Time For A Squeeze: Here Are Cathie Wood's Top Holdings

By now, even the shoeshine boys know that just three months after pundits, traders and the media fawned over her every move during the February meltup, ARK Investment's Cathie Wood has become the market's anti-Midas - everything she touches, or owns, turns to shit.

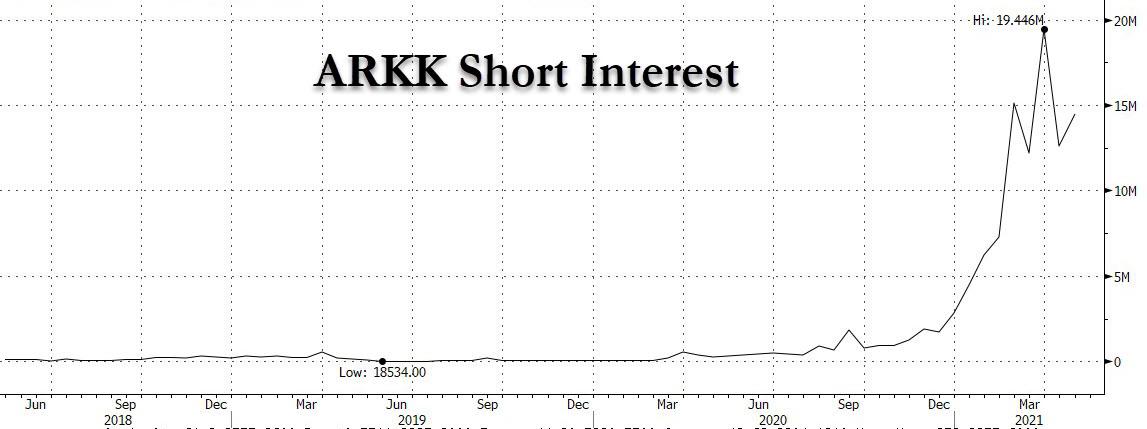

As such, "short Cathie" has become such a consensus trade that as Nomura writes this morning, a key “thematic extension” on its the Vol desk is "hedge funds pressing downside plays in ARKK (buyers of Jun and Aug Put Spreads / Puts)"; at the same time short interest in the ARKK ETF has hit an all time high.

(Click on image to enlarge)

And while in this particular case consensus is likely right, as there are virtually no redeeming qualities to the momentum-chasing "active managed" ETF which has continued to rotate out of liquid names into illiquid stocks as its AUM has collapsed and as Wood is increasingly desperate and hoping for a Hail Mary meltup in high beta momentum stocks, the bigger problem is that unless timed perfectly, consensus trades tend to blow up painfully before they eventually pay off.

Which begs the question: has ARKK, and by extension the stocks it owns - first and foremost TSLA, but also Teladoc, Roku, Square and bunch of other "story" stocks - been hammered too far too fast as wave after wave of shorts have piled on, and is now the time to take the other side in expectation of the inevitable short squeeze, especially now that the reflation theme is fading fast and the market will soon start contemplating that a return of the deflation trades may be on deck.

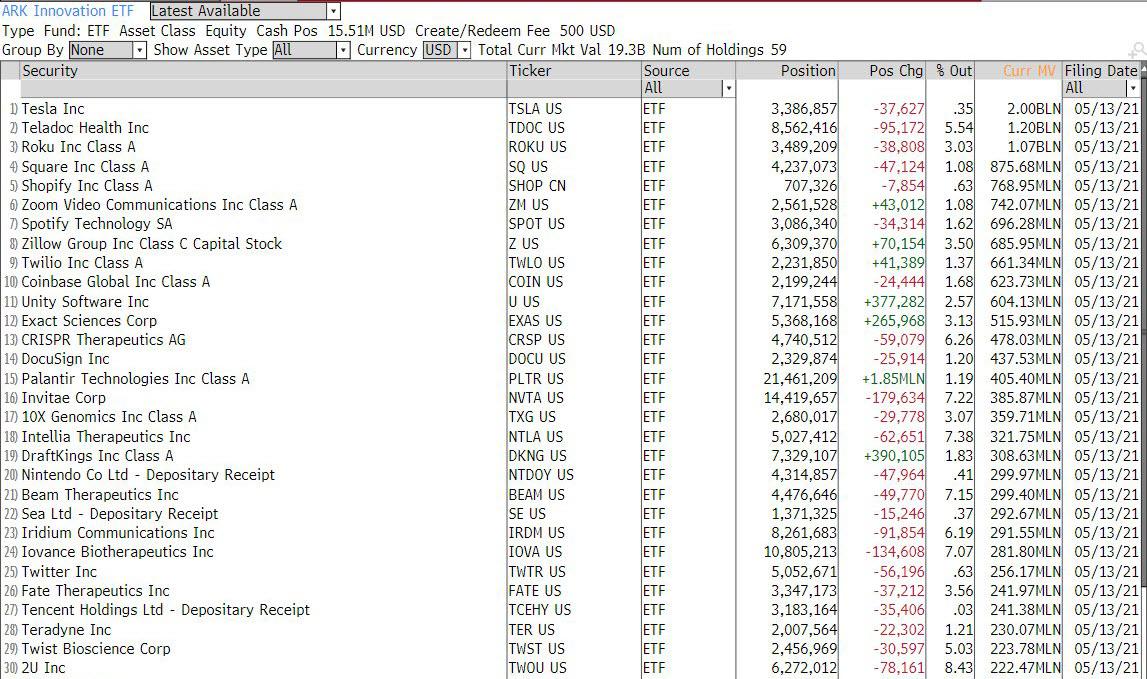

To help those investors who want to take the other side of the consensus hedge fund trade, we have listed the top stocks held by ARK's various ETFs, starting with the ARK Innovation ETF...

(Click on image to enlarge)

... the ARK Fintech ETF

(Click on image to enlarge)

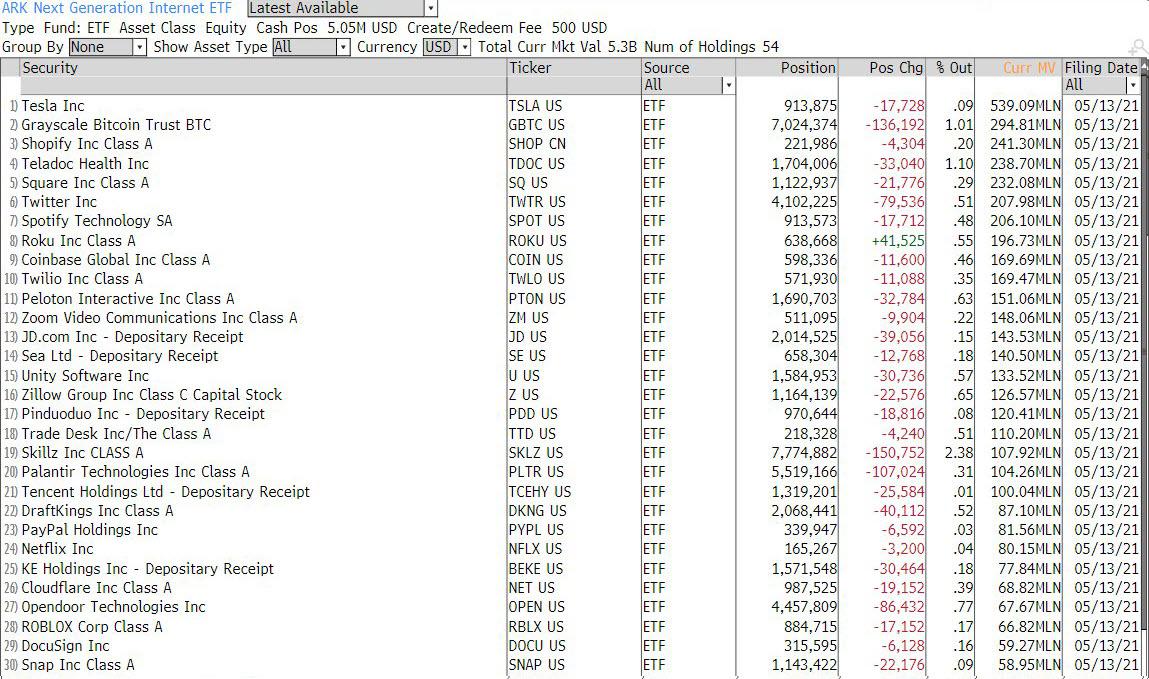

... the ARK Next Gen Internet ETF

(Click on image to enlarge)

... and the ARK Autonomous Technology and Robotics ETF

SInce there is quite a bit of overlap between the different ETFs, putting together a long basket of the 30 top names (especially the more illiquid ones) may soon be a profitable trade especially if the mood in the market is about to shift from peak inflation (and value) back to deflation (and growth).

So yes, you'll hate yourself in the morning, but you'll probably be much richer.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more