Thoughts For Thursday: Moving Up, Moving Down

Stocks closed higher on Wednesday in the third day of an up, down, up trading week thus far. Yesterday, the market seemed to react positively to the release of the FOMC May meeting minutes.

The S&P 500 closed at 3,978, up 37 points, the Dow closed at 32,120, up 192 points and the Nasdaq Composite closed at 11,435, up 170 points.

Most actives were across sectors, illustrating the breadth of yesterday's trading.

Chart: The New York Times

Currently market futures are mixed with S&P 500 market futures trading up 6 points, Dow market futures trading up 73 points and Nasdaq 100 futures trading down 15 points.

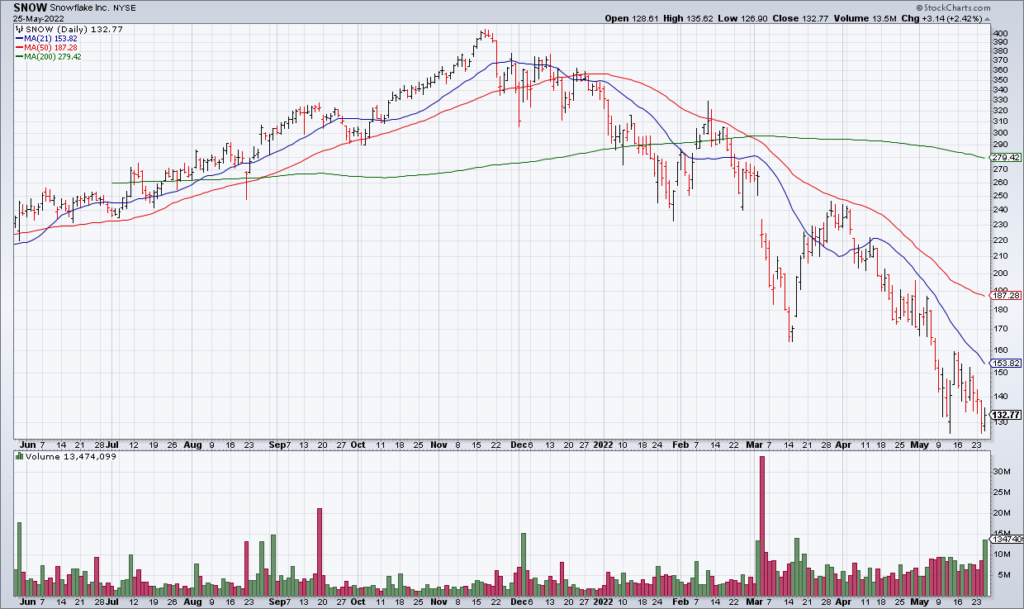

TalkMarkets contributor Greg Feirman as well as commenting on the Fed, discusses Poorly Received Results From NVDA And SNOW.

Both Nvidia (NVDA) and Snowflake (SNOW) have until now been two of the more prominent stars in the Tech equity galaxy.

"Adding to the crosscurrents were poorly received earnings reports from $400 billion chipmaker Nvidia and $40 billion data analysts company Snowflake, Wednesday afternoon. While NVDA’s 1Q came in fine, revenue guidance of $8.1 billion for 2Q22 came in a bit light and shares are currently -5% in the premarket."

"SNOW reported 84% revenue growth in the 1Q22 and guided 2Q22 revenue growth to 71%-73%- though it still trades at 20x current year revenue. As with NVDA, these numbers are by no means terrible but SNOW shares are nevertheless -14% in the premarket."

"I continue to believe the right stance is to lean somewhat long short term. While the bear market is just beginning, it will not be a straight down affair. Powerful countertrend rallies will complicate things. For now, the resilient price action in spite of bad news has me hoping that it’s all priced in. Whether that’s true or not only time will tell."

Contributor Dennis Miller skewers the Fed in an amusing piece, entitled The Fed “Doth Protest Too Much”.

Starting with a look back at the Bernanke and Yellen tenures at the Fed, Miller then proceeds to bring us up to date commenting on recent remarks made by both Treasury Secretary Yellen and Fed Chair Powell.

"After the 2016 election, she immediately raised rates. CNN reported that much like Bernanke before her, she proclaimed victory and congratulated herself for a job well done.

‘The structure established for the Federal Reserve back then intentionally insulates us from short-term political pressures so we can focus on what’s best for the American economy in the longer run,’ Yellen concluded.”

While Trump criticized Yellen, she responded, “I can say, emphatically that partisan politics plays no role in our decisions about the appropriate stance of monetary policy.”

I looked up the definition of “Thou doth protest too much”:

“Overly insistent about something, to the point where the opposite is most likely true.”"

"Fast Forward to Today

Madam Yellen is now Treasury Secretary. Current Fed head, Jerome Powell has protected the banks with excuses about inflation being transitory, doing all he can to put off raising rates while continuing to buy bad debts from the banks.

CNBC tells us:

“Treasury Secretary Janet Yellen on Thursday defended the Biden administration’s economic achievements over the president’s first year in office and said that she hopes to see inflation closer to 2% by the end of 2022.

…. She and other administration advisors have in recent months sought to quell public concerns about a sharp rise in prices thanks to widespread supply-chain disruptions and fierce demand for goods. The Labor Department said earlier in January that prices rose 7% in December on a year-over-year basis, the fastest pace of inflation since 1982.”

Well, Ms. Yellen, HOPE IS NOT A PLAN!"

"Government spending is out of control, their policies are adding to inflation and will require a massive effort to get things under control. The Fed is too little, too late. Inflation rages on.

If you don’t fix the cause, you don’t solve the problem.

In 2010 Bernanke told America the problem of “too big to fail” banks must be solved. While we have been fed lots of crap from various Fed heads, things are worse today. The Fed has provided no true oversight of the banking system."

Contributor Mish Shedlock also takes the Fed to task in his piece, Fed Minutes Show Inflation Risks Are Skewed To The Upside.

"Minutes from the FOMC meeting on May 3-4 show concern about what the average person already knows.

Image courtesy of Fed Board of Governors, Text by Mish from Latest Minutes

Minutes of the Federal Open Market Committee

Please consider the Minutes of the FOMC May 2-3 Meeting.

Notably, the Fed is sticking with an over-optimistic economic outlook. The staff anticipates "GDP growth would rebound in the second quarter and advance at a solid pace over the remainder of the year."

On retail sales, "participants indicated that they expected robust growth in consumption spending. They pointed to several elements supporting this outlook, including strong household balance sheets, wide availability of jobs, and the U.S. economy's resilience in the face of new waves of the virus."

"All participants concurred that the U.S. economy was very strong, the labor market was extremely tight, and inflation was very high and well above the Committee's 2 percent inflation objective."

The Fed is drinking Kool-Aid. A recession is baked in the cake, and obviously so.

But the Fed cannot admit that. Given the stated nonsense on a "strong economy" perhaps a clueless Fed does not even see a recession."

Contributor Brad Thomas gives readers his take on The Social Media Company That “Snapped” The Markets.

"It’s no secret that the social ad space that launched platforms like Twitter, Facebook, and Pinterest into the billion-dollar territory is now having a tough go of it. Nearly every major name in the sector has reported sluggish first-quarter growth."

"Nearly every major name in the sector missed the mark in terms of industry targets too. Though none has slid so severely as Snap Inc. (SNAP)... in a filing released Monday afternoon, Snap Inc. announced dire second-quarter projections from predictions made barely a month ago.

“There is a lot to deal with in the macro-environment today,” Chief Executive Officer Evan Spiegel said at a JP Morgan Chase & Co. conference. Revenues have apparently declined “further and faster” than expected since Snap’s last discussion on the subject.

The company cited a range of circumstances including (of course) inflation, Apple’s privacy policy updates, and even the war in Ukraine."

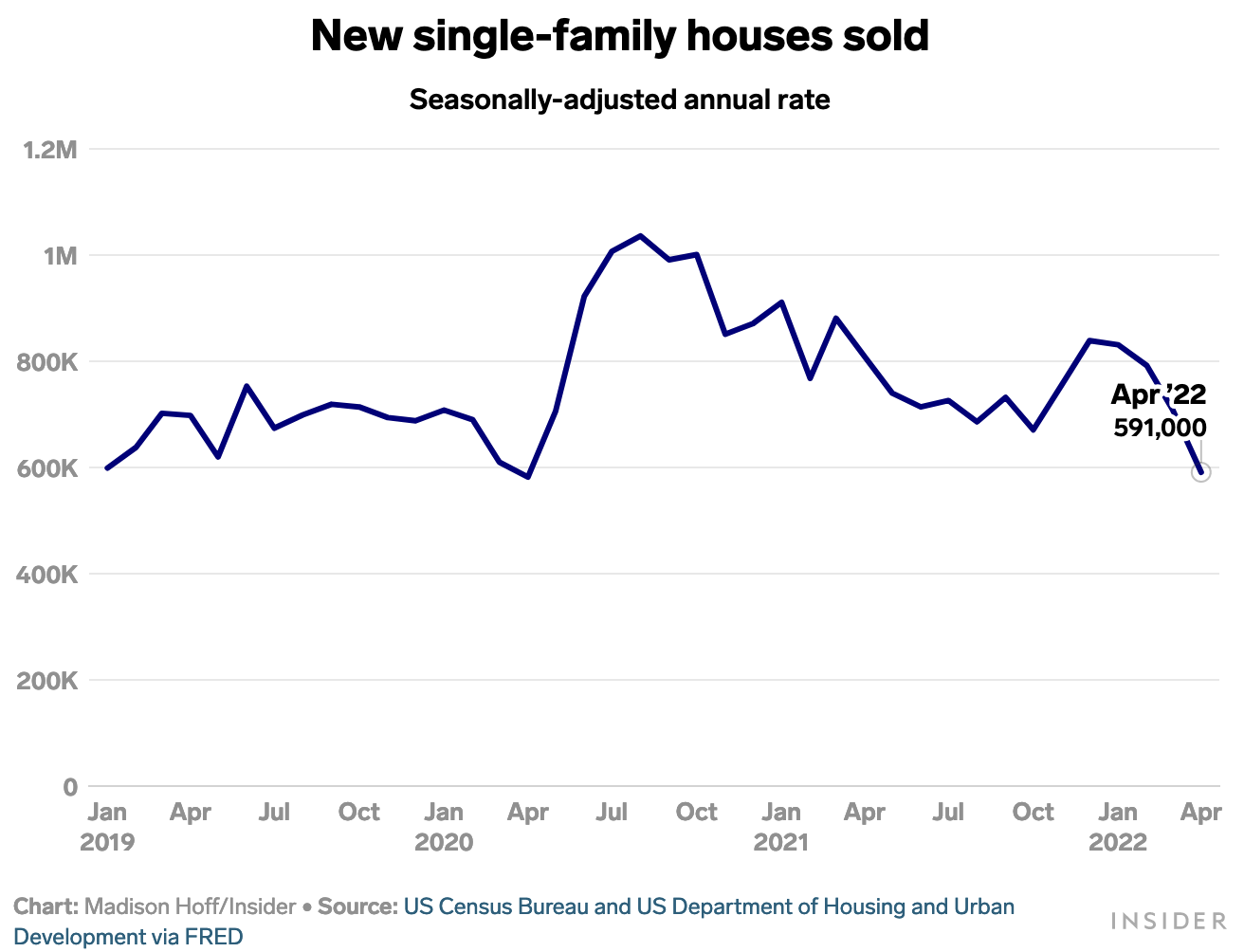

Usually, we try to end this column on a positive note, but this morning TalkMarkets contributor Danielle Park writes that, Grim Home Affordability Finally Starting To Dent Buyer Demand, thereby knocking the wind out of our proverbial sails.

"Sales of new US homes plummeted last month to the slowest rate since April 2020 as buyer ability shrank under the weight of inflated home prices, higher rates, food, and fuel. See Business Insider: New Home Sales just plunged to pandemic era lows.

At the same time, the unsold inventory of new homes suddenly doubled over the past year to 9 months’ supply (a balanced market is considered six months’ supply). Homebuilder stocks tumbled 3% on the day, taking the overall decline for the S&P Homebuilder’s ETF (XHB) to -33% from last December."

That's a wrap for this week. Perhaps, the market will close out the month in a blaze of blooming glory.

Take time to remember our veterans over the Memorial Day holiday.

I'll see you on Tuesday.

Image: David Marshall