Tim Duy's Fascinating Take On The State Of The Economy

|

| By Permission |

|

| By Permission |

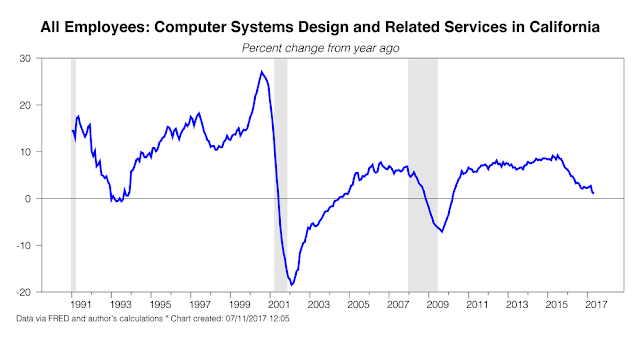

Tim Duy has a fascinating take on the state of the US economy. I will hopefully try to make sense of his viewpoint and offer another point of view. First, notice his charts above showing the tech economy in what appears to be a slight contraction.

The professor makes this interesting conclusion:

High asset prices alone do not imply that a fall in those prices will bring the economy down. Those asset prices need to be linked in a very tangible way to a fairly significant and widespread imbalance in the economy for their decline to bring about a broader economy collapse.

Duy makes the case that a tight Fed brought down the economy in the early 1990's, not a fall in asset prices. One wonders why the Fed is interested in clipping asset prices if they won't impact the economy if the economy is balanced! You may have to ask the Fed because it seems nobody knows why.

However, I think it is important to note that if the economy fizzles instead of crashes, that could panic the Fed to allow easy money in the next cycle. I don't think that fizzles are insignificant. I am not implying that Duy thinks they are insignificant. He views them as a better alternative to a precipitous crash.

But fizzles brought on Fed panic in the 1990's, resulting in the dot com bubble. One should wonder why the Fed wants to slow a balanced economy. Maybe keeping wages under control for the benefit of the capitalists is continually a motive for the Fed tightening, even in very tepid "good times". It seems kind of crazy if you consider the lukewarmness of the current economy.

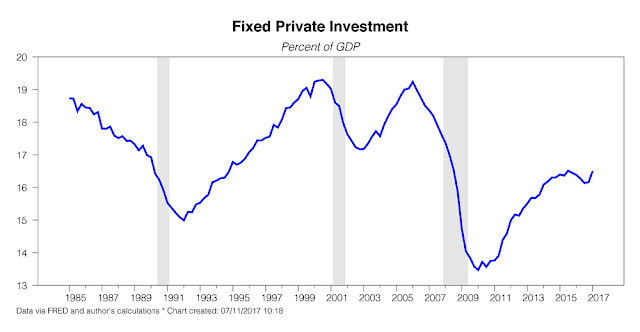

The Fed must be anticipating the potential for a precipitous decline in asset values, especially the stock market, so it wants to clip those values now. But a look at more of Professor Duy's charts shows that things are not exactly bubbling up compared to past excess in the real economy. Will pruning back stocks result in the destruction of the real economy? Duy says no.

But what if all this tightening causes private investment to crumble? It is already on the low side. It looks from his charts that the only private investment that is improving is in housing. The uptick in private nonresidential investment is the Trump effect, but that doesn't appear to be a lasting phenomenon. So, if that turns out to be the case, the real economy may prove to be more unbalanced in favor of real estate going forward. We look forward to further analysis from the professor to see where imbalances may arise, if at all.

|

| By Permission |

|

| By Permission |

|

| By Permission |

Disclaimer: I have no financial interest in any companies or industries mentioned. I am not an investment counselor nor am I an attorney so my views are not to be considered investment advice. The ...

more