the JOLT survey show job openings are increasing, at 6.6 million in October, and the quit level is rising, at 3.1 million in October. A rising quit level is one indication individuals view the job market as improving and are willing to pursue an opportunity in another position. One disappointing metric from the October JOLTS data is the declining hire level.

The decline in hiring is occurring at the same time job openings are rising, and is an indication employers are having difficulty finding individuals qualified for open positions or individuals simply willing to work.

The quality of labor issue partially surfaced in the NFIB Small Business Optimism Survey last week. Although the percentage of firms reporting few or no qualified applicants declined last month, the trend is rising from earlier in the recession. Also, the percentage of firms citing quality of labor as a single most important business problem continues to rise and is approaching levels reached prior to the recession.

In conclusion, recent data mostly suggests the labor market is improving. The near-term risk is the fact more state governors and city mayors are re-instituting lockdown measures that negatively impact businesses. This rising shutdown issue is occurring outside the U.S., as well.

Offsetting this risk is the rollout of the Pfizer (PFE) /BioNTech (BNTX) vaccine. Broadly, the economic data is trending favorably and is supportive of a healing labor market. Getting past the virus headwind can't occur fast enough.

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more